Choosing the right outsourced financial management services can make or break your business’s financial health. At Clear View Business Solutions, we’ve seen firsthand how proper financial management fuels growth and stability.

This guide will walk you through the essential steps to select the best financial partner for your needs. We’ll cover everything from assessing your requirements to vetting potential providers, ensuring you make an informed decision.

The first step in finding the right outsourced partner is to pinpoint your business’s financial management needs. This process requires a thorough examination of your current financial situation and future goals.

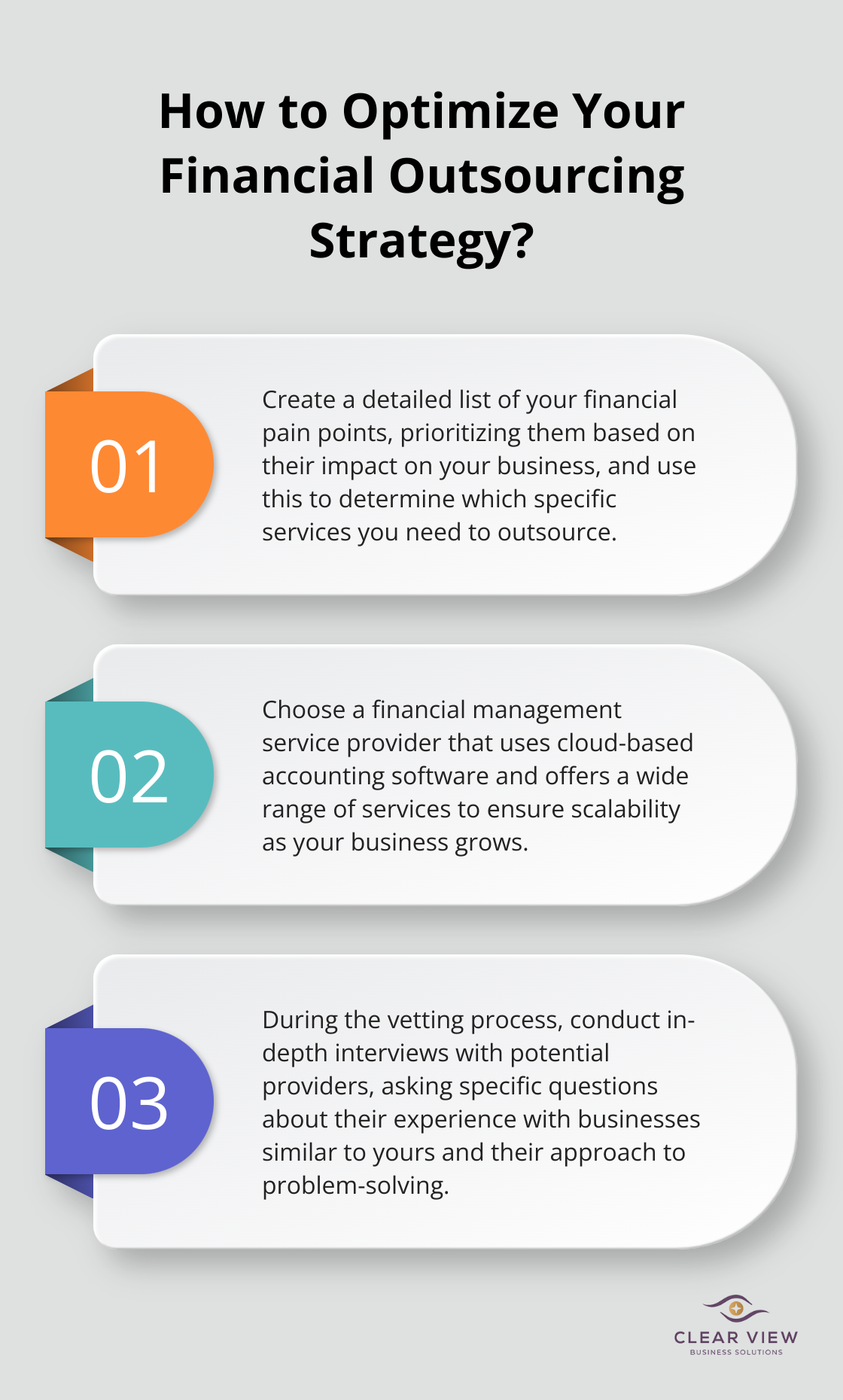

Start by identifying your most pressing financial challenges. Do you struggle with cash flow management? Does tax compliance cause problems? Or perhaps you find it difficult to interpret your financial data for strategic decision-making. Create a list of these issues and prioritize them based on their impact on your business.

Take an honest look at your internal financial management capabilities. Does your staff possess the right skills to handle complex financial tasks? Is your team overwhelmed with day-to-day bookkeeping, leaving little time for strategic financial planning? Understanding where your team excels and where it falls short will help you determine which tasks to outsource.

Based on your challenges and internal capabilities, outline the specific services you need. This could range from basic bookkeeping and payroll processing to more advanced services like financial forecasting or CFO-level strategic advice. Be as specific as possible. For example, instead of just “tax services,” you might need “quarterly tax planning and annual tax preparation for an S-corporation.”

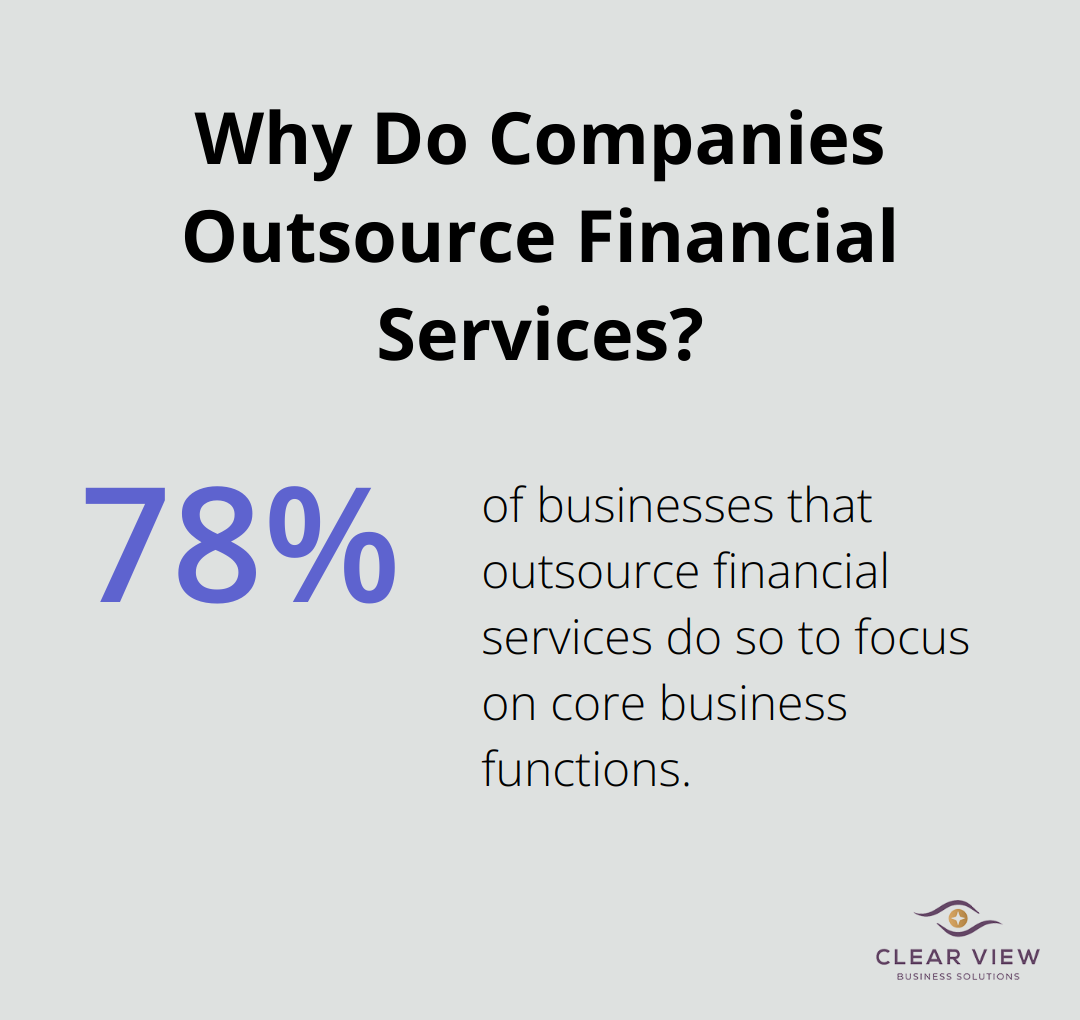

Your needs may evolve as your business grows. A study by Deloitte found that 78% of businesses that outsource financial services do so to focus on core business functions. This highlights the importance of choosing a provider that can scale with you.

When considering which services to outsource, think about the potential return on investment. According to a 2023 survey, 1 in 3 small businesses were penalized for payroll tax filing errors.

At this stage, it’s also worth considering any industry-specific financial management needs. For instance, if you’re in e-commerce, you might need a provider with experience in multi-state sales tax compliance. If you’re a nonprofit, look for expertise in fund accounting and grant management.

A thorough assessment of your financial management needs will equip you to find a service provider that aligns with your business goals and can deliver real value. This groundwork sets the stage for the next critical step: evaluating potential financial management service providers.

The best financial management service providers possess proven experience in your industry. Financial needs vary greatly across sectors. A construction company has different requirements than a tech startup. Look for case studies or client testimonials from businesses similar to yours. This industry-specific knowledge proves invaluable in navigating sector-specific regulations and financial practices.

Choose a provider that offers a wide range of services, from basic bookkeeping to advanced financial strategy. This breadth ensures you won’t outgrow your financial partner. A provider with diverse offerings allows clients to scale their financial management needs seamlessly as their business expands.

The technology a provider uses can significantly impact your financial management experience. Look for providers that utilize cloud-based accounting software. This flexibility enables businesses to easily adapt their financial management processes to changing requirements, such as adding new accounts or modifying existing ones. A recent survey by Sage found that 67% of accountants prefer cloud accounting solutions for their efficiency and accessibility.

Cost-effectiveness matters, but avoid providers that offer prices significantly lower than market rates. This could indicate subpar service quality. Instead, look for transparent pricing structures. There are many outsourcing pricing models, and it’s important to evaluate them all in order to figure out which best suits your needs. Some providers offer tiered pricing models, allowing you to choose a plan that fits your budget and needs. The goal is to find a provider that offers value, not just the lowest price.

Don’t underestimate the power of client testimonials and online reviews. These provide valuable insights into a provider’s reliability, communication style, and overall quality of service. Look for providers with a track record of long-term client relationships, as this often indicates consistent, high-quality service.

Effective communication forms the backbone of a successful financial management partnership. The best providers offer clear, timely, and regular communication channels. They should be readily accessible when you have questions or concerns. Look for providers who assign dedicated account managers or teams to ensure personalized attention.

In today’s digital landscape, data security is paramount. Top-tier financial management service providers implement robust security measures to protect your sensitive financial information. This includes encryption, secure data storage, and regular security audits. Ask potential providers about their data security protocols and compliance with industry standards (such as GDPR or CCPA).

As you evaluate potential financial management service providers, consider these factors carefully. The right partner will not only handle your current financial needs but will also support your business’s growth and success in the long term. Now, let’s explore how to effectively vet these potential providers to ensure you make the best choice for your business.

Selecting the right financial management service provider requires a meticulous evaluation process. Here’s how you can effectively assess potential financial partners:

Ask for detailed proposals from your shortlisted providers. These proposals should outline their service offerings, pricing structure, and implementation timeline. Focus on how they address your specific needs identified in the previous step. A well-crafted proposal demonstrates the provider’s understanding of your business and their ability to tailor their services accordingly.

U.S. accounting firms reported strong top-line and bottom-line growth in their latest fiscal year results, driven by high demand for their services.

Schedule interviews with the top contenders after you review the proposals. Prepare specific questions that address your concerns and requirements. Ask about their experience with businesses similar to yours, their approach to problem-solving, and how they stay updated with industry changes.

During these interviews, observe how well they communicate complex financial concepts. A provider who explains intricate financial matters in simple terms will prove invaluable in helping you understand your business’s financial health.

Don’t overlook the important step of verifying credentials and checking references. Request a list of current clients in your industry and contact them. Ask about their experience working with the provider, focusing on aspects like reliability, responsiveness, and the impact on their business.

Online reviews can also offer insights, but approach them critically. Look for patterns in feedback rather than focusing on isolated comments. Websites like Clutch.co or GoodFirms provide verified reviews of financial service providers, offering a more reliable perspective.

The significance of cultural fit cannot be overstated. Your financial management partner will access sensitive information and play a key role in your business decisions. Ensure their communication style and values align with your company culture.

Evaluate their responsiveness during the vetting process. If they respond slowly or communicate unclearly now, it will likely worsen once you become a client. Look for a provider who communicates proactively and transparently, and aligns with your preferred communication methods.

Surprisingly, ‘cultural fit’ remains a low priority with only 22% of executives citing it as a main concern in provider selection.

Selecting the right outsourced financial management services impacts your business’s financial health and growth potential. A thorough assessment of your needs and potential providers sets the stage for a successful partnership. The ideal financial management partner offers more than technical expertise; they provide industry-specific knowledge, advanced technology, and aligned communication.

Clear View Business Solutions understands the complexities of financial management for small businesses and startups. Our team offers comprehensive financial services tailored to your specific needs, from bookkeeping to advanced tax planning and IRS representation. We support you in navigating the financial landscape, ensuring compliance, and making informed decisions that drive growth.

Financial management challenges should not hold your business back. Take action today to find the right financial partner who can support your goals and help you achieve long-term success. With the right outsourced financial management services, you can focus on running and growing your business while experts handle the financial intricacies.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.