Tax planning and strategy is a powerful tool for individuals and businesses to optimize their financial position. By taking a proactive approach, you can significantly reduce your tax burden and keep more of your hard-earned money.

At Clear View Business Solutions, we’ve seen firsthand how effective tax planning can transform our clients’ financial outlook. This blog post will guide you through key strategies to create a robust tax plan that aligns with your financial goals.

Tax planning is a strategic approach to manage finances with the goal of minimizing tax liability. It involves analyzing your financial situation to identify opportunities for tax savings. This process includes understanding current tax laws and regulations, anticipating changes, and making decisions that will reduce your tax burden within the bounds of the law. Effective tax planning can lead to significant savings for both individuals and businesses.

A proactive stance on tax planning can yield substantial benefits. Instead of rushing at the last minute, it’s wise to start thinking about taxes well before the filing deadline. This approach opens up more opportunities to implement tax-saving strategies throughout the year.

For example, small business owners in Tucson can make informed decisions about equipment purchases or hiring new employees with a clear understanding of the tax consequences. These decisions (when made strategically) can result in considerable tax savings.

An effective tax strategy comprises several key components:

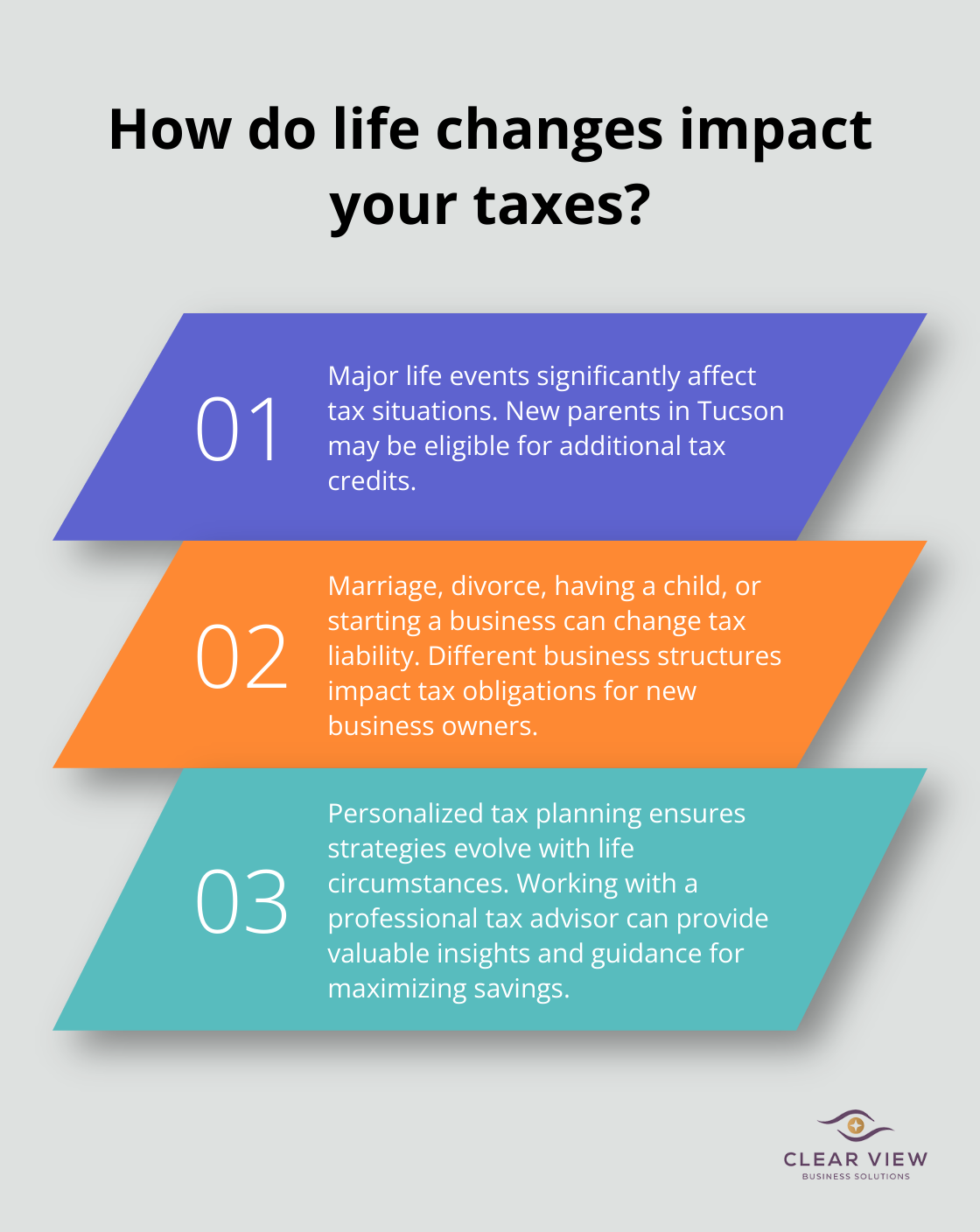

Major life events such as marriage, divorce, having a child, or starting a business can significantly affect your tax situation. New parents in Tucson might be eligible for additional tax credits, while new business owners need to consider how different business structures could impact their tax liability.

A personalized approach to tax planning ensures that your strategy evolves with your life circumstances, maximizing potential savings at every stage. This is where working with a professional tax advisor can provide valuable insights and guidance.

As we move forward, let’s explore specific strategies that individuals and families can use to optimize their tax situation and keep more of their hard-earned money.

Tax planning isn’t just for businesses. Families and individuals can significantly reduce their tax burden with smart strategies. Here’s how you can keep more of your hard-earned money:

The standard deduction for 2025 is $14,600 for single filers and $29,200 for married couples filing jointly. However, itemizing might save you more. Track expenses like mortgage interest, property taxes, and medical costs. If these exceed the standard deduction, itemizing could lower your taxable income.

Tax credits are more valuable than deductions because they directly reduce your tax bill. The Child Tax Credit can provide up to $2,000 per qualifying child. For education expenses, the American Opportunity Credit offers up to $2,500 per eligible student. These credits can substantially decrease your tax liability.

Contributing to retirement accounts is a powerful tax-saving tool. In 2025, those 50 to 59 or 64 or older will be able to contribute up to $31,000 to a 401(k), while those 60 to 63 will be able to contribute up to $34,750. For IRAs, the limit is $7,000 (or $8,000 for those 50+). These contributions can lower your taxable income now while building your nest egg for the future.

Charitable donations can reduce your tax bill if you itemize deductions. Consider bunching donations in alternate years to surpass the standard deduction threshold. Donate appreciated stocks held for over a year to avoid capital gains tax and deduct the full market value.

If you control when you receive income or incur expenses, strategic timing can lower your tax bill. For instance, freelancers can delay invoices to January to push that income into the next tax year. Similarly, prepay deductible expenses in December to increase your current year deductions.

Tax planning can be complex, but the savings make it worthwhile. Specialized tax professionals (like those at Clear View Business Solutions) can create personalized tax strategies that take advantage of every possible tax-saving opportunity while ensuring full compliance with IRS regulations. As we move forward, let’s explore how small businesses can implement effective tax planning strategies to optimize their financial position and foster growth.

Your business structure impacts your tax obligations significantly. Sole proprietorships expose you to personal liability for business debts. Partnerships provide flexibility but require careful planning to avoid tax pitfalls. S corporations can offer tax advantages for some businesses, while C corporations might benefit others, especially those planning rapid growth.

Many startups in Tucson benefit from forming an LLC, which combines liability protection with tax flexibility. However, the best choice depends on your specific situation. A tax professional can help determine the most tax-efficient structure for your business.

Your employee compensation methods can significantly affect your tax bill. Offer a mix of salary and benefits. Health insurance, retirement plans, and other fringe benefits are often tax-deductible for the business while providing value to employees.

Setting up a SIMPLE IRA for your employees can provide tax benefits for both your business and your staff. In 2025, employees can contribute up to $16,000 to a SIMPLE IRA (with an additional $3,500 catch-up contribution for those 50 and older).

Strategic equipment purchases can lead to substantial tax savings. Section 179 benefits apply to small and mid-size businesses that spend less than $4.38 million per year for equipment.

Additionally, bonus depreciation allows businesses to deduct 80% of the cost of eligible assets in the first year. This can reduce your tax bill while investing in your business’s future.

As your business grows, your tax strategy should evolve. Time major purchases or expansions to maximize tax benefits. For instance, if you plan to expand your Tucson-based business, you might accelerate some expenses into the current tax year to offset higher projected income.

Also, explore tax credits specific to your industry or location. The Research and Development (R&D) tax credit can provide significant savings for businesses investing in innovation.

Tax planning requires ongoing attention. Regular reviews with a tax professional can ensure you take advantage of all available opportunities. These reviews can help you adapt your strategy to changing business conditions and new tax laws.

Tax planning and strategy empowers individuals and businesses to optimize their financial position. You can reduce your tax burden significantly through strategic moves such as maximizing deductions, leveraging credits, and making smart retirement account contributions. Small businesses benefit from choosing the right structure, implementing effective employee compensation strategies, and utilizing depreciation benefits to foster growth while minimizing taxes.

Professional guidance proves invaluable in navigating complex tax laws and identifying potential savings opportunities. Clear View Business Solutions specializes in comprehensive financial advisory and tax services for individuals and small businesses in Tucson. Our team of experts can help develop a personalized tax strategy that aligns with your financial goals.

Proactive tax planning plays a key role in achieving financial success. You can take control of your financial future and make the most of every dollar you earn by staying informed, implementing strategic tax moves, and seeking professional advice when needed. Tax planning and strategy requires ongoing attention to adapt to changing laws and evolving financial situations.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.