High income tax planning is a critical aspect of financial management for top earners. At Clear View Business Solutions, we understand the complexities and challenges faced by individuals in higher tax brackets.

This blog post will explore effective strategies and advanced techniques to optimize your tax situation. We’ll provide practical insights to help you navigate the intricacies of high-income taxation and maximize your financial potential.

The Internal Revenue Service (IRS) doesn’t set a single, fixed definition for “high income.” However, individuals who earn over $400,000 annually typically fall into this category. Tax implications can vary significantly based on factors like filing status and income source.

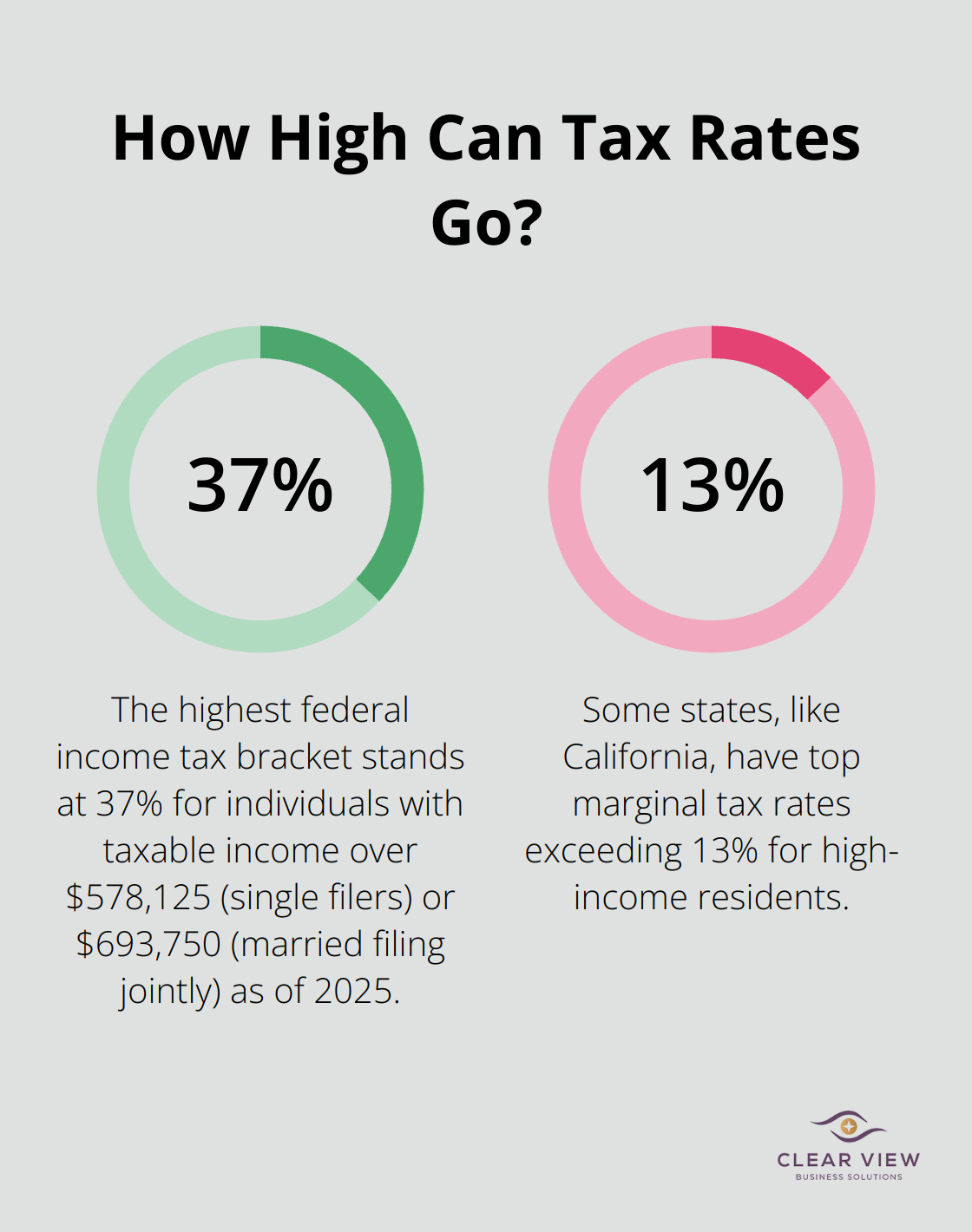

As of 2025, the highest federal income tax bracket stands at 37% for individuals with taxable income over $578,125 (single filers) or $693,750 (married filing jointly). These are marginal tax rates, which apply only to income above these thresholds. For example, a single filer earning $600,000 will pay 37% only on the amount exceeding $578,125.

Many people incorrectly believe that entering a higher tax bracket means all their income is taxed at that rate. The U.S. tax system is progressive, with different rates applying to different portions of income. For instance, a married couple filing jointly with $750,000 in taxable income will pay 10% on the first $22,000, 12% on the next portion, and so on, up to 37% on income over $693,750.

While federal taxes remain uniform across the country, state taxes can significantly impact high earners’ overall tax burden. Some states, like California, have top marginal rates exceeding 13% for high-income residents. Others (such as Florida and Texas) have no state income tax at all. This disparity can lead to substantial differences in after-tax income for high earners in different states.

The complexities of high-income taxation often surprise individuals, especially those who have recently experienced a significant income increase or have relocated to a new state. Understanding these nuances proves essential for comprehensive tax planning. Professional tax advisors (like those at Clear View Business Solutions) can provide invaluable insights into optimizing your tax strategy based on your specific financial situation and location.

As we move forward, we’ll explore effective strategies that high-income earners can employ to optimize their tax situations and maximize their financial potential.

High earners can reduce their taxable income by maximizing contributions to tax-advantaged retirement accounts. In 2025, individuals can contribute up to $23,500 to a 401(k) plan (with an additional $7,500 catch-up contribution for those 50 or older). IRA contribution limits stand at $7,000, with a $1,000 catch-up contribution.

For those who max out employer-sponsored plans, a backdoor Roth IRA strategy presents an attractive option. This involves making a non-deductible contribution to a traditional IRA and immediately converting it to a Roth IRA. While this doesn’t offer an immediate tax deduction, it allows for tax-free growth and withdrawals in retirement.

Municipal bonds offer an excellent option for high-income investors. The interest from these bonds typically remains exempt from federal taxes (and often state taxes for residents of the issuing state). Although yields might be lower than corporate bonds, the tax benefits can result in a higher after-tax return for those in high tax brackets.

Investments in qualified opportunity zones allow investors to defer capital gains taxes and potentially eliminate taxes on future appreciation if held for at least 10 years. However, investors should carefully evaluate the investment merits beyond just the tax benefits.

Charitable donations provide significant tax benefits while supporting important causes. Donating appreciated securities instead of cash allows donors to avoid capital gains taxes on the appreciation while still claiming the full market value as a charitable deduction.

For those with substantial charitable intentions, a donor-advised fund (DAF) serves as an excellent tool. Making a large contribution to a DAF in a high-income year allows donors to claim the tax deduction immediately and distribute the funds to charities over time. This strategy proves particularly effective for those close to the threshold between itemizing deductions and taking the standard deduction.

Timing plays a critical role in tax planning. Those with control over when they receive income or incur expenses can strategically shift these between tax years to their advantage. For instance, if an individual expects to be in a lower tax bracket next year, they should consider deferring income to that year if possible.

Conversely, in a high-income year, accelerating deductions into the current year can prove beneficial. This might involve prepaying property taxes or making an extra mortgage payment to increase the mortgage interest deduction.

These strategies require careful implementation and should form part of a comprehensive financial plan tailored to each individual’s specific situation. As we move forward, we’ll explore advanced tax reduction techniques that can further optimize your financial position.

Real estate investments offer substantial tax advantages for high earners. Investors can qualify for tax write-offs, pass-through deductions, incentive programs, and other tax benefits. The depreciation deduction allows investors to offset rental income with a non-cash expense. A $1 million property (excluding land value) can provide an annual depreciation deduction of about $36,000 over 27.5 years for residential properties.

The 1031 exchange rule enables investors to defer capital gains taxes by reinvesting proceeds from a property sale into a like-kind property. This strategy can build long-term wealth while deferring tax liabilities.

The choice of business entity can dramatically affect tax liabilities. S corporations allow business owners to pay themselves a reasonable salary subject to payroll taxes, with the remaining profits distributed as dividends, potentially saving on self-employment taxes.

A business owner with $300,000 in profits who pays themselves a $100,000 salary might save around $6,000 in self-employment taxes compared to operating as a sole proprietorship. However, it’s important to work with a tax professional to determine a defensible salary amount to avoid IRS scrutiny.

Tax-loss harvesting involves selling underperforming investments to realize losses that can offset capital gains. This strategy can be particularly effective for high-income individuals with substantial investment portfolios.

An investor with $50,000 in long-term capital gains from stock sales could sell other positions at a $50,000 loss to completely offset those gains, potentially saving $10,000 in taxes (assuming a 20% long-term capital gains rate).

Investors must be cautious of the wash-sale rule, which disallows losses if a substantially identical security is purchased within 30 days before or after the sale.

High-income earners should explore available tax credits and incentives, which can directly reduce tax liability dollar-for-dollar. The Research and Development (R&D) tax credit can be particularly valuable for business owners in technology or innovation-driven fields. This federal tax liability reduction can be taken for approved domestic expenses.

For qualified small businesses, up to $250,000 of the R&D credit can offset payroll taxes. This can significantly benefit startups that may not yet have income tax liability but incur substantial payroll costs.

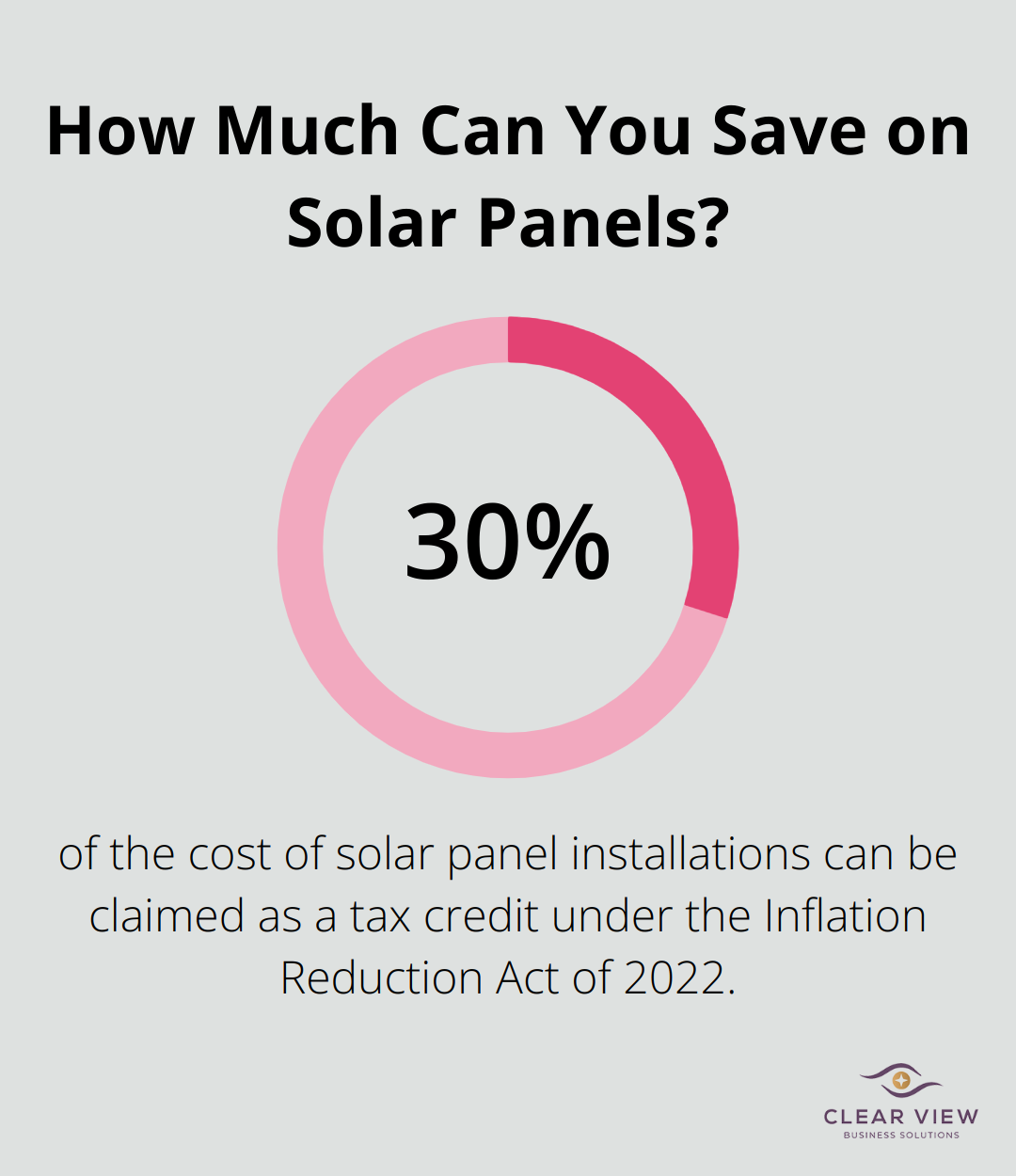

Energy-efficient home improvements can qualify for tax credits. The Inflation Reduction Act of 2022 increased the credit for solar panel installations to 30% of the cost, with no upper limit. A $30,000 solar system could result in a $9,000 tax credit.

These advanced strategies require careful planning and execution. High-income earners should work closely with experienced tax professionals to ensure compliance and maximize benefits. Clear View Business Solutions specializes in tailoring these strategies to individual circumstances, helping clients navigate the complexities of high-income taxation.

High income tax planning requires a complex yet essential approach for top earners. We explored strategies from retirement contributions to advanced techniques like real estate investments and business structure optimization. These approaches can reduce tax liabilities and enhance overall financial well-being. The dynamic nature of taxation underscores the importance of ongoing professional guidance in tax planning.

Clear View Business Solutions specializes in providing tailored tax strategies for high-income individuals and businesses. Our expertise helps you proactively plan to optimize your financial position. The benefits of proactive tax management extend beyond reducing your annual tax bill; it creates a comprehensive financial strategy that aligns with your long-term goals.

Successful high-income earners view tax planning as an ongoing process that requires regular review and adjustment. You can navigate the complexities of high-income taxation and maximize your financial potential with the right strategies and guidance. Professional expertise and a proactive approach will help you turn tax planning into a powerful tool for wealth creation and preservation.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.