QuickBooks is a powerful tool that can revolutionize financial management for small businesses. However, many entrepreneurs struggle to harness its full potential.

At Clear View Business Solutions, we’ve seen firsthand how proper QuickBooks training for small business owners can lead to significant improvements in efficiency and financial clarity.

This guide will walk you through the essential steps to master QuickBooks, from initial setup to advanced techniques that will streamline your operations and boost your bottom line.

The first step to QuickBooks mastery is to choose the appropriate version. Most small businesses opt for QuickBooks Online due to its accessibility and cloud-based features. It allows you to work from virtually anywhere, on any device, with no additional fees for remote access. However, QuickBooks Desktop might be a better fit if you need robust inventory tracking or industry-specific functions.

After you select your version, set up your company file. Input your business details, including your company name, tax information, and fiscal year. Accuracy at this stage will prevent future complications (and potential headaches).

Focus on your chart of accounts next. This serves as the backbone of your financial records, categorizing all your transactions. QuickBooks offers industry-specific templates, but customization to fit your unique business needs is recommended. A well-structured chart of accounts simplifies financial reporting and tax preparation.

Tailor QuickBooks to your specific business requirements. This includes setting up your preferences for invoicing, expense tracking, and reporting. Don’t overlook the importance of setting user permissions if multiple team members will access the system.

Consider integrating QuickBooks with other business tools you use. This can include payment processors, e-commerce platforms, or customer relationship management (CRM) systems. Integration streamlines your workflow and reduces manual data entry (which can be a significant time-saver).

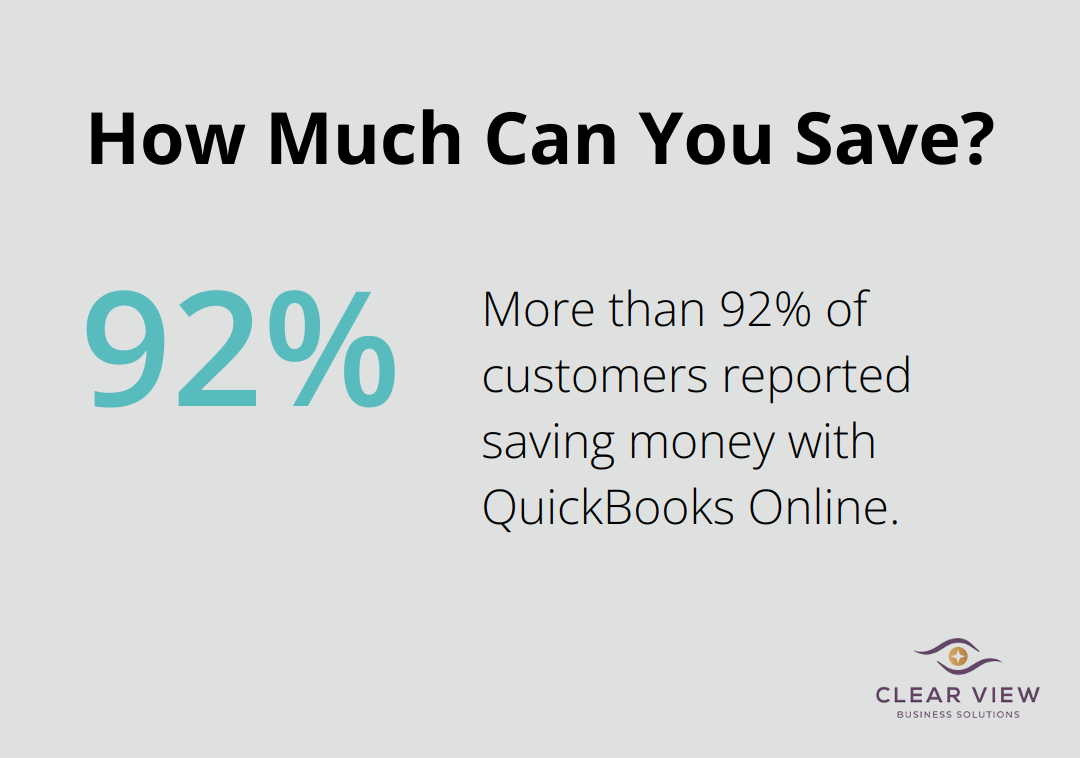

Proper QuickBooks setup can significantly reduce bookkeeping time for small businesses. According to a recent report, more than 92% of customers reported saving money with QuickBooks Online, with average savings of $500 each year. Take the time to configure it correctly from the start, and you’ll establish a solid foundation for your financial management. As you master these setup steps, you’ll be ready to explore the essential QuickBooks features that will drive your small business success.

QuickBooks offers a range of powerful features that can transform your small business’s financial management. Let’s explore the key tools that will help you take control of your finances.

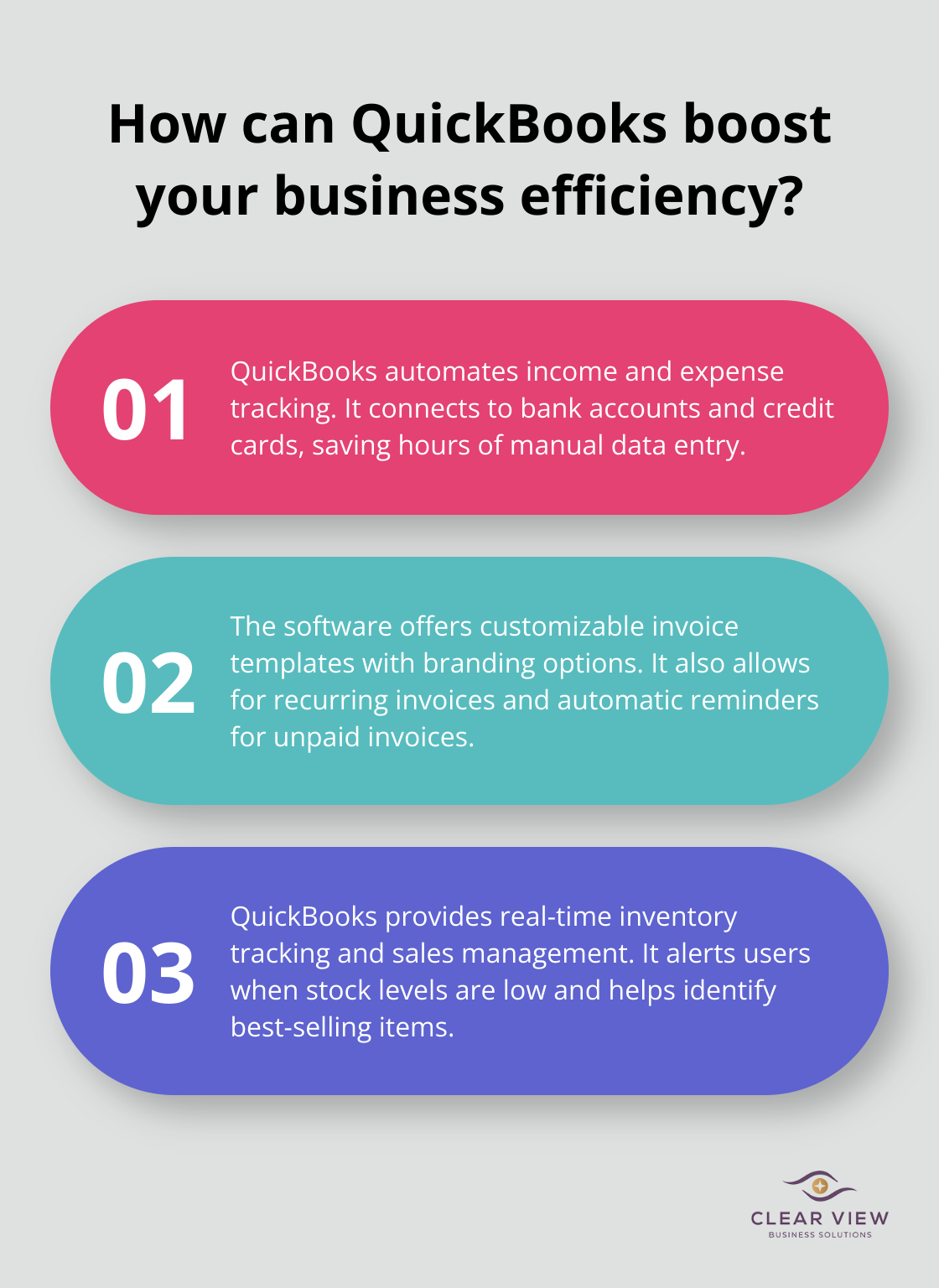

QuickBooks simplifies the process of recording and categorizing your financial transactions. Connect your bank and credit card accounts to automatically import transactions, which saves you hours of manual data entry.

To maximize efficiency, set up rules to automatically categorize recurring transactions. This not only saves time but also reduces the risk of human error. Review these categorizations regularly to ensure accuracy, especially as your business evolves.

Creating and sending professional invoices is essential for maintaining a positive cash flow. QuickBooks allows you to customize invoice templates with your logo and brand colors, making a lasting impression on clients. You can also set up recurring invoices for regular customers, ensuring timely billing without the need for manual intervention.

A helpful tip: use QuickBooks’ invoice tracking feature to monitor unpaid invoices and send automatic reminders to clients. This proactive approach can significantly improve your accounts receivable turnover.

For businesses dealing with physical products, QuickBooks’ inventory tracking feature is a game-changer. It provides real-time updates on stock levels, alerting you when it’s time to reorder. This prevents stockouts and overstocking, optimizing your cash flow.

The sales tracking feature integrates seamlessly with inventory management, giving you a clear picture of your best-selling items and profit margins. Use this data to make informed decisions about pricing, promotions, and inventory investments.

QuickBooks’ reporting capabilities are where its true power shines. Generate comprehensive financial reports with just a few clicks, including profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into your business’s financial health and performance.

A practical tip: schedule regular financial review sessions using these reports. Monthly reviews work well for most small businesses. This practice helps you spot trends, identify areas for improvement, and make data-driven decisions to drive your business forward.

As you master these essential QuickBooks features, you’ll gain better control over your finances and free up time to focus on growing your business. While QuickBooks is user-friendly, getting professional guidance can help you unlock its full potential. The next chapter will explore advanced QuickBooks techniques to further enhance your financial management skills.

Regular bank reconciliation maintains accurate financial records. QuickBooks’ automated bank feed feature simplifies this process. This tool imports transactions directly from your bank, which reduces manual data entry and error risk. Set up rules to automatically categorize recurring transactions. This can save you hours each month and ensure consistency in your financial records.

A study by Intuit found that Intuit Enterprise Suite could save growing businesses $447K with a 299% return on investment over 3 years. This time savings allows you to focus more on strategic business activities.

QuickBooks offers robust payroll features that save time and reduce compliance risks. The software automatically calculates payroll taxes, generates paychecks, and files payroll tax forms. This automation reduces the likelihood of costly errors and ensures timely tax payments.

For tax management, QuickBooks tracks your income and expenses throughout the year, which makes tax preparation much smoother. The software generates reports that you can easily share with your tax professional (streamlining the tax filing process).

QuickBooks integrates with a wide range of business tools. These integrations can boost your productivity by eliminating duplicate data entry and providing a more comprehensive view of your business operations.

For example, integrating QuickBooks with your e-commerce platform automatically syncs sales data (saving you hours of manual data entry). Similarly, connecting QuickBooks to your CRM system provides valuable insights into customer profitability and helps inform your sales strategies.

QuickBooks’ budgeting and forecasting tools allow you to create detailed financial projections based on your historical data. These projections help you make informed decisions about future investments, hiring, and expansion plans.

Try to set up a budget in QuickBooks based on your past performance and future goals. Then, regularly compare your actual results to your budget using QuickBooks’ variance reports. This practice helps you identify areas where you’re over or under-spending and adjust your strategies accordingly.

For forecasting, use QuickBooks’ cash flow projector to anticipate potential cash shortages or surpluses. This tool proves invaluable for managing your working capital and planning for future expenses or investments.

Professional QuickBooks setup extends beyond initial configuration. It helps businesses avoid common pitfalls, unlock advanced features, and maximize the software’s potential for their specific needs.

QuickBooks empowers small business owners to take control of their finances and make informed decisions. The software streamlines bookkeeping processes and provides valuable insights through detailed reports. Small business owners should explore new features regularly, attend webinars, and participate in online forums to enhance their skills.

Accurate financial records require consistent maintenance. Small business owners should set aside time each week to reconcile accounts, categorize transactions, and review their financial position. This practice will keep books in order and help spot trends and opportunities for growth.

Professional guidance can accelerate mastery of QuickBooks. Clear View Business Solutions specializes in QuickBooks training for small business owners. Our team can help set up QuickBooks accounts, customize them to specific business needs, and teach how to leverage advanced features (maximizing benefits for your business).

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.