Tax season doesn’t have to drain your wallet. Smart planning throughout the year can save you thousands of dollars.

We at Clear View Business Solutions see businesses and individuals miss valuable opportunities every day. The right tax optimization strategies can reduce your burden significantly while staying completely compliant with IRS regulations.

Self-employed individuals can slash their tax bills through strategic business expense deductions. Office supplies, professional software subscriptions, business meals (at 50% deductibility), and equipment purchases all reduce taxable income dollar for dollar. The IRS allows deduction of any ordinary and necessary business expense, which makes your smartphone bill, internet connection, and that expensive industry conference legitimate write-offs.

Vehicle expenses offer two paths: the standard mileage rate or actual expenses that include gas, maintenance, and depreciation. Track every business mile you drive to maximize these deductions.

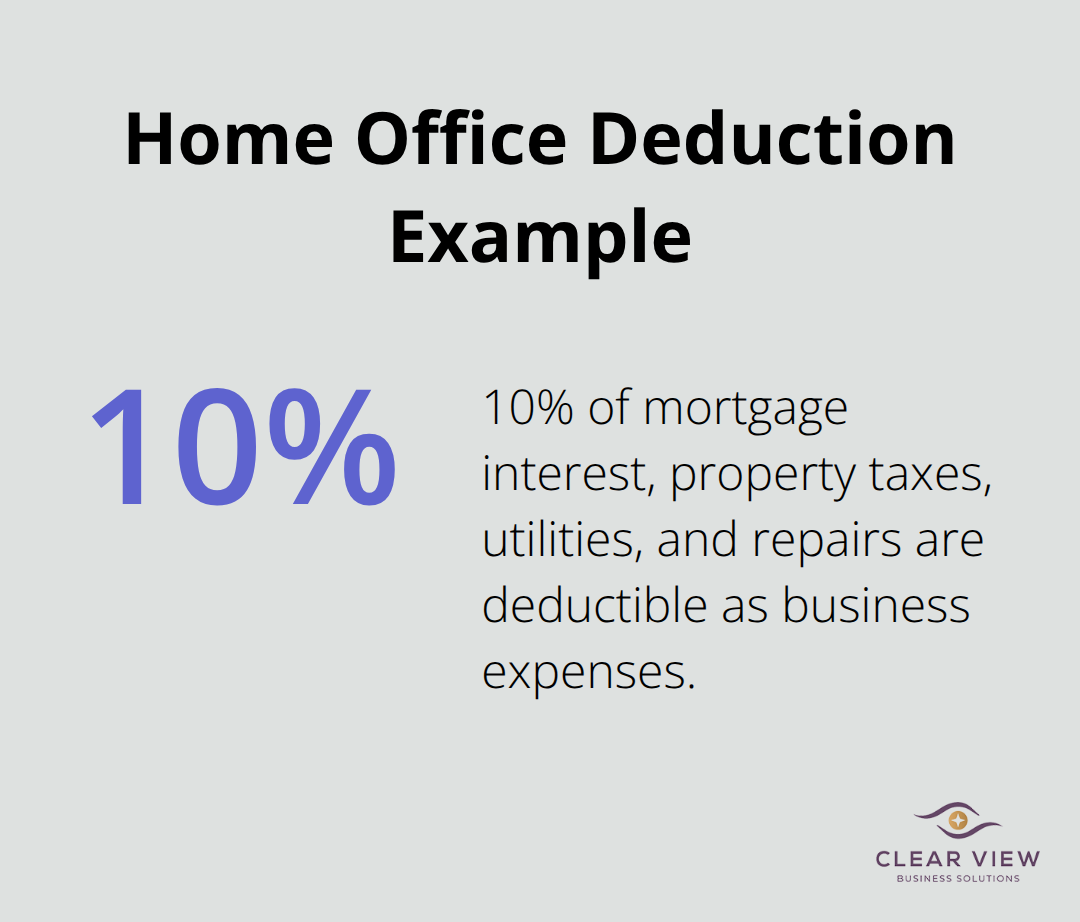

The home office deduction transforms part of your housing costs into business expenses. The simplified method allows $5 per square foot up to 300 square feet, which provides up to $1,500 in deductions annually. The actual expense method often yields higher savings for larger spaces and lets you deduct the percentage of home expenses equal to your office space percentage.

A 200-square-foot office in a 2,000-square-foot home qualifies for 10% of mortgage interest, property taxes, utilities, and repairs as business deductions. You must use this space regularly and exclusively for business to qualify.

Medical and dental expenses that exceed 7.5% of your adjusted gross income become deductible. This threshold means someone who earns $60,000 can deduct medical costs above $4,500. Qualified expenses include prescription medications, medical equipment, therapy sessions, and mileage to medical appointments at 22 cents per mile.

Health Savings Account contributions provide immediate deductions up to $3,850 for individuals and $7,750 for families in 2023, plus tax-free withdrawals for qualified medical expenses. These powerful deductions set the foundation for the next level of tax optimization through strategic account management.

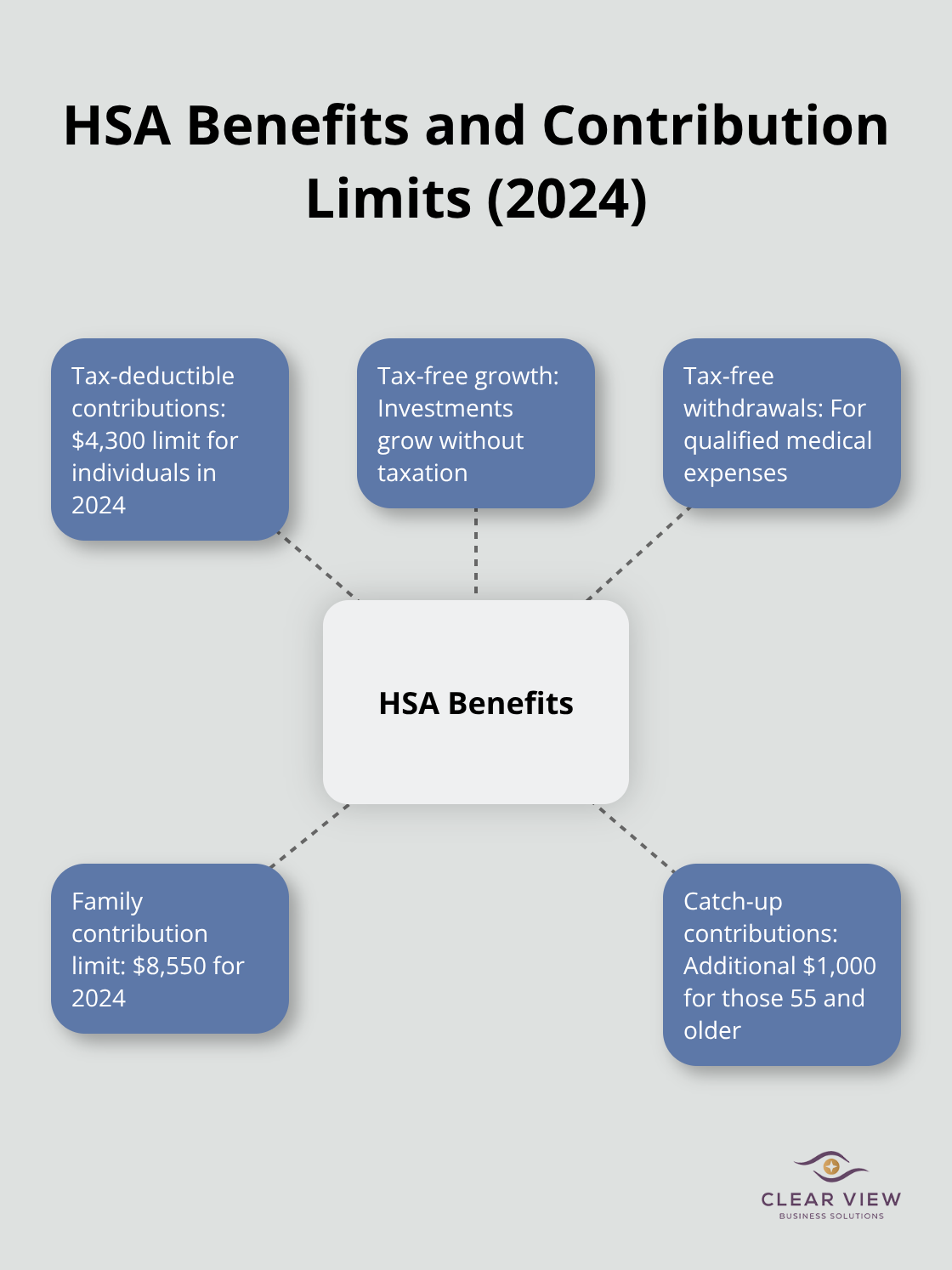

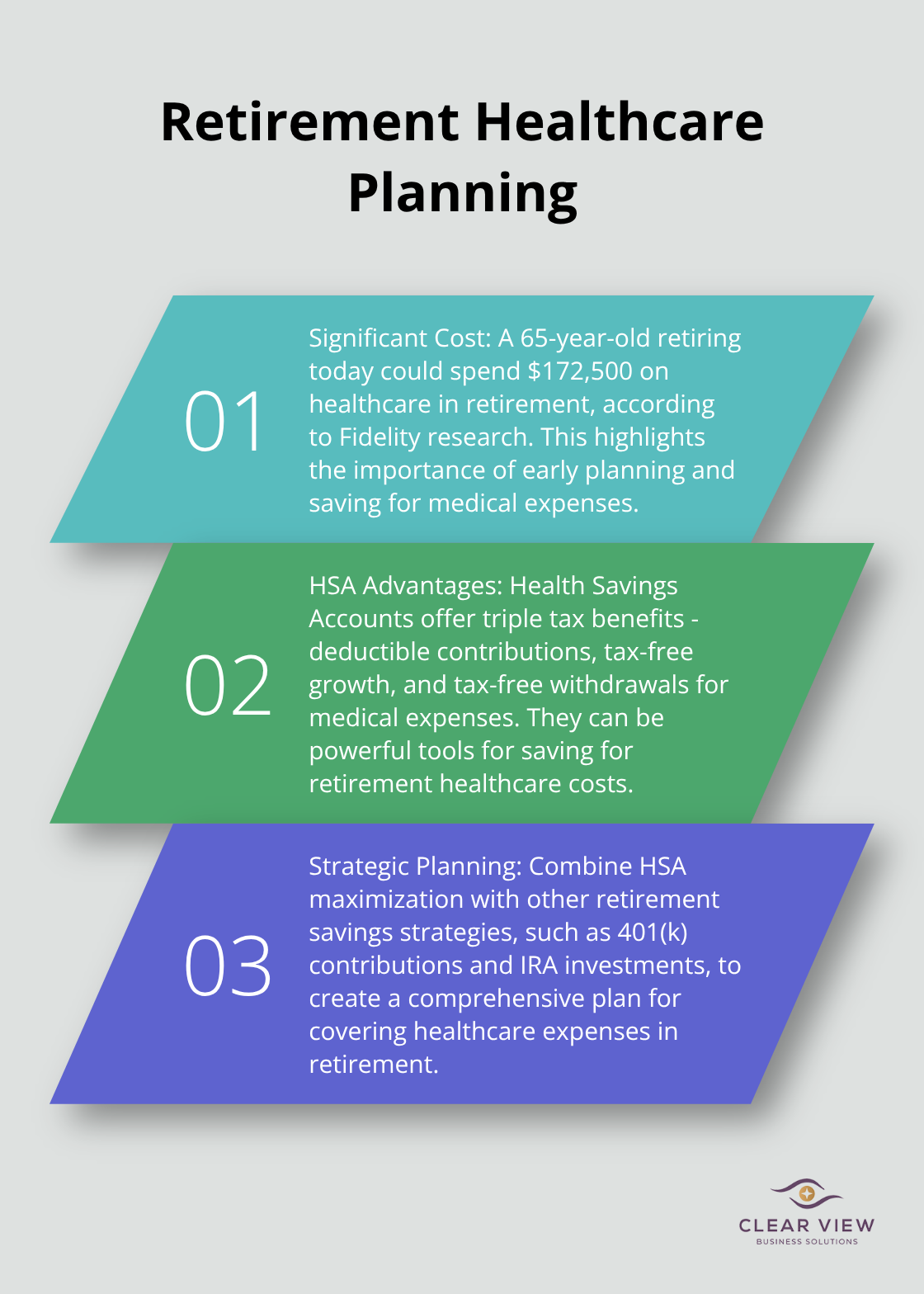

The order matters when you fund tax-advantaged accounts. Start with employer 401k matches since that represents free money, then max out Health Savings Accounts at $4,300 for individuals and $8,550 for families in 2024. These accounts offer triple tax benefits: deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses.

After age 65, HSA withdrawals for non-medical expenses face taxation like traditional retirement accounts, which makes them superior retirement vehicles.

Traditional and Roth IRA contributions cap at $7,000 annually, with an additional $1,000 catch-up contribution for those 50 and older. The backdoor Roth conversion lets high earners bypass income limits when they contribute to a traditional IRA then convert to Roth.

For 2024, 401k contributions max at $23,000 with $7,500 catch-up contributions. Self-employed individuals can contribute up to $69,000 annually through SEP-IRAs or solo 401ks, which beats traditional employee plans significantly.

HSAs provide the most powerful tax advantages available. You deduct contributions immediately, investments grow tax-free, and qualified medical withdrawals never face taxation. The 2024 contribution limits reach $4,300 for individuals and $8,550 for families (with an additional $1,000 catch-up for those 55 and older).

A 65-year-old retiring today could spend $172,500 on health care in retirement according to Fidelity research, which makes HSAs essential retirement tools beyond their immediate tax benefits.

529 plans grow tax-free and allow tax-free withdrawals for qualified education expenses. Many states offer tax deductions for contributions, with some like New York providing up to $10,000 in annual deductions. Coverdell Education Savings Accounts limit contributions to $2,000 annually but cover K-12 expenses.

The American Opportunity Tax Credit provides up to $2,500 per student for the first four years of college, which often delivers more value than education savings for many families. These account strategies work best when combined with smart tax planning that can multiply your savings.

December 31st marks your final opportunity to reduce this year’s tax bill through strategic income and expense decisions. You can accelerate deductible expenses like medical procedures, charitable donations, and business equipment purchases into the current tax year while you defer income when possible. Self-employed professionals can delay December invoices until January or prepay deductible business expenses before year-end.

High earners should consider deferral of bonuses, consulting fees, or investment sales until January to push income into the next tax year. Conversely, if you expect higher income next year, accelerate income recognition now to take advantage of lower current tax brackets. The IRS allows flexible timing for many income sources, but employees have limited control over W-2 wages compared to business owners and contractors.

Tax bracket management becomes essential when you control income timing. A single filer earning $95,000 pays 22% on income above $47,150, while someone earning $44,000 pays only 12% on most income.

You can sell underperforming investments to offset capital gains and reduce taxable income by up to $3,000 annually through tax-loss harvesting. The wash sale rule prevents you from claiming losses if you repurchase the same or substantially identical securities within 30 days (wait 31 days or buy similar but different investments). Excess losses above $3,000 carry forward indefinitely to offset future gains.

Municipal bonds provide tax-free income and help balance portfolios after you harvest losses from taxable investments. This strategy works particularly well for investors in higher tax brackets who benefit most from tax-free municipal bond income.

Qualified charitable distributions from IRAs allow taxpayers age 73 or older to donate up to $105,000 directly to charity while they satisfy required minimum distributions tax-free. This strategy beats taking distributions and donating after-tax dollars because you avoid taxation entirely on the distributed amount.

Cash donations to qualified charities can offset up to 60% of adjusted gross income, while appreciated securities donations avoid capital gains taxes entirely. You can bunch multiple years of charitable giving into one tax year through donor-advised funds to maximize deduction benefits when they exceed the standard deduction threshold ($13,850 for single filers in 2024).

Tax optimization strategies work best when you implement them systematically throughout the year rather than scramble them together at year-end. The combination of maximized business deductions, funded tax-advantaged accounts, and strategic year-end planning can save thousands annually. Self-employed individuals benefit most from home office deductions and business expense write-offs, while employees should focus on retirement account contributions and HSA maximization.

Professional guidance becomes invaluable when you navigate complex tax situations that involve multiple income sources, significant investments, or business ownership. Tax laws change frequently, and missed opportunities cost real money. We at Clear View Business Solutions provide comprehensive tax services that include tax planning, IRS representation, and bookkeeping to help individuals and small businesses maximize their tax benefits while they maintain full compliance.

Start to implement these strategies immediately rather than wait for next tax season. Review your current withholdings, increase retirement contributions, and begin to track deductible expenses today. The sooner you act, the more you save.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.