Tax planning and optimization can make a significant difference in your financial well-being. At Clear View Business Solutions, we’ve seen how strategic tax management can lead to substantial savings for businesses and individuals alike.

Effective tax planning goes beyond simply filing your returns on time. It’s about making informed decisions throughout the year to minimize your tax burden and maximize your financial resources.

Tax planning is a strategic approach to manage finances with the goal of minimizing tax liability. It involves analyzing your financial situation and making decisions that will reduce your tax burden within the bounds of the law. Tax planning doesn’t find loopholes or engage in questionable practices. Instead, it focuses on understanding the tax code and using it to your advantage.

For example, a small business owner in Tucson might purchase new equipment in December rather than January. This decision could allow them to claim depreciation for the entire year, potentially reducing their taxable income.

Successful tax planning requires a comprehensive understanding of your financial situation and applicable tax laws. It also involves staying current with changes in tax legislation. The Tax Cuts and Jobs Act of 2017 made significant changes to the tax code that affected many individuals and businesses.

One crucial aspect of tax planning is timing. This includes deciding when to recognize income and when to make deductible expenses. If you expect to be in a lower tax bracket next year, you might consider deferring some income to that year.

Understanding and maximizing available deductions and credits is another key element. The IRS offers numerous deductions and credits, but they often come with specific requirements. The Child Tax Credit can provide up to $2,000 per qualifying child, and you may be able to claim the credit even if you don’t normally file a tax return.

It’s important to understand the difference between tax planning and tax evasion. Tax planning involves legally reducing your tax liability by structuring your transactions efficiently. Tax evasion, on the other hand, is the illegal non-payment or underpayment of taxes.

Claiming a home office deduction when you legitimately use a portion of your home exclusively for business is tax planning. However, falsely claiming personal expenses as business expenses to reduce your taxable income is tax evasion.

Tax planning is a complex but rewarding process that can lead to significant savings. As we move forward, we’ll explore specific strategies for tax optimization that can help you make the most of your financial resources.

Timing plays a key role in tax planning. Freelancers in Tucson might delay billing for December work until January. This action pushes the income into the next tax year, potentially lowering the current year’s tax bill. Small business owners could prepay some of next year’s expenses in December to increase current year deductions.

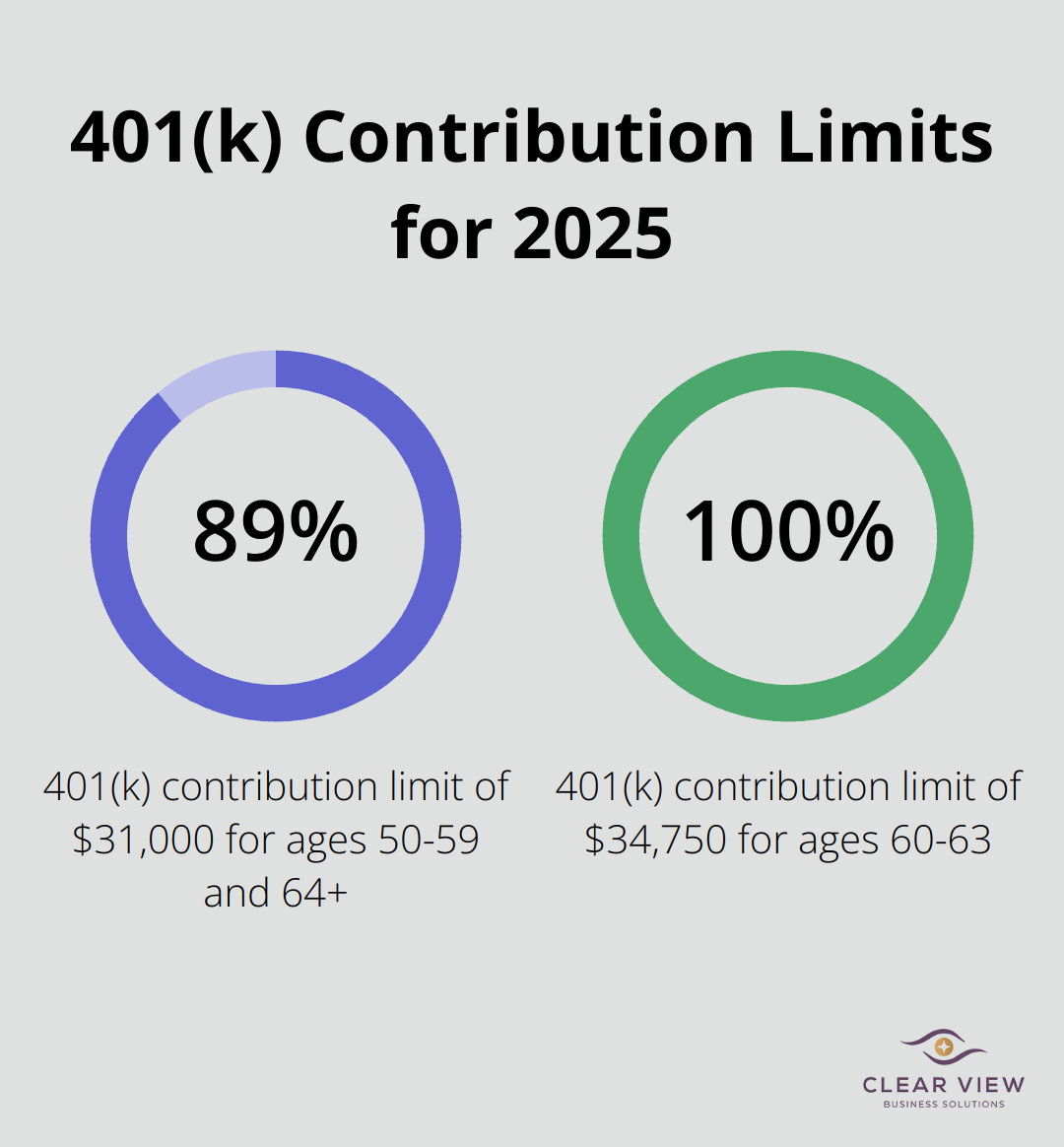

One of the most effective ways to reduce your tax burden is to maximize contributions to tax-advantaged accounts. In 2025, you can contribute up to $31,000 to a 401(k) if you’re 50 to 59 or 64 or older, and $34,750 if you’re 60 to 63 (these contributions reduce your taxable income dollar for dollar). For example, if you earn $80,000 and contribute $20,000 to your 401(k), you’ll only be taxed on $60,000.

Your business structure significantly impacts your tax liability. Sole proprietorships offer simplicity but leave you personally liable for business debts. An S Corporation can offer tax advantages by allowing you to pay yourself a reasonable salary and take additional profits as dividends, potentially reducing self-employment taxes.

Tax-efficient investing can save you thousands. Try to hold investments for over a year to qualify for long-term capital gains rates, which are lower than short-term rates. For 2025, if you’re in the 22% tax bracket, you’ll pay 0% on long-term capital gains up to $44,625 for single filers or $89,250 for married filing jointly.

Tax credits directly reduce your tax bill, making them more valuable than deductions. The Retirement Savings Contributions Credit (Saver’s Credit) can provide a credit of up to 50% of your contribution if your AGI is not more than $46,000 for married filing jointly, $34,500 for head of household, or $23,000 for other filers. This credit is often overlooked but can significantly benefit lower to middle-income taxpayers.

Tax laws change frequently. What worked last year might not be the best strategy this year. To stay ahead of these changes and avoid common pitfalls, let’s explore some tax planning strategies you should consider.

Tax planning is complex, and even small errors can lead to significant financial consequences. Here are some critical mistakes to avoid in your tax planning efforts:

Accurate record-keeping forms the foundation of effective tax planning. The IRS requires taxpayers to maintain records that support income, deductions, and credits claimed on tax returns. Without proper documentation, you might miss out on valuable deductions or face challenges during an audit.

Self-employed individuals in Tucson must track business expenses throughout the year. The IRS allows deductions for ordinary and necessary business expenses, but you need receipts and records to back up your claims.

Tax laws are complex and change frequently. Misunderstanding these laws can lead to costly mistakes. Many people incorrectly believe that all home office expenses are tax-deductible. However, the IRS has specific requirements for claiming this deduction.

To claim a home office deduction, you must use a portion of your home exclusively and regularly for your business. If you use a spare bedroom as both a home office and a guest room, you likely won’t qualify for the deduction.

Many taxpayers miss out on valuable deductions and credits simply because they don’t know about them. The Retirement Savings Contributions Credit (Saver’s Credit) often goes unnoticed. This credit can provide a tax break of up to $1,000 for individuals or $2,000 for married couples filing jointly who contribute to retirement accounts and meet income requirements.

Another commonly missed opportunity is the ability to deduct state and local sales taxes instead of state and local income taxes. This can benefit residents of states with no income tax, like Florida or Texas.

Major life events such as marriage, divorce, having a child, or buying a home can significantly impact your tax situation. Failure to adjust your tax strategy accordingly can result in unexpected tax bills or missed opportunities for savings.

For example, if you’ve recently married, you’ll need to decide whether to file jointly or separately. While filing jointly often provides more benefits, there are situations where filing separately might result in a lower overall tax liability.

Tax planning requires ongoing attention and adjustments throughout the year. Waiting until tax season to start planning can limit your options and lead to rushed decisions.

If you wait until April to realize you need to increase your retirement contributions to lower your tax bill, it’s too late. Most tax-saving strategies (like maxing out your 401(k) contributions) need implementation before the tax year ends.

Tax planning and optimization empowers individuals and businesses to maximize their financial resources. Strategic timing of income and expenses, use of tax-advantaged accounts, and selection of appropriate business structures can significantly reduce tax burdens. Smart investment strategies and careful consideration of available tax credits further enhance the ability to retain more hard-earned money.

Effective tax planning requires ongoing attention and adjustments throughout the year. Maintaining accurate records, staying informed about tax laws, and adapting strategies for life changes are essential steps in the process. Professional guidance often proves invaluable in navigating the complex world of taxes and maximizing savings.

Clear View Business Solutions specializes in comprehensive financial advisory and tax services tailored to individuals and small businesses in Tucson. Our expertise in tax planning, bookkeeping, and IRS representation can help you navigate tax law intricacies and optimize your financial decisions. Tax planning and optimization builds a stronger financial foundation, freeing up resources for investment and growth.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.