Most Americans pay more taxes than necessary because they confuse tax preparation with strategic planning. The difference costs the average household $1,200 annually in missed savings opportunities.

We at Clear View Business Solutions see this pattern repeatedly. Effective tax planning for individuals requires year-round strategy, not last-minute scrambling before April deadlines.

Tax preparation involves document collection and form completion after the year ends. Strategic tax planning occurs throughout the year and focuses on tax burden minimization through proactive decisions. The IRS provides year-round planning guidance to help taxpayers organize their tax records and make filing season less stressful.

Tax filing without strategic planning costs you money every single year. Most Americans overpay taxes by $1,040 annually according to the National Association of Tax Professionals. Most people wait until January to think about taxes, but the most impactful decisions happen months earlier. Retirement account contributions, asset sale timing, and deduction management require advance planning that reactive filers cannot access.

Income timing generates the largest tax savings for most individuals. You can accelerate income in low-tax years and defer it during high-income periods to save thousands annually. The Tax Foundation reports that strategic Roth IRA conversions during low-income years provide average savings of $3,200 over retirement. Tax-loss harvesting reduces capital gains taxes when you sell losing investments to offset gains. Health Savings Account contributions offer triple tax benefits (deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses) that most taxpayers ignore completely.

December tax planning eliminates most strategic options. Missed contribution deadlines for retirement accounts cost the average worker $1,400 in annual tax savings according to Fidelity research. Ignored estimated tax payments trigger penalties that averaged $150 per taxpayer in 2023. The biggest mistake involves equal treatment of all income instead of understanding how different income types receive different tax treatment under current law.

These fundamental differences between reactive filing and strategic planning set the foundation for specific strategies that can dramatically reduce your tax burden throughout the year.

Strategic tax planning focuses on three high-impact areas that generate measurable savings. The standard deduction for 2024 reaches $15,000 for single filers and $30,000 for married couples, but itemized deductions often produce larger savings when you have substantial medical expenses, mortgage interest, or charitable contributions. The Child Tax Credit provides $2,000 per qualifying child under 17, while the Earned Income Tax Credit delivers up to $7,430 for families with three or more children according to IRS data.

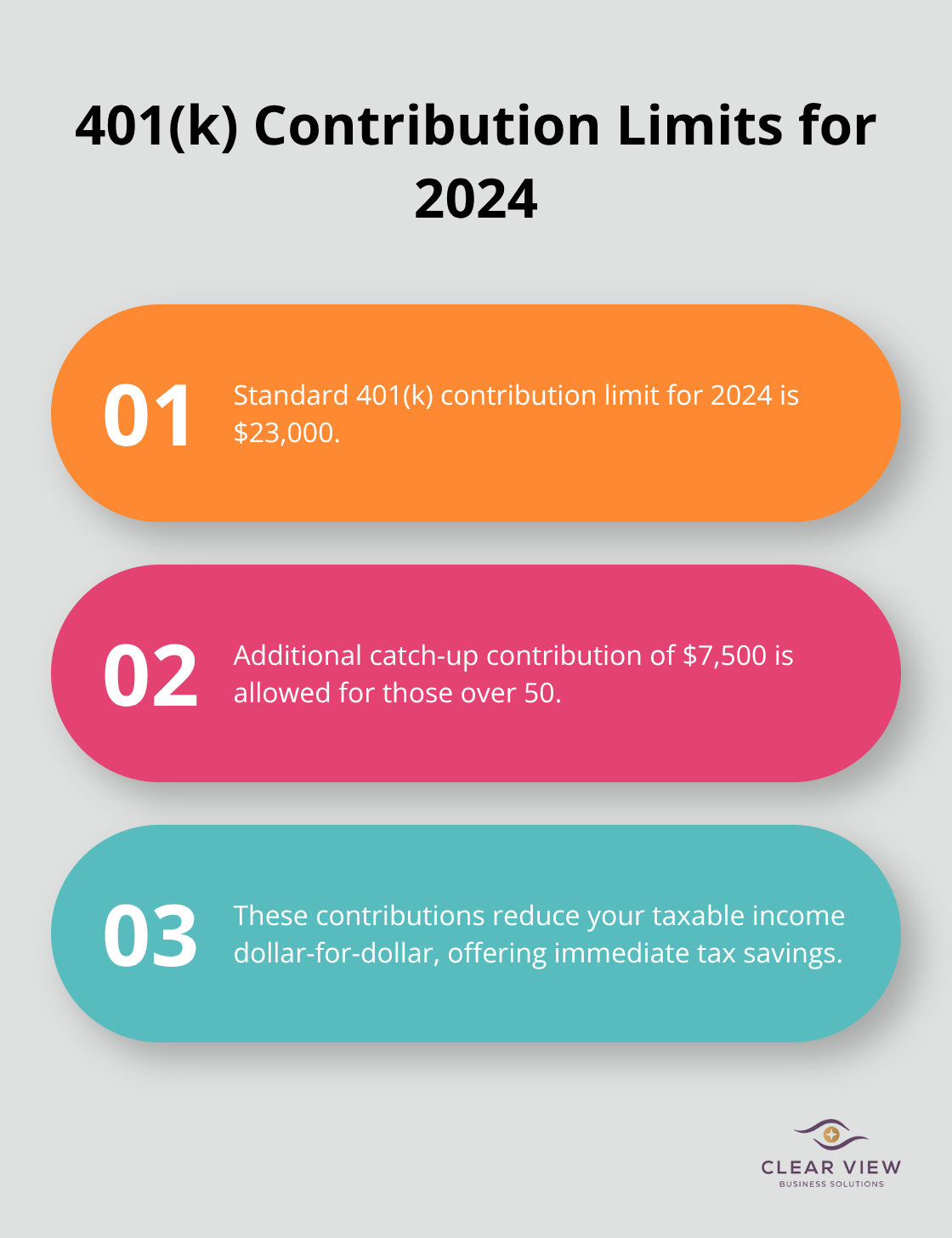

Traditional 401k contributions reduce your taxable income dollar-for-dollar, with 2024 limits at $23,000 plus $7,500 catch-up contributions for those over 50. Health Savings Accounts offer triple tax benefits through deductible contributions, tax-free growth, and tax-free medical withdrawals. HSA limits reach $4,300 for individuals and $8,550 for families in 2024. Roth conversions during low-income years save thousands in retirement taxes (particularly effective when your income drops temporarily).

Tax-loss harvesting allows you to sell losing investments to offset capital gains, which reduces your overall tax burden. Long-term capital gains rates of 0%, 15%, or 20% depend on your income level, which makes timing critical for asset sales. The $3,000 annual capital loss deduction against ordinary income helps reduce taxes when your investments decline. Asset location strategy places tax-inefficient investments in tax-advantaged accounts while keeping tax-efficient investments in taxable accounts to maximize after-tax returns.

Strategic income timing can shift your tax burden between years to take advantage of lower rates. Self-employed individuals control when they collect payments and can defer income to the following year when tax rates might be lower. Accelerated depreciation on business equipment purchases reduces current-year taxes (Section 179 allows up to $1,220,000 in immediate deductions for 2024). Bunched charitable donations in alternating years help exceed the standard deduction threshold and maximize tax benefits.

These core strategies work best when you implement them as part of a comprehensive approach that considers your complete financial picture and upcoming life changes.

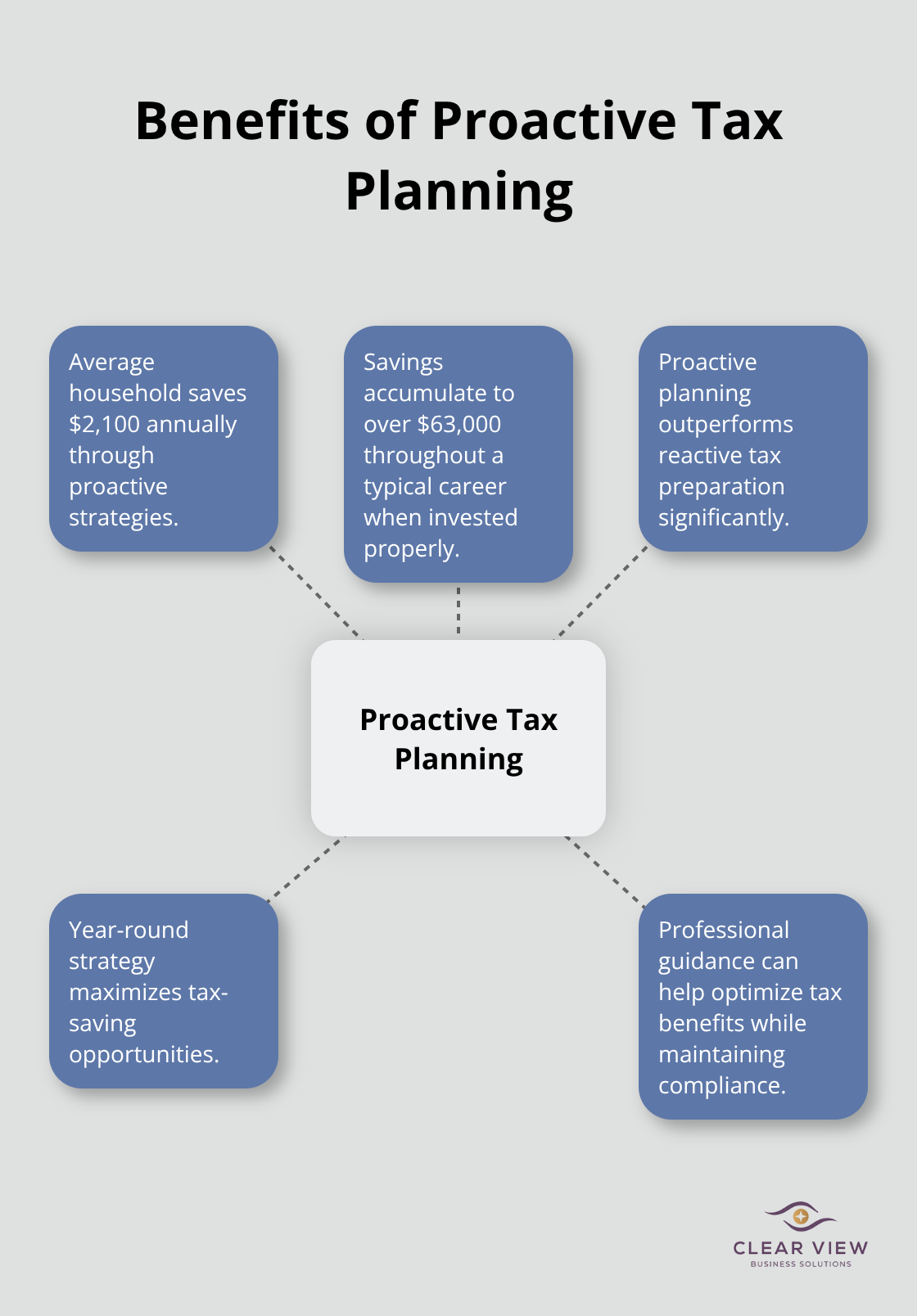

Tax planning starts January 1st, not December 31st. The National Association of Enrolled Agents reports that taxpayers who begin planning in January save an average of $2,100 more annually than those who start planning in the fourth quarter. January planning provides financial status information and helps uncover planning opportunities before you miss critical opportunities. Fourth-quarter planning limits your options to last-minute retirement contributions and basic deduction timing.

April 15th marks the federal tax filing deadline, but quarterly estimated payments due January 15th, April 15th, June 15th, and September 15th prevent underpayment penalties that averaged $150 per taxpayer in 2023 according to IRS data. December 31st ends your window for most tax strategies including retirement contributions, charitable donations, and capital gains management. The IRS requires 90% of current year taxes or 100% of prior year taxes through withholdings and estimated payments to avoid penalties.

January 31st deadline for HSA contributions for the previous tax year extends your planning window beyond other retirement accounts. This extended deadline provides additional flexibility for tax planning decisions after you review your complete tax picture. HSA contributions offer triple tax benefits that make them particularly valuable for last-minute tax reduction strategies (deductible contributions, tax-free growth, and tax-free medical withdrawals).

Self-employed individuals and investors with significant capital gains must make quarterly payments to avoid penalties. The safe harbor rule requires payments equal to 100% of last year’s tax liability if your adjusted gross income exceeded $150,000. Underpayment penalties compound at 8% annually, which makes accurate estimated payments financially critical. The IRS Tax Withholding Estimator helps calculate proper payment amounts based on income fluctuations throughout the year. Missing estimated payments triggers automatic penalties even if you receive a refund when filing your return.

Strategic tax planning for individuals produces measurable financial benefits that compound over time. The average household saves $2,100 annually through proactive strategies compared to reactive tax preparation. These savings accumulate to over $63,000 throughout a typical career when you invest them properly.

You should implement these strategies immediately rather than wait until December. Start with maximum retirement account contributions, track deductible expenses throughout the year, and schedule quarterly estimated tax payments to avoid penalties. Review your withholdings with the IRS Tax Withholding Estimator to optimize cash flow.

The complexity of current tax law makes professional guidance valuable for most taxpayers. We at Clear View Business Solutions provide comprehensive tax planning services that help clients maximize tax benefits while they maintain full compliance with federal requirements (including strategic planning and year-round advisory support). Tax planning success requires consistent action throughout the year rather than last-minute decisions.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.