Tax season can be stressful, but with the right strategies, you can keep more money in your pocket. At Clear View Business Solutions, we’ve compiled essential tax planning tips for individuals to help you maximize your savings.

Our guide covers everything from understanding tax brackets to timing your income and expenses strategically. By implementing these tactics, you’ll be well-equipped to reduce your tax burden and make the most of your hard-earned money.

The U.S. tax system uses a progressive structure, with seven federal tax brackets ranging from 10% to 37% for 2024. Your income is taxed at different rates as it increases. Knowledge of your tax bracket allows for more effective financial planning. The lowest rate is 10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly).

Deductions reduce your taxable income and can potentially lower your tax bracket. The IRS offers two main types: standard and itemized. For 2024, the standard deduction is $14,600 for single filers and $29,200 for married couples filing jointly (an increase of $1,500 from tax year 2023).

Itemizing deductions benefits taxpayers whose qualifying expenses exceed the standard deduction. Common itemized deductions include:

Many taxpayers overlook valuable deductions. Self-employed individuals can deduct health insurance premiums and half of their self-employment tax. Educators can deduct up to $300 for classroom supplies. Students can deduct up to $2,500 in student loan interest, even without itemizing.

Medical expenses often go unclaimed. If your medical costs exceed 7.5% of your adjusted gross income, you can deduct the amount over this threshold. This includes expenses like prescription medications, doctor visits, and mileage driven for medical purposes.

To optimize your deductions:

If you’re unsure which deductions apply to your situation, consult with a tax professional. Tax laws change frequently, so stay informed about new deductions or changes to existing ones. Recent legislation has expanded certain credits and deductions related to energy-efficient home improvements and electric vehicle purchases.

Tax planning can become complex, especially as your financial situation evolves. A professional tax advisor can help you navigate these complexities and identify all possible deductions to minimize your tax liability. They stay up-to-date with the latest tax laws and can provide personalized strategies tailored to your specific circumstances.

As we move forward, let’s explore strategies to reduce your taxable income even further, including maximizing retirement account contributions and utilizing health savings accounts.

At Clear View Business Solutions, we often see clients who miss key opportunities to reduce their taxable income. Let’s explore some powerful strategies that can help you keep more money in your pocket.

One of the most effective ways to lower your taxable income is to maximize contributions to retirement accounts. In 2024, you can contribute up to $23,000 to a 401(k) if you’re under 50, and if you’re age 50 or older, you’re eligible for an additional $7,500 in catch-up contributions, raising your employee contribution limit to $30,500. These contributions are tax-deductible and can potentially push you into a lower tax bracket.

Don’t limit yourself to workplace retirement plans. Consider opening a traditional IRA for additional tax benefits. If you’re self-employed, look into SEP IRAs or Solo 401(k)s, which often have higher contribution limits.

Health Savings Accounts (HSAs) offer a triple tax advantage: contributions are tax-deductible, grow tax-free, and withdrawals for qualified medical expenses are tax-free. For 2024-2025, the minimum deductible amounts are $1,650 for a single plan and $3,200 for a family plan.

Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year to year. This makes them an excellent vehicle for both current medical expenses and long-term savings. Some employers even offer HSA contribution matches (essentially providing free money and additional tax savings).

Tax-loss harvesting involves selling investments at a loss to offset capital gains. This strategy can reduce your tax bill while rebalancing your portfolio. For example, if you have $10,000 in capital gains this year, you could sell underperforming investments at a $10,000 loss to cancel out the gains, reducing your tax liability.

Be aware of the wash-sale rule, which prohibits buying a substantially identical security within 30 days before or after the sale. To maintain your investment strategy, consider buying similar but not identical investments.

Charitable donations can significantly reduce your taxable income if you itemize deductions. Consider bunching multiple years of donations into a single tax year to exceed the standard deduction threshold. Donor-advised funds allow you to make a large contribution in one year for an immediate tax deduction, while spreading out the actual charitable gifts over time.

For those over 70½, Qualified Charitable Distributions (QCDs) from IRAs can satisfy Required Minimum Distributions (RMDs) without increasing taxable income. This strategy can be particularly beneficial for retirees who don’t need the additional income from their RMDs.

These strategies can lead to substantial tax savings, but tax laws are complex and ever-changing. It’s important to consult with a tax professional to ensure these strategies align with your specific financial situation and goals. As we move forward, let’s explore how timing your income and expenses can further optimize your tax situation.

Deferring income can be an effective strategy to minimize your tax liabilities. Employees can request to delay year-end bonuses until January. Self-employed individuals have more flexibility and can postpone billing clients until late December, ensuring payment arrives in the new year.

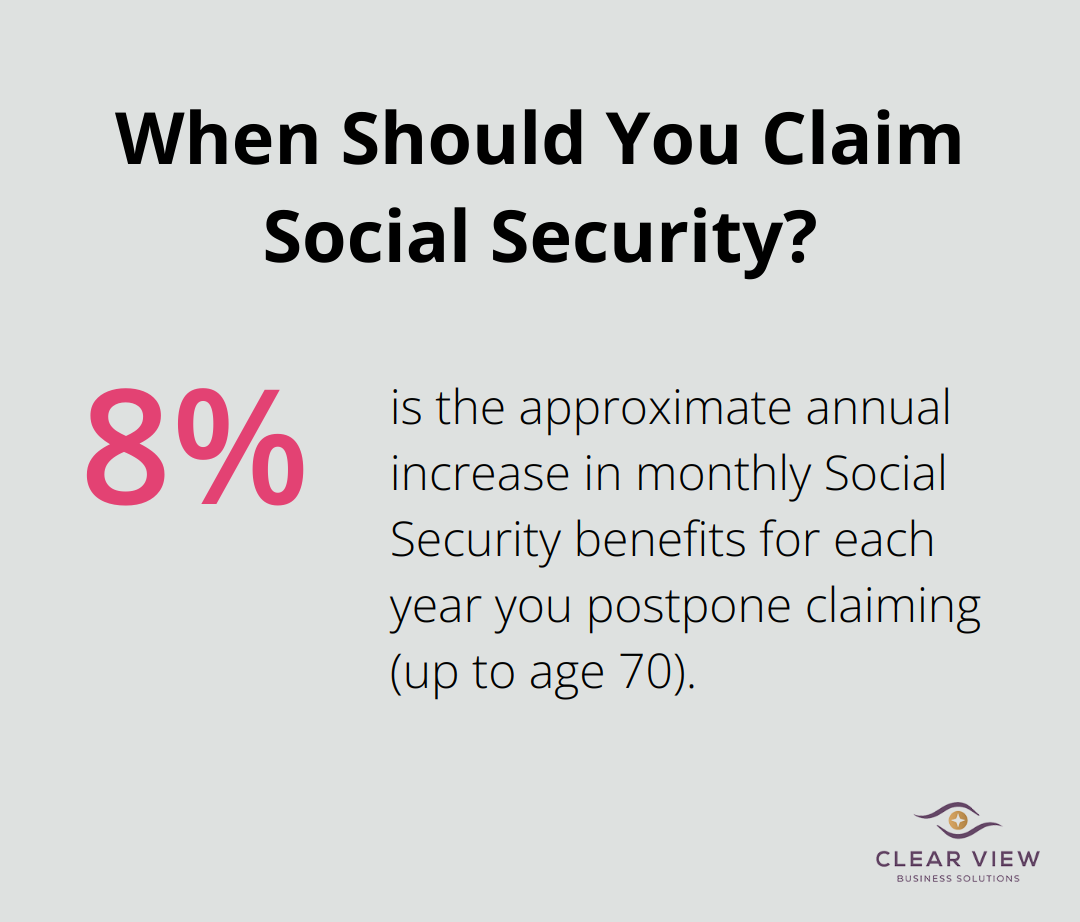

Retirees should consider delaying Social Security benefits. Each year you postpone claiming benefits (up to age 70), your monthly payment increases by about 8%. This strategy not only boosts your future income but can also reduce your current year’s taxable income.

To lower your immediate tax burden, accelerate deductions into the current tax year. Try to prepay January’s mortgage payment in December to claim additional interest on this year’s taxes. Self-employed individuals or small business owners can purchase necessary equipment or supplies before year-end to increase deductions for the current year.

Charitable contributions offer another opportunity for timing. If you’re close to the threshold for itemizing deductions, consider bundling multiple years of donations into one tax year. This approach can push you over the standard deduction limit, maximizing your tax benefit.

Strategic management of investments can yield significant tax savings. For example, by offsetting the capital gains of one investment with the capital loss of another, you could potentially save $7,000 on taxes (based on a $20,000 gain and a 35% tax rate).

For long-term investments (held over a year), timing sales is critical. In 2024, single filers with taxable income up to $47,025 ($94,050 for married filing jointly) pay 0% on long-term capital gains. If your income fluctuates year to year, timing large sales to coincide with lower-income years can result in substantial tax savings.

Implementing these strategies requires careful planning and consideration of your overall financial picture. While timing can be a powerful tool, it’s essential to make decisions based on sound financial principles rather than tax considerations alone. A professional tax advisor can help you navigate these complexities and develop a comprehensive tax strategy that aligns with your long-term financial goals.

Effective tax planning requires a year-round approach to maximize your financial well-being. You must understand your tax bracket, maximize deductions, and implement strategies to reduce taxable income. These tax planning tips for individuals will help you keep more of your hard-earned money and optimize your tax position.

Tax laws change frequently, making it essential to stay informed about new regulations and updates. What worked in previous years might not be the best approach now. You should review your financial situation regularly and adjust your tax planning strategies to optimize your tax position.

Professional guidance becomes invaluable when navigating the intricacies of tax law. At Clear View Business Solutions, we provide comprehensive tax services and financial advisory for individuals and small businesses in Tucson. Our team stays up-to-date with the latest tax regulations to help you make informed decisions and maximize your tax benefits. We can help you identify overlooked deductions, optimize your retirement contributions, and implement effective tax-saving techniques.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.