At Clear View Business Solutions, we know that business owner tax planning is a critical aspect of financial success. Effective tax strategies can significantly impact your bottom line and future growth.

This guide offers essential tips to help you navigate the complex world of business taxes, maximize deductions, and reduce your tax burden. Whether you’re a seasoned entrepreneur or just starting out, these insights will help you make informed decisions and keep more money in your pocket.

Your business structure significantly affects your tax obligations. Different structures lead to varying tax treatments, filing requirements, and potential savings. Let’s explore the main types and their tax implications.

Sole proprietorships and partnerships operate as pass-through entities. This means the business income flows directly to the owner’s personal tax return. While this simplifies filing, it can result in higher self-employment taxes. The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).

C corporations can lower their taxes and avoid double-taxation in a number of ways. S Corporations, however, allow business income to pass through to shareholders. This structure potentially reduces self-employment taxes.

LLCs offer tax flexibility. Owners can choose to be taxed as sole proprietorships, partnerships, S corporations, or C corporations. This adaptability allows business owners to select the most advantageous tax treatment for their specific situation.

Your business structure determines which tax forms you need to file:

Key tax deadlines also vary by structure. For calendar year filers:

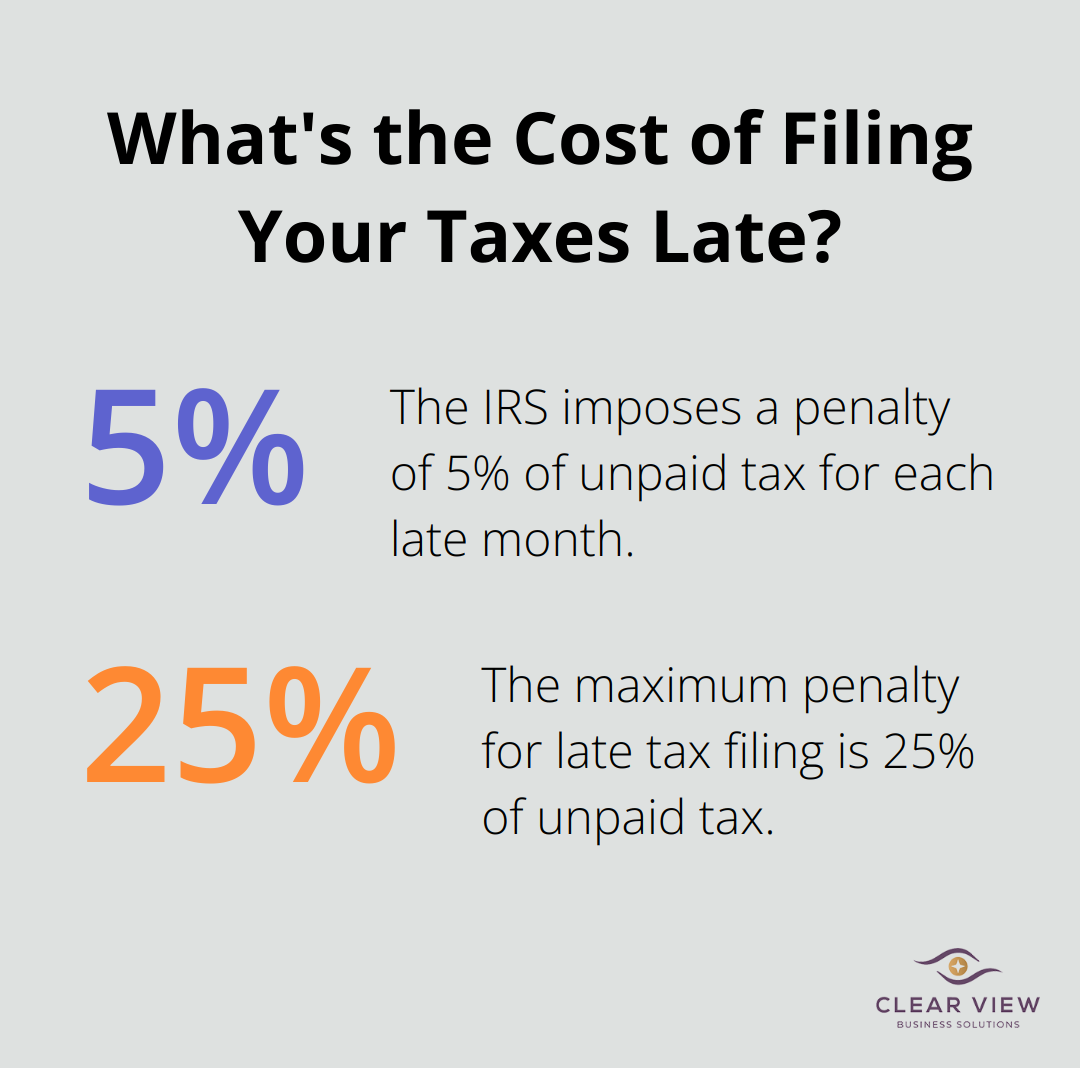

The IRS imposes penalties for missed deadlines (5% of unpaid tax for each late month, up to 25%).

Understanding these structures and their tax implications forms the foundation of effective tax planning. The next crucial step involves maximizing deductions and credits to further reduce your tax burden.

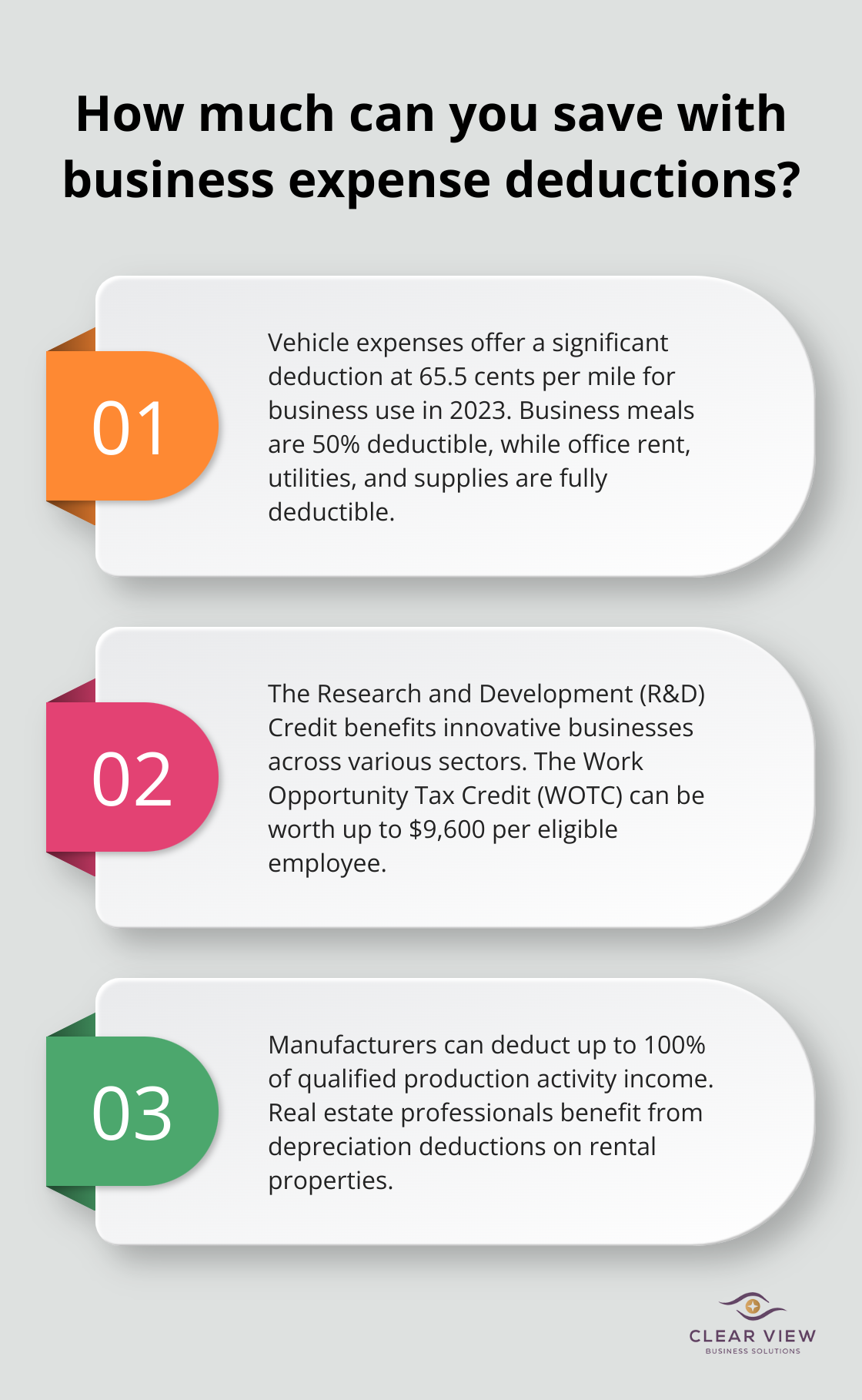

The IRS allows you to deduct ordinary and necessary business expenses. This includes office rent, utilities, supplies, and employee wages. Don’t overlook less obvious deductions like business-related travel, meals (50% deductible), and home office expenses if you qualify.

Vehicle expenses represent one of the most significant deductions for small businesses. If you use your car for business, you can deduct 65.5 cents per mile driven for business use in 2023.

Different industries have unique tax advantages. Manufacturers can deduct up to 100% of qualified production activity income. Retailers can write off unsold inventory. Real estate professionals benefit from depreciation deductions on rental properties.

The construction industry can take advantage of the domestic production activities deduction, which can result in substantial annual savings. It’s essential to work with a tax professional who understands your industry’s specific opportunities.

Tax credits directly reduce your tax bill dollar-for-dollar, making them even more valuable than deductions. The Research and Development (R&D) Credit benefits innovative businesses across various sectors (not just tech companies). The Inflation Reduction Act of 2022 (IRA) has increased and modified this credit for qualified small businesses.

The Work Opportunity Tax Credit (WOTC) rewards businesses for hiring individuals from certain target groups, such as veterans or long-term unemployed. This credit can be worth up to $9,600 per eligible employee.

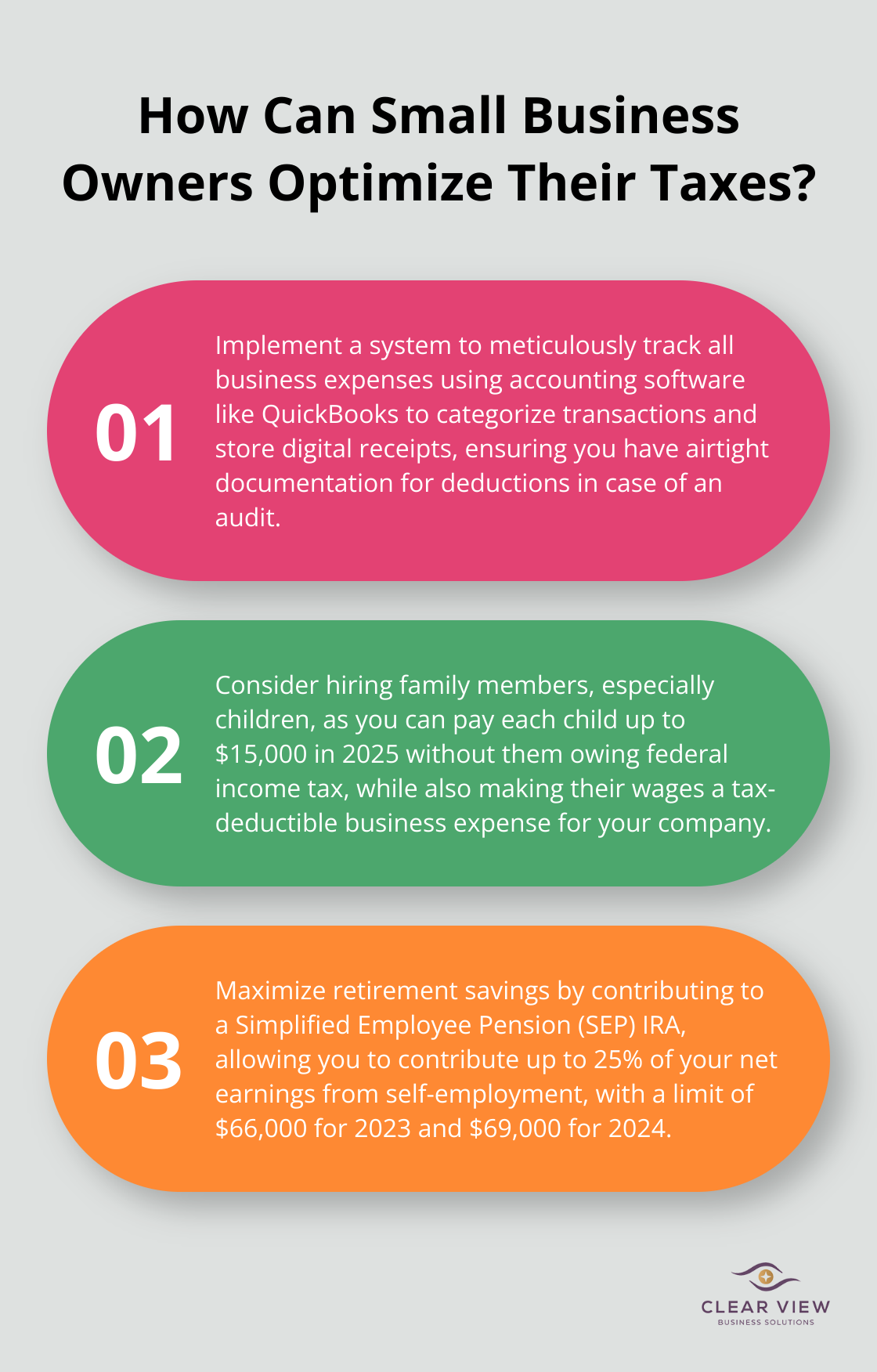

The IRS demands thorough documentation. Without proper records, you risk losing valuable deductions if audited. Implement a system to track all business expenses meticulously. Use accounting software (like QuickBooks) to categorize transactions and store digital receipts.

Maintain a mileage log for vehicle expenses and keep detailed records of business meals, including attendees and the business purpose discussed. This level of detail can make the difference between a smooth audit and a costly nightmare.

Tax planning shouldn’t be a once-a-year activity. Implement these strategies throughout the year and stay informed about new opportunities to significantly reduce your tax burden. Every dollar saved in taxes becomes another dollar you can reinvest in growing your business.

The next step in optimizing your tax strategy involves timing your income and expenses strategically. Let’s explore how you can leverage this approach to further minimize your tax liability.

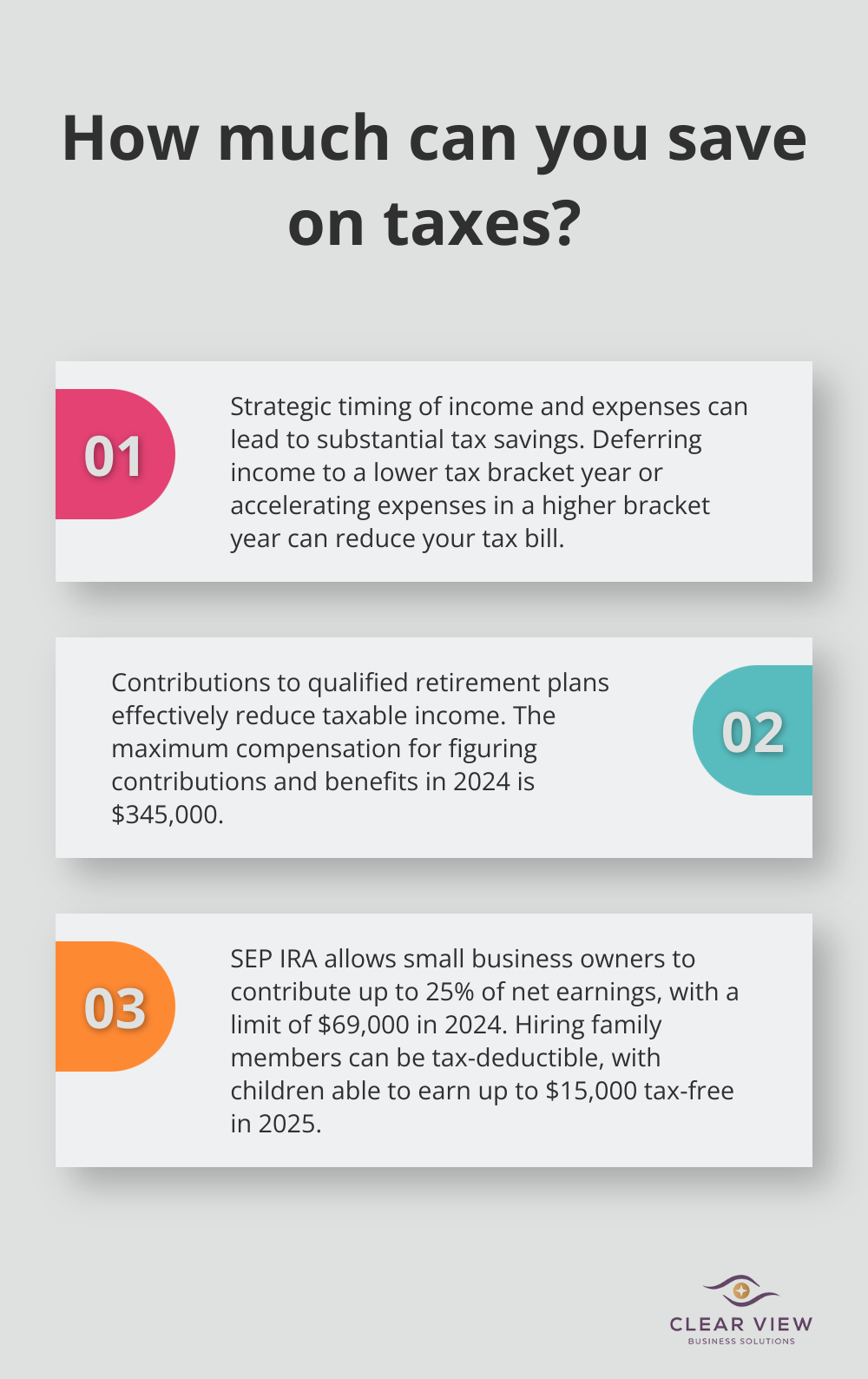

Smart timing of income and expenses can lead to substantial tax savings. If you expect to be in a lower tax bracket next year, consider deferring income to the following year. This could involve delaying billing for services or postponing year-end bonuses. Conversely, if you anticipate being in a higher bracket, accelerate income into the current year.

For expenses, the reverse strategy applies. If you’re in a higher tax bracket this year, consider prepaying some of next year’s expenses now. This could include stocking up on office supplies, paying insurance premiums in advance, or scheduling and paying for equipment maintenance.

Contributions to qualified retirement plans are one of the most effective ways to reduce your taxable income. For 2024, the maximum compensation used for figuring contributions and benefits is $345,000.

For small business owners, a Simplified Employee Pension (SEP) IRA can be particularly attractive. You can contribute up to 25% of your net earnings from self-employment, up to $66,000 for 2023 (this limit increases to $69,000 in 2024).

Hiring family members can be a smart tax move. If you hire your children, their wages become a tax-deductible business expense for you. Plus, you can pay each child up to $15,000 in 2025 without them owing any federal income tax.

Paying estimated taxes correctly is important to avoid penalties. The IRS expects you to pay taxes as you earn income throughout the year. For most business owners, this means making quarterly estimated tax payments.

Try to pay at least 90% of your current year’s tax liability or 100% of your previous year’s liability (110% if your adjusted gross income was over $150,000). This approach helps you avoid underpayment penalties while ensuring you’re not overpaying.

Tax laws are complex and ever-changing. While these tips can guide you, working with a professional tax advisor is important for developing a comprehensive tax strategy tailored to your unique situation. Clear View Business Solutions specializes in creating personalized tax plans that maximize savings and keep you compliant with all relevant regulations.

Effective business owner tax planning empowers financial success. Understanding your business structure, maximizing deductions, and implementing strategic income and expense timing can significantly reduce your tax burden. Retirement plan contributions, strategic family hiring, and proper estimated tax payment management offer additional avenues for substantial savings.

Tax laws change frequently and require expert navigation. We at Clear View Business Solutions specialize in creating personalized tax plans that maximize savings and ensure compliance. Our approach allows for better cash flow management, more accurate financial forecasting, and informed business decisions throughout the year.

Proactive tax planning yields long-term benefits beyond reducing your current tax bill. It frees you to focus on growing your business without the stress of unexpected tax burdens. Every dollar saved in taxes becomes a dollar you can reinvest in your business, potentially fueling growth and success.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.