Estate planning is a crucial step in securing your financial legacy, but it often comes with significant legal fees. At Clear View Business Solutions, we frequently encounter clients wondering about the tax implications of these expenses.

Are attorney fees for estate planning tax deductible? This question is more complex than it might seem at first glance, and understanding the answer can have a substantial impact on your financial planning.

Estate planning encompasses a range of services that prepare for the management and distribution of your assets after death. These services typically include the creation of essential legal documents such as wills, trusts, and powers of attorney. Advanced planning might involve strategies for estate tax minimization, charitable giving plans, or business succession plans. Some clients also opt for long-term care planning or special needs trusts for family members with disabilities.

The cost of estate planning can vary widely depending on the complexity of your financial situation and the specific services you require. According to a LegalZoom survey, estate planning with an attorney typically costs between $1,500-$3,500. This can include the creation of essential documents and more comprehensive planning strategies.

Attorneys often use two main fee structures for estate planning services: hourly rates and flat fees.

While these costs may seem significant, they represent an investment in your family’s future financial security. Many people find that the peace of mind and potential tax savings (in some cases) outweigh the initial expenses.

It’s important to discuss fees upfront with your chosen estate planning professional. This transparency allows you to budget appropriately for these services and avoid any surprises. Some attorneys offer free initial consultations, which can provide an opportunity to discuss your needs and get a clearer picture of potential costs.

As we move forward, it’s important to consider not just the cost of estate planning, but also its potential tax implications. The next section will explore whether these attorney fees for estate planning are tax deductible, a question that can significantly impact your overall financial strategy.

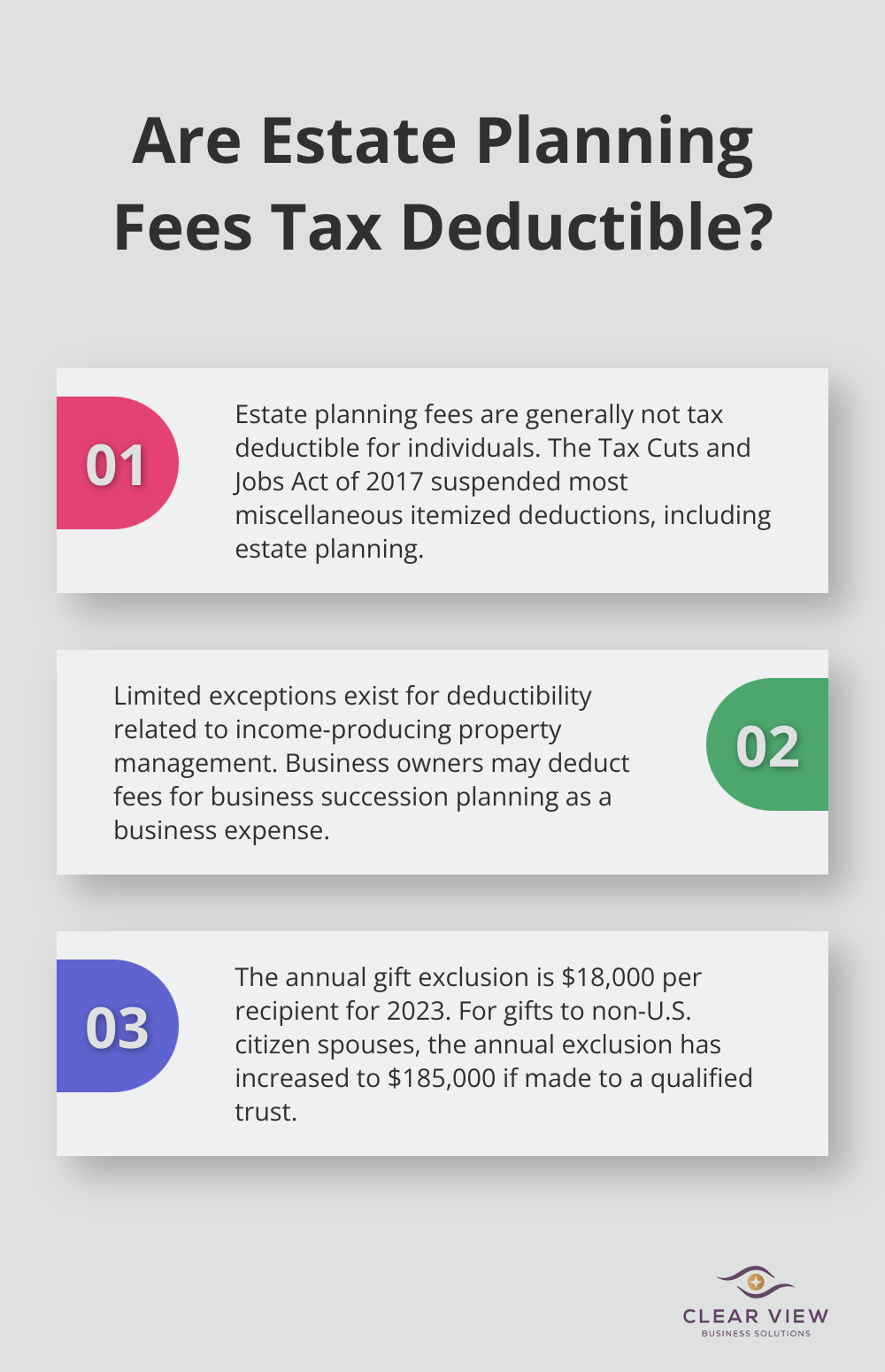

Estate planning fees are generally not tax deductible for individuals under current tax laws. The Tax Cuts and Jobs Act of 2017 suspended most miscellaneous itemized deductions, including those for estate planning.

The Internal Revenue Service (IRS) now classifies most estate planning expenses as personal legal expenses, which are not tax-deductible. This includes fees for creating wills, trusts, and other estate planning documents. The IRS considers these expenses personal in nature rather than necessary for producing income or managing property held for income production.

While the general rule is non-deductibility, some narrow exceptions exist where certain estate planning fees might still qualify as tax-deductible. These exceptions typically relate to the management of income-producing property or the collection of taxable income.

For example, if part of your estate planning involves setting up a trust to manage income-producing assets, the portion of the legal fees specifically related to that income-producing aspect might be deductible. However, these exceptions are limited and often complex to navigate without professional guidance.

For business owners, a potential silver lining exists. If your estate planning involves business succession planning or other aspects directly related to your business, those specific fees might qualify as a deductible business expense. This applies because the IRS considers them necessary for the continuation and management of the business, rather than personal expenses.

If you believe some of your estate planning fees might fall under the deductible exceptions, meticulous documentation becomes essential. Keep detailed records of all estate planning expenses, including itemized invoices from your attorney that clearly delineate between personal planning and any potentially deductible services.

Given the limited deductibility of estate planning fees, it’s more important than ever to focus on other tax-saving strategies within your estate plan. This might include leveraging annual gift exclusions (currently $18,000 per recipient for 2023), setting up charitable trusts, or exploring life insurance trusts. For gifts made to spouses who are not U.S. citizens, the annual exclusion has been increased to $185,000, provided the additional (above the $18,000 annual exclusion) is made to a qualified trust. These strategies can help reduce your overall estate tax liability, potentially offsetting the non-deductibility of planning fees.

While the landscape of tax deductions for estate planning has changed, the importance of comprehensive estate planning remains paramount. It continues to serve as a vital tool for protecting your assets, providing for your loved ones, and ensuring your wishes are carried out. The next section will explore strategies to maximize tax benefits in estate planning, despite the limitations on fee deductibility.

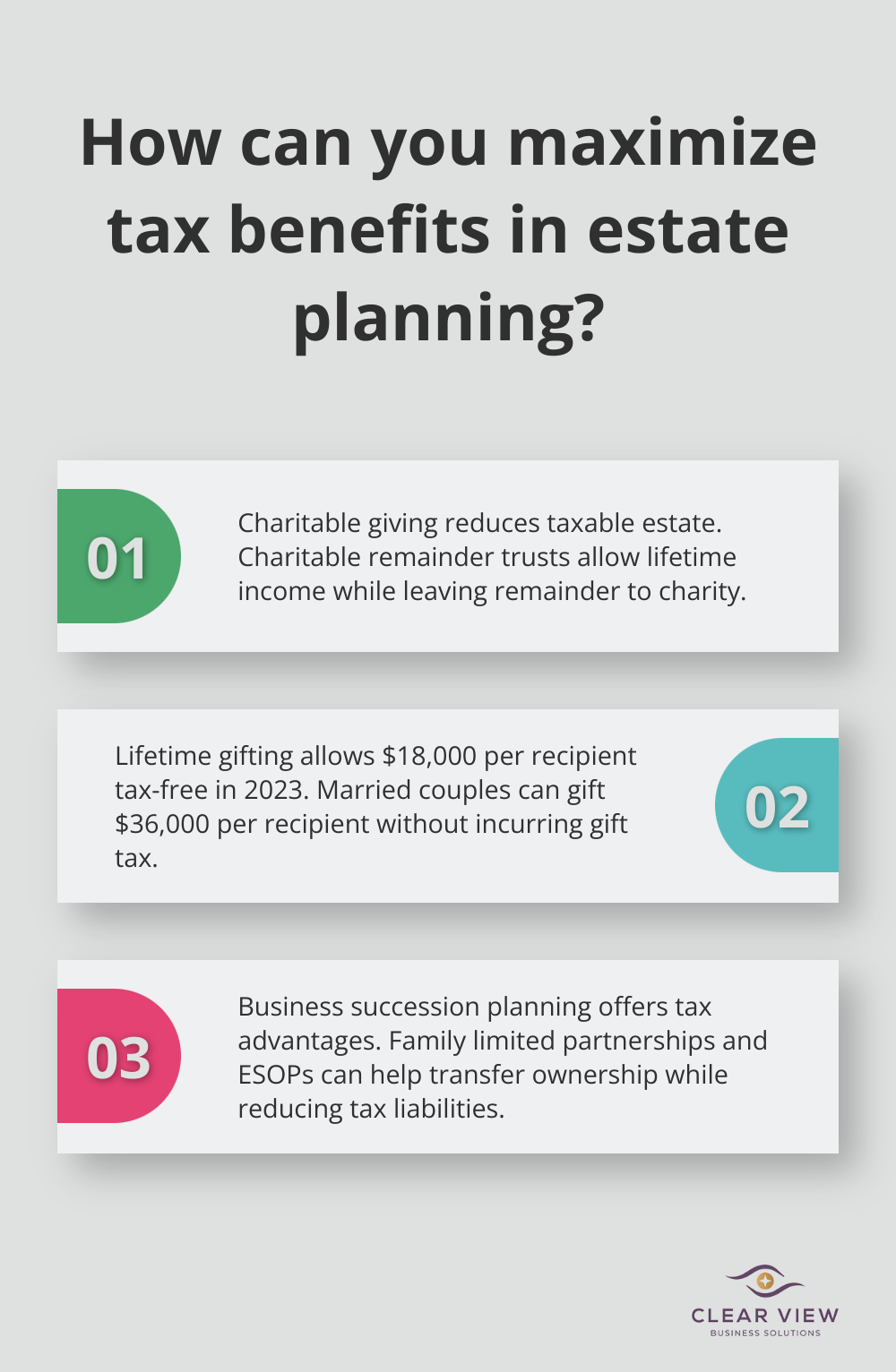

One effective strategy incorporates charitable giving into your estate plan. Donations to qualified charities can reduce your taxable estate while supporting causes you care about. Setting up a charitable remainder trust allows you to receive income during your lifetime while leaving the remainder to a charity, potentially reducing your estate tax liability. Beneficiaries of these trusts must report payments received from the trust on their personal income tax returns.

The IRS allows you to give up to $18,000 per recipient in 2023 without incurring gift tax. For married couples, this amount doubles to $36,000 per recipient. Over time, this strategy can significantly reduce your taxable estate. The lifetime gift tax exemption is currently $12.92 million per individual. The value of lifetime taxable gifts (beginning with gifts made in 1977) is added to the net amount when computing estate tax.

For business owners, integrating business succession planning into your estate plan can offer tax advantages. Techniques like creating a family limited partnership or using an employee stock ownership plan (ESOP) can help transfer business ownership while potentially reducing tax liabilities. These strategies require careful planning and documentation, so working with experienced professionals is essential.

Maintaining meticulous records is paramount. This includes keeping detailed logs of gifts made, charitable contributions, and any business-related estate planning expenses. In the event of an IRS audit, this documentation can prove invaluable in substantiating your tax position.

Estate planning and tax laws are complex and subject to change. Working with experienced professionals (such as those at Clear View Business Solutions) can help you navigate these complexities and create a tailored plan that maximizes available tax benefits while meeting your specific needs and goals.

Attorney fees for estate planning are not tax deductible under current IRS regulations. This fact does not diminish the importance of estate planning in securing your financial legacy and protecting your loved ones. Estate planning helps manage and distribute assets, minimize conflicts among beneficiaries, and ensure your wishes are carried out.

Despite limitations on deductibility, you can still maximize tax benefits within your estate plan. Strategies such as charitable giving, lifetime gifting, and business succession planning can reduce your overall tax liability (these approaches require expert guidance to implement effectively). The true value of estate planning lies in the peace of mind it provides, knowing you’ve taken steps to protect your assets and provide for your loved ones.

At Clear View Business Solutions, we offer financial advisory and tax services to help you navigate these challenges. Our team can assist you in creating a tailored estate plan that aligns with your goals while maximizing available tax benefits. Don’t let the non-deductibility of estate planning fees deter you from this essential financial step.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.