At Clear View Business Solutions, we know that aligning tax and business strategies is essential for long-term success. Many business owners overlook the profound impact that tax planning can have on their company’s growth and profitability.

In this post, we’ll explore how integrating tax considerations into your business planning can lead to better decision-making and improved financial outcomes. We’ll also provide practical steps to help you create a cohesive tax and business strategy that supports your goals.

Every financial choice you make has tax implications that affect your entire operation. When you expand your product line or hire new employees, you don’t just grow your business-you change your tax landscape. Investing in new equipment can lead to significant tax deductions through depreciation. The Tax Cuts and Jobs Act changed deductions, depreciation, expensing, tax credits and other things that affect businesses.

Smart tax planning doesn’t just save money-it fuels growth. Strategic timing of income recognition and expenses can free up cash flow for reinvestment. A study by the National Small Business Association found that 40% of small businesses spend over 80 hours per year on federal taxes. This time and energy could be redirected into growth initiatives instead (a potential game-changer for many companies).

To harness the power of tax planning, you must weave it into the fabric of your business strategy. This means considering tax implications at every decision point, from choosing your business structure to planning your exit strategy.

Selecting an S-Corporation structure over a sole proprietorship can save self-employment taxes on a portion of your income. Statistics from 1986 and 1987 confirmed that the Tax Reform Act of 1986 had a large effect on how some small corporations were taxed.

Navigating complex tax decisions requires expertise. Professional tax advisors don’t just file your taxes-they work with you year-round to ensure every business move is tax-optimized. Clear View Business Solutions, for example, helps clients in Tucson navigate these complex decisions, integrating tax planning into overall strategy.

Effective tax planning isn’t about aggressive avoidance. It’s about understanding the rules and using them to your advantage. Your tax strategy can become a powerful tool for business success when you approach it strategically.

As we move forward, we’ll explore specific areas where aligning your tax and business strategies can yield significant benefits. Let’s start by examining how your choice of entity structure can impact your tax obligations and business flexibility.

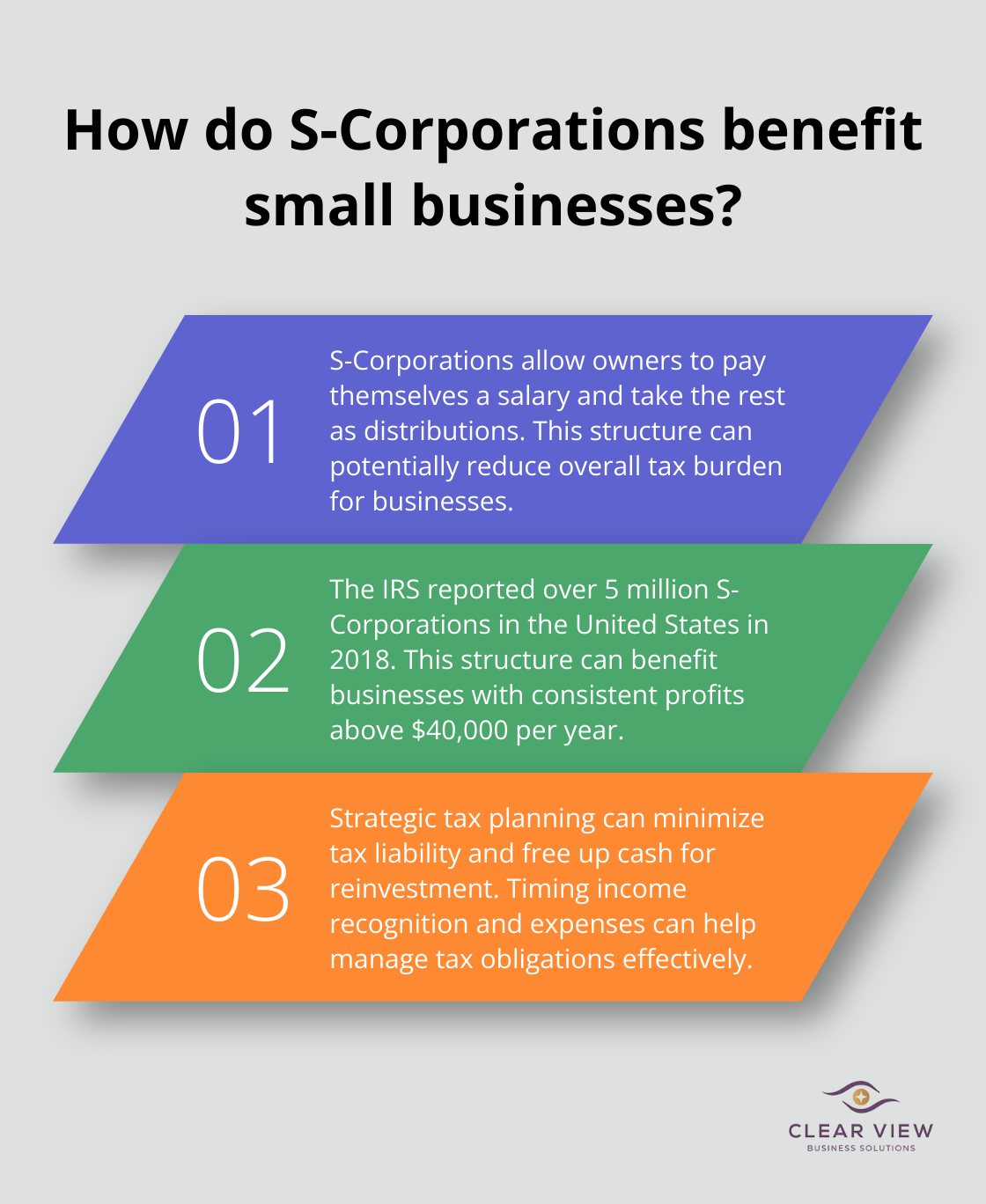

Your choice of business structure significantly impacts your tax obligations and financial health. Each structure comes with its own set of tax rules. Sole proprietorships offer simplicity but expose you to self-employment taxes on all profits. S-Corporations allow you to pay yourself a reasonable salary and take the rest as distributions, potentially reducing your overall tax burden.

The IRS reported over 5 million S-Corporations in the United States in 2018, underscoring their popularity among small business owners. This structure can benefit businesses with consistent profits above $40,000 per year.

Effective cash flow management fuels business growth, and tax planning plays a pivotal role. You can minimize your tax liability and free up cash for reinvestment by timing your income recognition and expenses strategically.

If you expect to be in a lower tax bracket next year, consider deferring income to the following year. Conversely, if you anticipate higher profits, accelerating deductible expenses into the current year could lower your tax bill.

Your investment decisions should always factor in potential tax consequences. Holding investments for over a year qualifies you for long-term capital gains rates, which are typically lower than short-term rates.

The Tax Cuts and Jobs Act introduced Qualified Opportunity Zones, allowing investors to defer capital gains taxes by reinvesting in designated economically distressed communities. This program may provide a tax incentive for private, long-term investment in economically distressed communities.

Thoughtful employee compensation planning can create a win-win situation for both your business and your staff. Consider offering a mix of salary and benefits that provides tax advantages for your company while attracting and retaining top talent.

Implementing a 401(k) plan allows your employees to save for retirement while providing your business with tax deductions for contributions. The Bureau of Labor Statistics reported that 67% of private industry workers had access to retirement benefits in 2020, making this a competitive offering.

As you consider these strategies to optimize your business structure for tax efficiency, it’s essential to understand how to implement them effectively. In the next section, we’ll explore practical steps you can take to align your tax and business strategies for maximum impact.

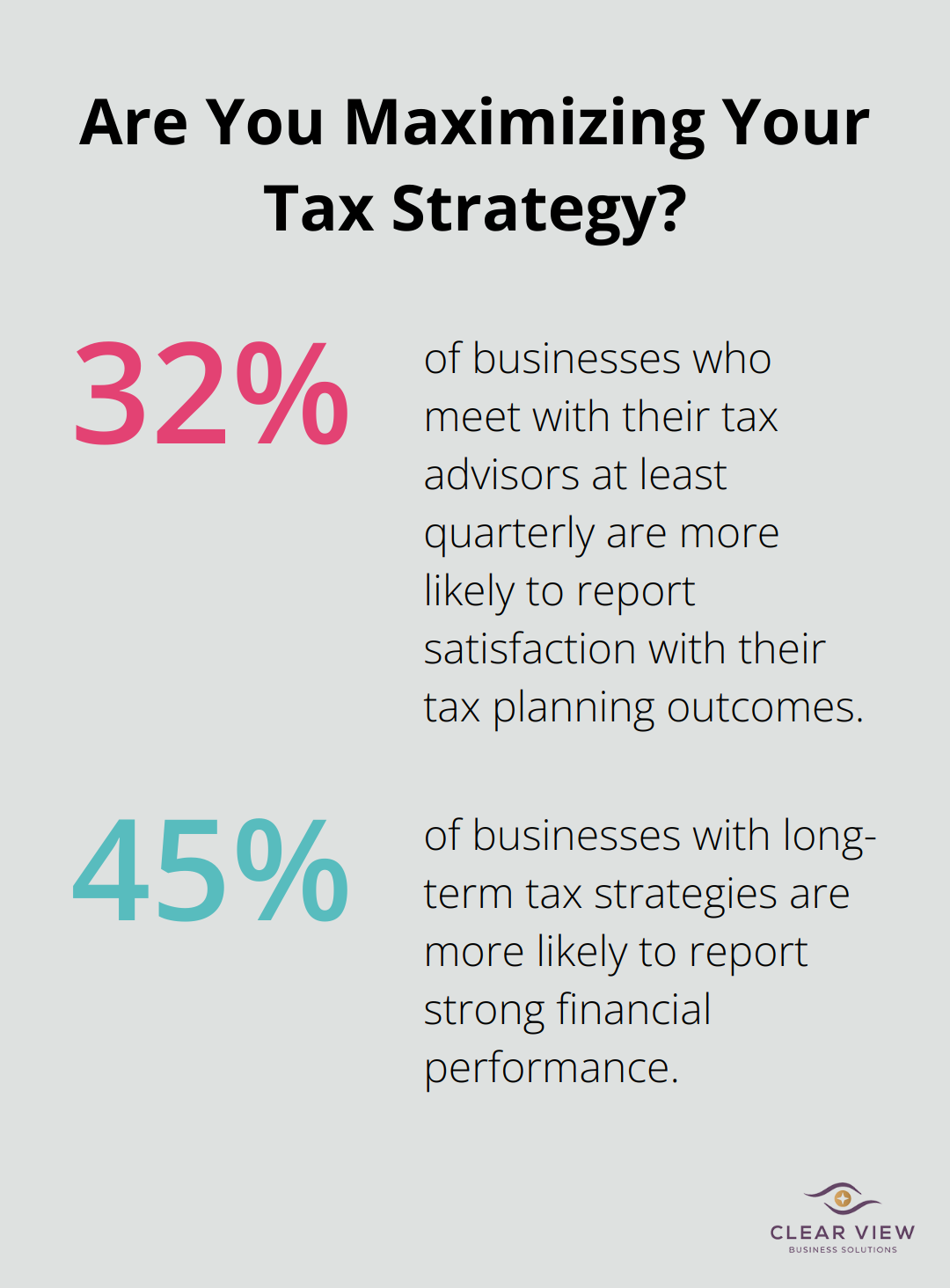

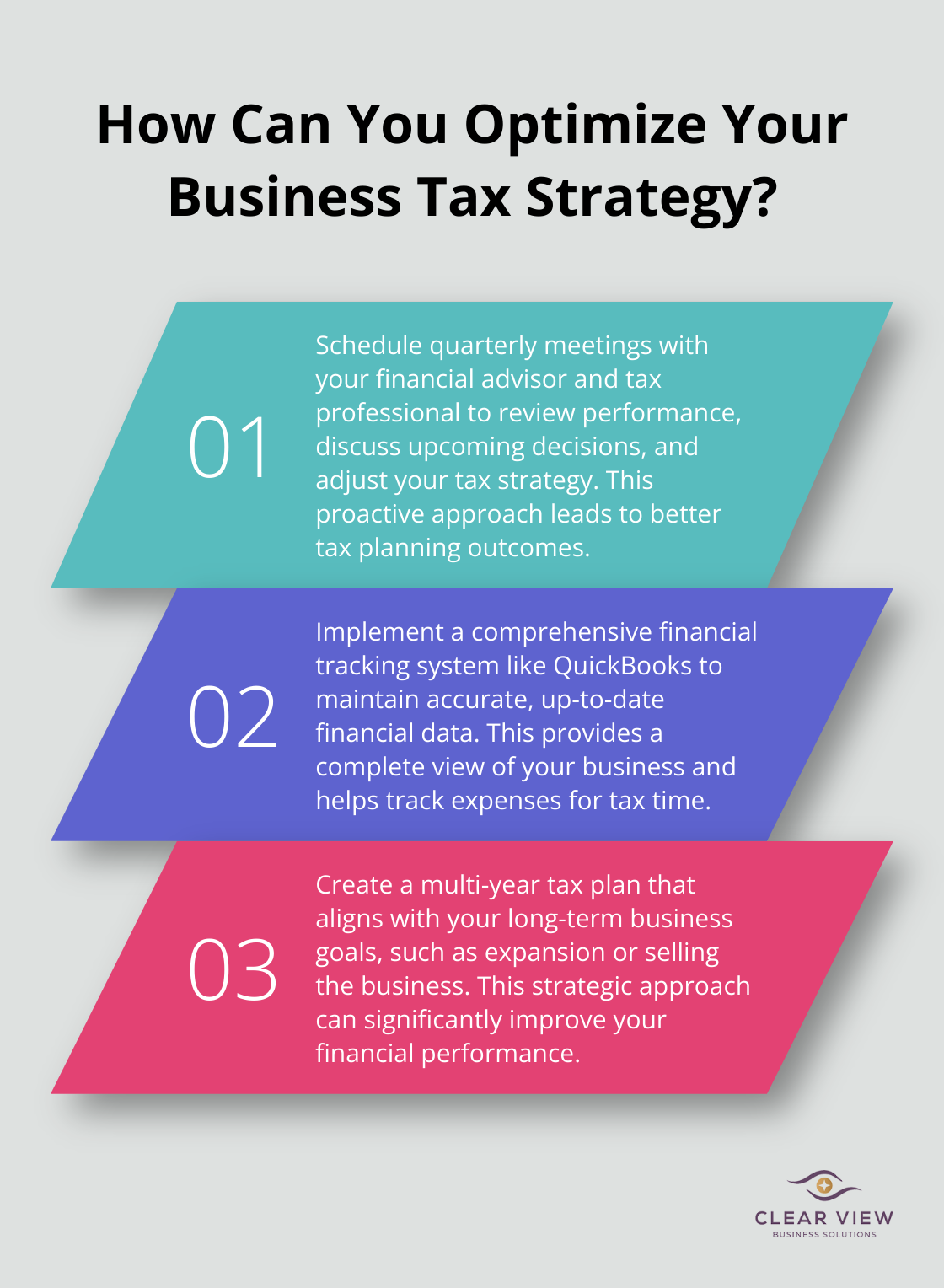

Don’t wait for tax season to think about your tax strategy. Set up quarterly meetings with your financial advisor and tax professional. These sessions allow you to review your financial performance, discuss upcoming business decisions, and adjust your tax strategy accordingly. A study by the National Federation of Independent Business found that businesses who meet with their tax advisors at least quarterly are 32% more likely to report satisfaction with their tax planning outcomes.

Accurate, up-to-date financial data forms the foundation of effective tax planning. Implement a comprehensive financial tracking and reporting system. QuickBooks is a popular choice for small businesses, offering a complete view of your business, tracking where your money is going, and providing clarity with custom accounting reports. It also helps track receipts and more for tax time.

Tax laws constantly evolve, and staying informed is essential. Subscribe to reputable tax news sources or consider joining a professional association in your industry. The Tax Policy Center provides regular updates on tax law changes and their potential impacts on businesses.

Your tax strategy should align with your long-term business goals. Do you plan to expand? Sell the business in a few years? Each scenario has different tax implications. Work with your advisor to create a multi-year tax plan that supports your business objectives. A survey by the American Institute of CPAs found that businesses with long-term tax strategies were 45% more likely to report strong financial performance.

Many businesses leave money on the table by not fully utilizing available tax credits and deductions. The Research and Development (R&D) tax credit, for example, is often overlooked. The IRS provides guidelines and audit technique guides for field examiners on the examination of Research Credit cases.

Aligning tax and business strategies creates a powerful synergy that drives companies forward. This integrated approach minimizes tax liabilities, maximizes cash flow, and supports informed investment decisions aligned with long-term goals. Companies that adopt this strategy position themselves to leverage tax credits, respond to legal changes, and allocate resources efficiently.

Professional guidance proves invaluable when navigating the complex intersection of tax planning and business strategy. Clear View Business Solutions specializes in helping small businesses in Tucson optimize their tax and business strategies for maximum impact. Our team provides personalized advice tailored to specific business needs, ensuring clients make the most of every opportunity to enhance financial performance.

Take action today to integrate your tax and business strategies. With the right approach and expert support, you can transform tax planning from a necessary task into a powerful tool for business success. A well-crafted tax and business strategy builds a solid foundation for sustainable growth and prosperity.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.