At Clear View Business Solutions, we understand that mastering bookkeeping basics for small business is essential for financial success. Many entrepreneurs feel overwhelmed when it comes to managing their finances, but it doesn’t have to be complicated.

In this guide, we’ll break down the fundamentals of small business bookkeeping and provide practical tips to help you stay on top of your finances. Whether you’re just starting out or looking to improve your current practices, this post will equip you with the knowledge you need to make informed financial decisions for your business.

Small business bookkeeping forms the backbone of financial management for entrepreneurs. It involves the recording, organization, and tracking of all financial transactions in a business. Accurate bookkeeping keeps firms organized and effective and allows them to make wise decisions based on solid information.

Effective bookkeeping requires meticulous record-keeping of every dollar that flows in and out of a business. This includes sales, purchases, payments to vendors, and employee wages. Accurate records allow the generation of crucial financial statements that offer insights into business performance.

Three key financial statements small business owners should understand are:

While often confused, bookkeeping and accounting serve distinct functions. Bookkeeping focuses on the day-to-day recording of financial transactions. Accounting, on the other hand, involves the analysis, interpretation, and reporting of financial data to guide business strategy.

Bookkeeping acts as the foundation upon which accounting builds. Without accurate bookkeeping, accountants lack reliable data to work with, which makes their analyses and projections less valuable.

Maintaining organized financial records does more than just ensure compliance with tax laws. It provides numerous advantages:

Modern technology offers various tools to simplify the bookkeeping process. QuickBooks, a popular accounting software, stands out as a top choice for small businesses. It provides user-friendly interfaces, automated features, and comprehensive reporting capabilities. Clear View Business Solutions offers QuickBooks training as part of their full-cycle bookkeeping services, ensuring clients can maximize the software’s potential.

As we move forward, let’s explore the essential bookkeeping practices that every small business should implement to maintain financial health and drive growth.

The first rule of small business bookkeeping requires you to keep your personal and business finances separate. Open a dedicated business bank account and credit card. This separation simplifies your bookkeeping and protects your personal assets. A survey by Clutch reveals that 27% of small business owners use personal accounts for business, a practice that can lead to tax complications and personal liability issues.

Deciding between cash and accrual accounting is important. Under the accrual method, you generally report income in the tax year you earn it, regardless of when payment is received. You deduct expenses in the tax year they’re incurred. For most small businesses, cash accounting proves simpler and more intuitive. However, if your annual gross receipts exceed $25 million, the IRS requires you to use accrual accounting.

Accurate income and expense tracking is essential. Use accounting software to categorize transactions as they occur. QuickBooks (which Clear View Business Solutions offers training for) can automate much of this process. Set aside time each week to review and categorize transactions. This habit saves hours of work during tax season and provides real-time insights into your business’s financial health.

Effective management of accounts receivable (AR) and accounts payable (AP) maintains healthy cash flow. For AR, implement clear payment terms and follow up promptly on overdue invoices. Consider offering early payment discounts to incentivize prompt payments. For AP, negotiate favorable terms with suppliers and schedule payments to maximize your cash position without damaging vendor relationships.

Bank reconciliation helps you verify if your financial statements are 100% accurate and current. It also aids in fraud detection. Set a monthly date to compare your books against your bank statements. This practice ensures your records are accurate and can uncover discrepancies before they become major issues. Many small businesses that skip this step find themselves facing unexpected cash shortages or tax liabilities.

Implementing these practices creates a solid foundation for your business’s financial health. If you feel overwhelmed, professional help is available. Clear View Business Solutions specializes in guiding small businesses through these essential bookkeeping practices, ensuring you’re set up for success. As we move forward, let’s explore the tools and resources that can further streamline your bookkeeping process and enhance your financial management capabilities.

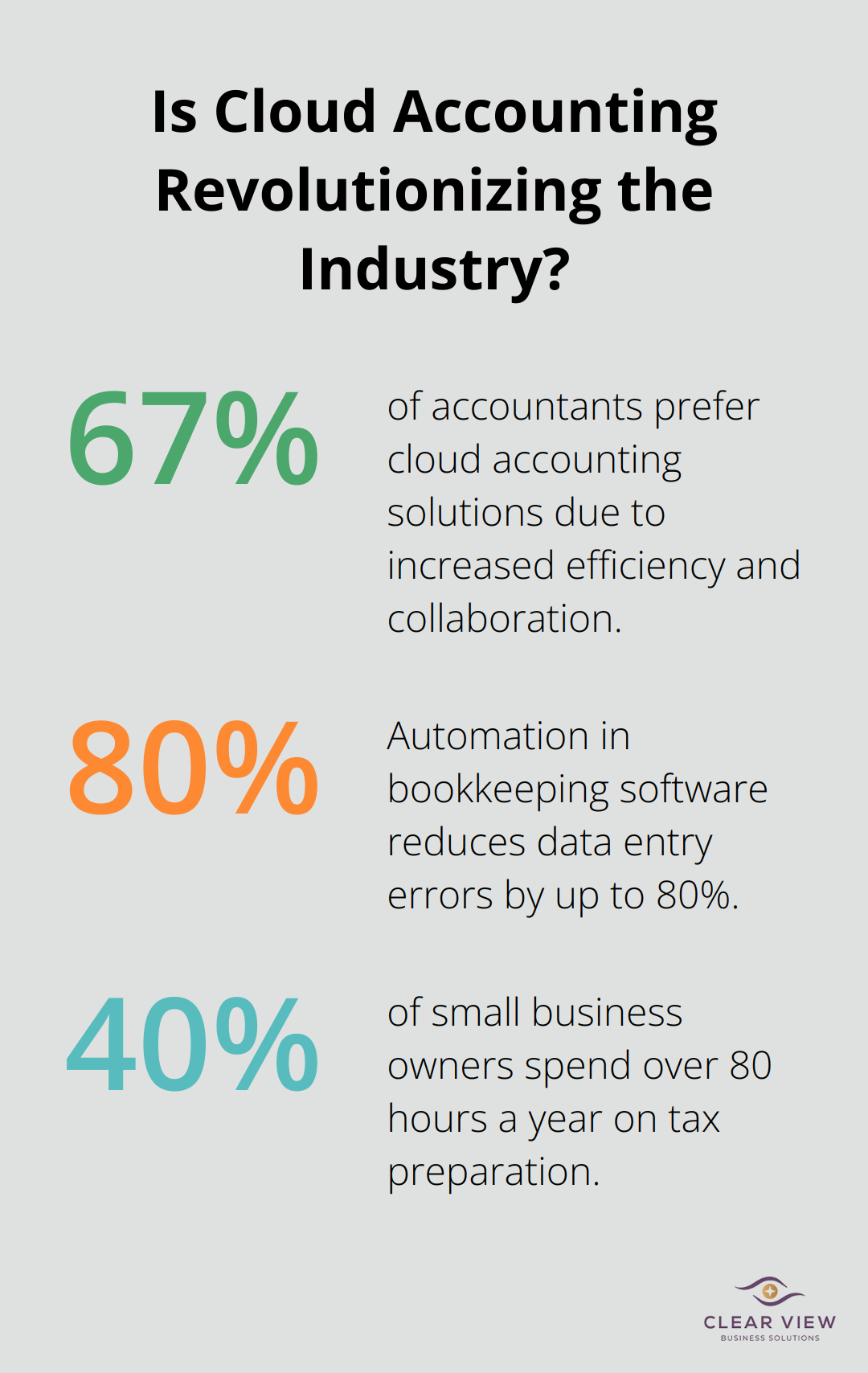

Cloud-based accounting systems for small businesses lets them access their financial data from anywhere, making things easier and saving money. A study by Sage reveals that 67% of accountants prefer cloud accounting solutions due to increased efficiency and collaboration.

QuickBooks Online stands out as a popular cloud-based accounting software. It offers features such as automatic bank reconciliation, invoice tracking, and financial report generation. Small business owners can save up to 40 hours per month on bookkeeping tasks with QuickBooks Online (according to Intuit).

Automation revolutionizes bookkeeping processes. Software like Xero and FreshBooks use artificial intelligence to categorize transactions automatically. This feature reduces data entry errors by up to 80% (as reported by Accounting Today).

These platforms also integrate with other business tools, creating a seamless financial ecosystem. For example, connecting an e-commerce platform with accounting software automatically records sales and updates inventory levels.

While software handles many bookkeeping tasks, professional help becomes invaluable at certain points. A survey by Score indicates that 40% of small business owners spend over 80 hours a year on tax preparation. This time could be better allocated to core business activities.

Professional bookkeeping services allow businesses to focus on growth and profitability, knowing that their financial data is well-organized and compliant with regulations. For businesses with complex financial situations or those looking to scale, professional bookkeeping services (such as those offered by Clear View Business Solutions) can be a wise investment.

QuickBooks remains a top choice for small business bookkeeping. Its user-friendly interface and comprehensive features make it an essential tool for financial management. QuickBooks offers:

Clear View Business Solutions provides QuickBooks training as part of their full-cycle bookkeeping services, ensuring clients maximize the software’s potential.

Selecting the appropriate bookkeeping tools and resources depends on various factors:

Try to assess your current needs and future goals when deciding between software solutions and professional services. A combination of both often yields the best results for small businesses aiming for growth and financial stability.

Mastering bookkeeping basics for small businesses is essential for financial success and growth. Accurate financial records provide clarity on your position, help identify trends, and enable you to spot potential issues early. Well-maintained books streamline tax preparation, facilitate easier access to financing, and prove invaluable when seeking investors or planning for expansion.

Modern tools and software have made bookkeeping more accessible, but many small business owners find professional assistance beneficial. At Clear View Business Solutions, we offer comprehensive bookkeeping services tailored to the unique needs of small businesses in Tucson. Our expertise in QuickBooks training, full-cycle bookkeeping, and tax planning can help you navigate the complexities of financial management.

Effective bookkeeping creates a solid foundation for your business to thrive. It goes beyond meeting legal requirements and positions you to make strategic decisions that drive your business forward. Investing time and resources in this aspect of your business will yield long-term benefits and help you achieve your entrepreneurial goals.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.