Taxes can be a headache for businesses and individuals alike. At Clear View Business Solutions, we often hear the question: “What is a tax strategy?” It’s more than just filing your taxes on time.

A well-crafted tax strategy is a proactive approach to managing your financial obligations, maximizing deductions, and aligning your fiscal decisions with your long-term goals.

Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible within legal boundaries. It goes beyond mere compliance, focusing on making informed choices that align with financial goals and leverage available tax benefits.

An effective tax strategy consists of several essential elements:

While often confused, tax strategy and tax planning are distinct concepts:

Tax planning typically focuses on short-term tactics to reduce tax bills for the current year. It might involve actions such as:

A tax strategy takes a more holistic, long-term approach. It considers the overall financial picture and aims to create sustainable tax efficiency over many years. Examples include:

Both a solid tax strategy and effective tax planning are important. While tax planning can provide immediate benefits, a well-crafted tax strategy ensures that financial decisions consistently work towards long-term goals while minimizing tax burdens.

A thoughtfully constructed tax strategy can significantly influence various aspects of your financial life. It not only helps in reducing tax liabilities but also plays a crucial role in achieving broader financial objectives. The next section will explore the numerous benefits of implementing a comprehensive tax strategy, demonstrating why it’s an essential tool for financial success.

A comprehensive tax strategy leads to substantial savings. The National Small Business Association reports that small businesses spend an average of $12,000 annually on tax compliance. A strategic approach reduces this burden. Identifying often-overlooked deductions and credits keeps more of your hard-earned money in your pocket. For example, the Research and Development (R&D) tax credit saves eligible businesses up to $250,000 per year, yet many fail to claim it due to lack of awareness.

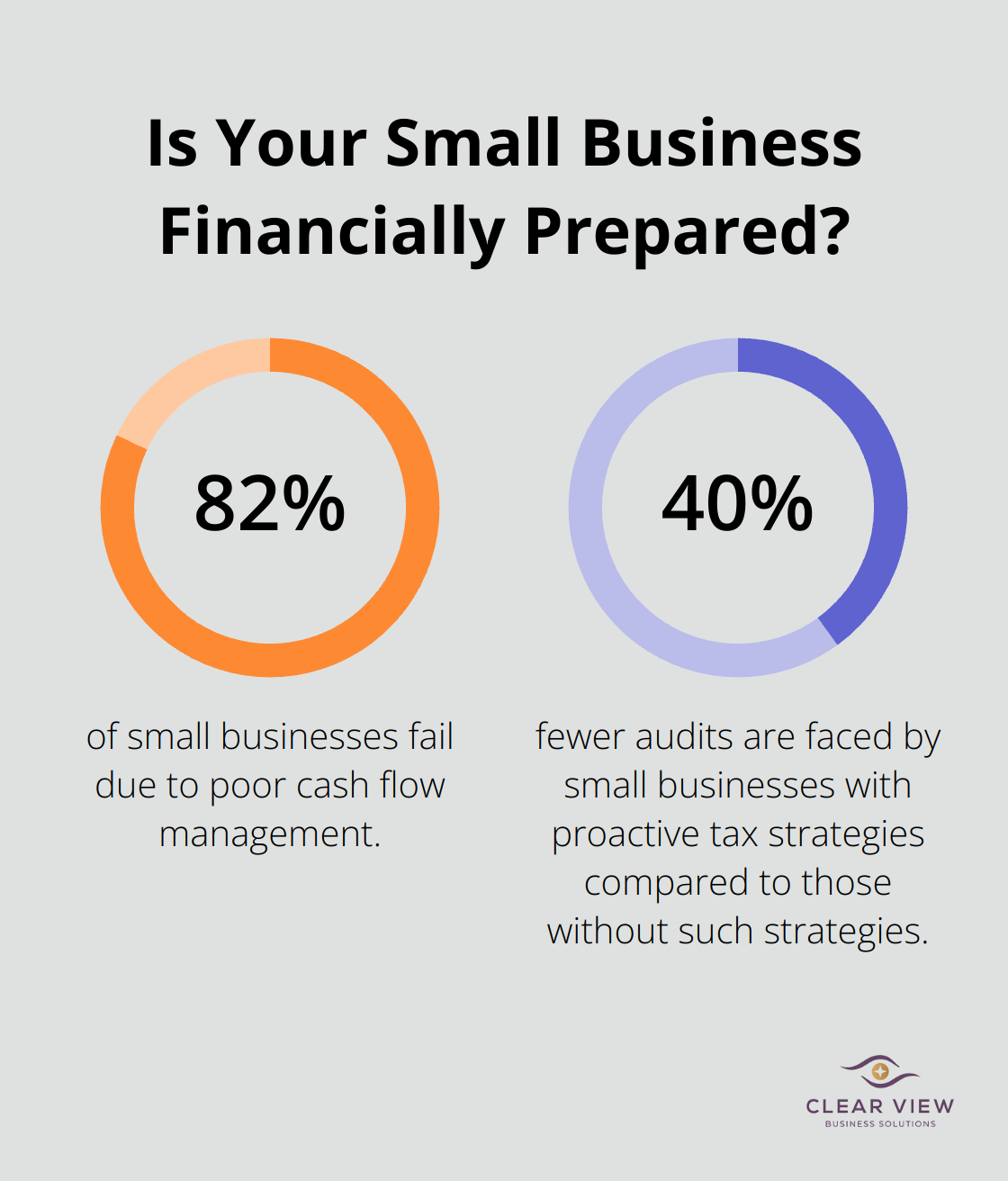

A solid tax strategy enhances cash flow management, a critical aspect of business success. A study by U.S. Bank reveals that 82% of small businesses fail due to poor cash flow management. Anticipating tax obligations and planning accordingly prevents cash crunches and maintains a steady financial footing. This foresight allows for better budgeting and investment in growth opportunities.

Tax season doesn’t need to cause anxiety. A proactive tax strategy transforms tax management into an ongoing process rather than a yearly scramble. This approach not only reduces stress but also minimizes the risk of errors that could lead to costly audits. According to the IRS, small businesses with proactive tax strategies face 40% fewer audits compared to those without such strategies.

A well-crafted tax strategy ensures that your financial decisions support your long-term objectives. It considers factors such as business growth plans, retirement goals, and estate planning. This alignment (often overlooked in day-to-day operations) proves essential for sustainable success.

Partnering with tax professionals (like those at Clear View Business Solutions) provides access to specialized knowledge and experience. These experts stay current with ever-changing tax laws and regulations, identifying opportunities you might miss on your own. They tailor strategies to your unique situation, maximizing benefits while ensuring compliance.

The next section will explore the key elements that make up a comprehensive tax strategy, providing a roadmap for effective tax management.

The first step in crafting a solid tax strategy involves a thorough analysis of your income sources. This step requires more than just tallying up your earnings. You need to understand the nature of each income stream and how it’s taxed. Salary income faces different tax treatment compared to investment income or business profits.

A study by the Tax Foundation found that understanding income composition can lead to an average tax savings of 3.8% for small businesses. This percentage might seem small, but for a business earning $500,000 annually, it translates to $19,000 in savings (enough to hire a part-time employee or invest in new equipment).

Your business structure significantly impacts your tax obligations. The choice between sole proprietorship, partnership, LLC, or corporation can make a substantial difference in your tax bill.

S Corporations can provide significant tax advantages for many small businesses. According to the National Federation of Independent Business, 78% of small business owners believe the 2017 tax relief had a positive effect on their businesses.

Timing plays a critical role in tax strategy. You can significantly reduce your tax burden by carefully managing when you receive income and incur expenses. This strategy doesn’t involve hiding income; it focuses on smart planning.

If you expect to be in a lower tax bracket next year, it might make sense to defer some income to the following year. Conversely, if you’re having a high-income year, accelerating deductible expenses into the current year could lower your tax bill.

The IRS reports that businesses that actively manage the timing of income and expenses save an average of 7.2% on their annual tax bills. For a business with $1 million in revenue, that’s $72,000 in savings (a substantial sum that could be reinvested for growth).

A comprehensive tax strategy should include careful consideration of your investment and retirement planning. Different investment vehicles offer various tax advantages. For example, contributions to traditional IRAs or 401(k)s can reduce your taxable income for the year, while Roth options provide tax-free growth and withdrawals in retirement.

Tax credits directly reduce your tax bill, making them a powerful tool in your tax strategy. Many businesses overlook valuable credits, such as the Research and Development (R&D) tax credit, which can save eligible businesses up to $250,000 per year. Try to identify all applicable credits for your specific situation to maximize your tax savings.

A tax strategy forms the foundation of financial success and peace of mind. It goes beyond simple tax planning, providing a comprehensive approach to manage your tax obligations effectively. Understanding what a tax strategy is and how to implement it can significantly reduce your tax burden, improve cash flow, and align your financial decisions with long-term goals.

The benefits of a well-crafted tax strategy are substantial. It maximizes deductions, optimizes business structures, and times income strategically to minimize tax liability while ensuring compliance with tax laws. A good tax strategy doesn’t exploit loopholes; it makes informed decisions that work within the legal framework to your advantage.

Clear View Business Solutions specializes in developing personalized tax strategies tailored to unique financial situations. Our expert team stays current with the latest tax laws, ensuring your strategy remains effective year after year. We offer comprehensive financial services for individuals and small businesses in Tucson, focusing on maximizing tax benefits and simplifying complex financial situations.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.