At Clear View Business Solutions, we know that smart tax planning can significantly boost your take-home pay. Many salaried employees overlook valuable opportunities to reduce their tax burden and keep more of their hard-earned money.

In this post, we’ll share practical tax planning tips for salaried employees to help you maximize your salary and minimize your tax liability. Get ready to learn strategies that could put more cash in your pocket.

Understanding your tax situation starts with knowing your tax bracket. The U.S. employs a progressive tax system, where higher income portions face higher tax rates.

For 2024, the federal tax system includes seven brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Your bracket depends on your taxable income and filing status. For instance, a single filer with $50,000 taxable income falls into the 22% bracket. However, this doesn’t mean all income faces a 22% tax. The first $11,600 is taxed at 10%, the next $35,375 at 12%, and only the remaining $3,025 at 22%.

Knowing your bracket helps you make informed decisions about deductions and credits, guiding whether to take the standard deduction or itemize.

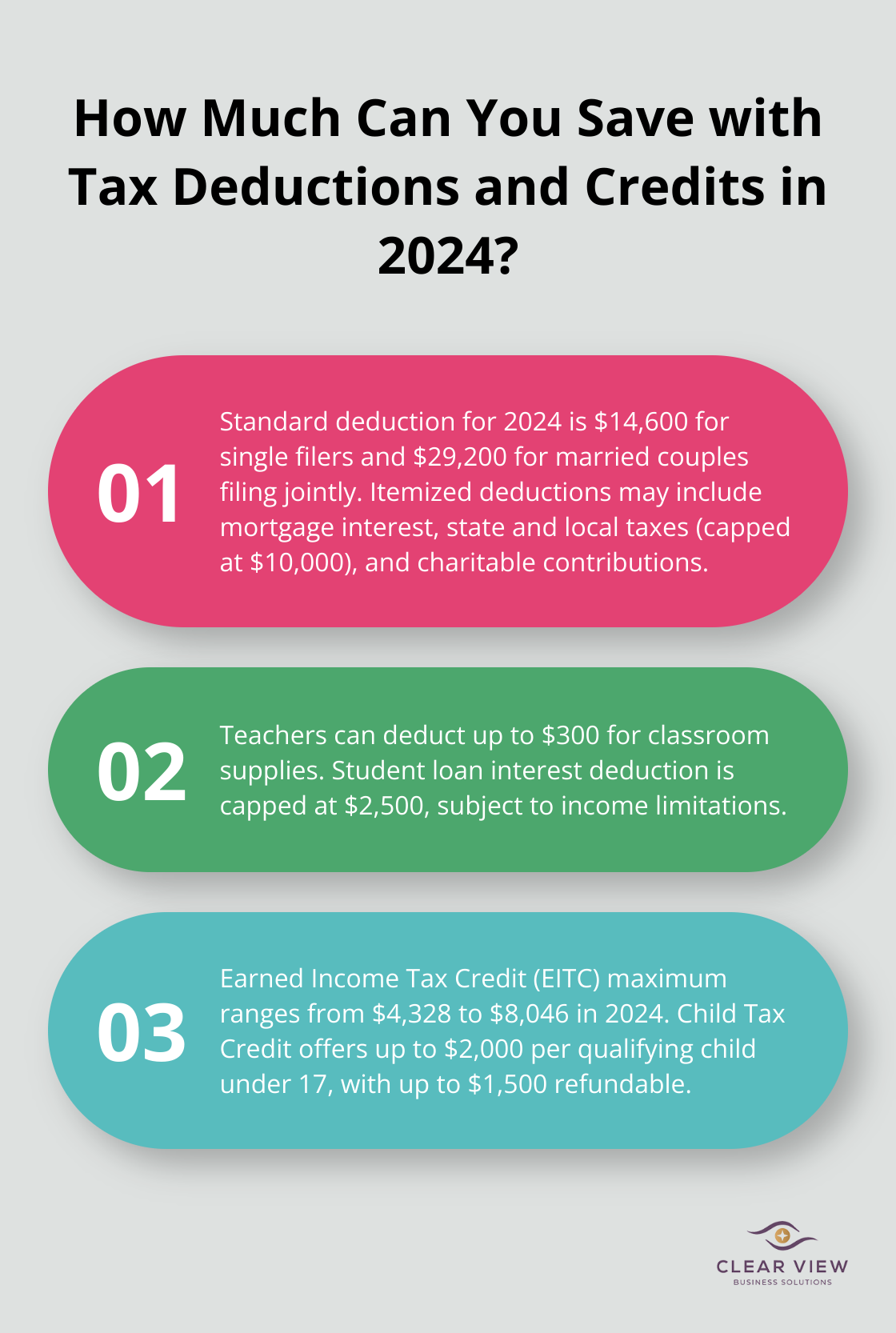

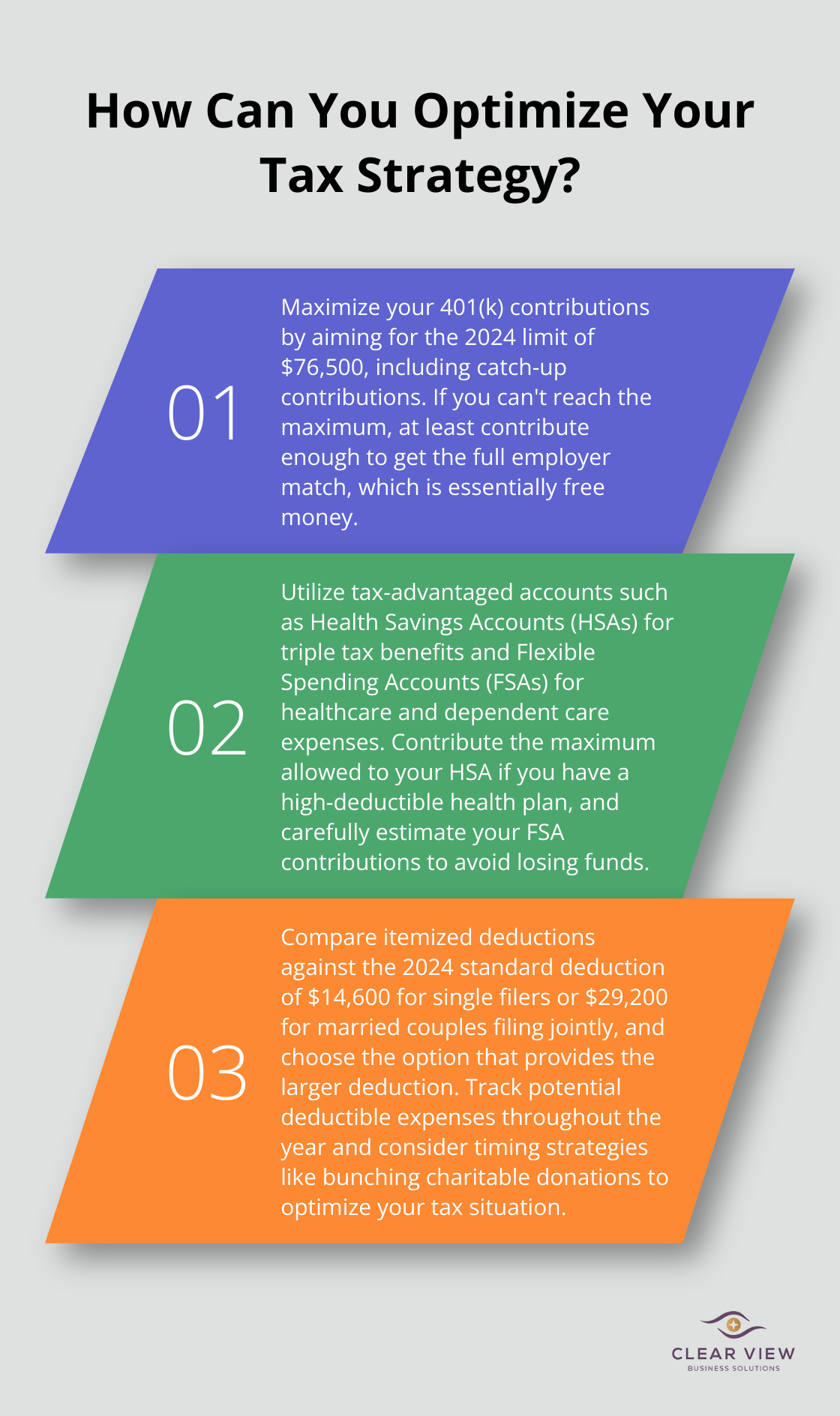

Employees have several options to reduce their tax liability. The standard deduction for 2024 stands at $14,600 for single filers and $29,200 for married couples filing jointly. This often proves the best choice for many employees.

Itemizing can benefit those with significant deductions. However, the Tax Cuts and Jobs Act (TCJA) temporarily increased the standard deduction, which reduced the number of taxpayers who claim itemized deductions generally.

Credits directly reduce your tax bill, making them more valuable than deductions. Common credits for employees include:

Not all income faces equal taxation. Your salary incurs taxes at ordinary income rates, but other income types follow different rules. Long-term capital gains (from investments held over a year) enjoy preferential rates of 0%, 15%, or 20%, depending on your income.

Bonuses or commissions typically face taxation as supplemental wages. The IRS allows employers to withhold a flat 22% for supplemental wages under $1 million. This rate might exceed or fall short of your actual tax rate, so plan accordingly.

Understanding these income types can help you make strategic decisions about realizing investment gains or structuring your compensation package.

As we move forward, let’s explore strategies to reduce your tax burden and maximize your take-home pay. These tactics will help you keep more of your hard-earned money in your pocket.

One of the most effective ways to lower your taxable income is to maximize contributions to tax-advantaged retirement accounts. In 2024, you can contribute up to $7,000 to these accounts if you’re under 50. These contributions are made with pre-tax dollars, which directly reduces your taxable income.

For example, if you’re in the 24% tax bracket and contribute $7,000 to your retirement account, you’ll save $1,680 in federal taxes. This significant amount stays in your pocket while also building your nest egg.

Don’t limit yourself to your 401(k). If you’re eligible, consider opening a traditional IRA. For 2024, you can contribute up to $7,000, potentially further lowering your taxable income.

Many employees overlook the tax advantages of their benefits package. Health Savings Accounts (HSAs) are a prime example. If you have a high-deductible health plan (deductible not less than $1,600), you can contribute up to $4,150 for individual coverage in 2024. These contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses.

Flexible Spending Accounts (FSAs) for healthcare and dependent care are another tax-saving tool. In 2024, you can contribute to these accounts. These contributions are made with pre-tax dollars, reducing your taxable income.

Don’t ignore commuter benefits. If your employer offers them, you can set aside money for parking and transit in 2024, all with pre-tax dollars.

Timing plays a key role in tax planning. If you expect a bonus or have control over when you receive certain income, consider the tax implications. Pushing income into a future year could keep you in a lower tax bracket for the current year.

Conversely, accelerating deductions into the current year can lower your tax bill. For example, if you’re close to the threshold for itemizing deductions, consider making charitable donations or paying property taxes before year-end to push you over the limit.

If you have investments, be strategic about realizing capital gains. Long-term capital gains (from assets held over a year) are taxed at lower rates than short-term gains. In some cases, you might even qualify for the 0% long-term capital gains rate.

These strategies can result in significant tax savings, but tax laws are complex and ever-changing. It’s always wise to consult with a tax professional to ensure you’re making the most of your unique situation. As we move forward, let’s explore how you can maintain these tax-saving habits throughout the year to maximize your financial benefits.

Tax planning requires year-round attention. Start by creating a system to track your income, expenses, and potential deductions. Use a spreadsheet or accounting software like QuickBooks to organize your financial data. Store all receipts, bank statements, and pay stubs in a secure location. For charitable donations, document the organization’s name, date, and contribution amount.

Keep all records of employment taxes for at least four years after filing the 4th quarter for the year. These should be available for IRS review. This practice not only simplifies tax season but also proves valuable during an audit (if one occurs).

Review your W-4 form regularly, especially after significant life events (such as marriage, divorce, or having a child). Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. Try to match your withholdings to your tax liability as closely as possible.

Large refunds often indicate overwithholding, which means you’ve provided an interest-free loan to the government. Conversely, underwithholding can result in an unexpected tax bill and potential penalties. Fine-tune your withholdings to achieve the right balance.

Tax laws evolve constantly. The Tax Cuts and Jobs Act of 2017, for example, introduced significant changes to the tax code (many set to expire after 2025). Monitor these changes and understand how they might impact your tax situation.

Subscribe to reliable tax news sources or follow the IRS newsroom for updates. The IRS typically announces inflation adjustments for the upcoming tax year in October or November. These adjustments can affect tax brackets, standard deductions, and contribution limits for retirement accounts.

Tax planning is complex, and strategies that work for one person may not suit another. A qualified tax professional can provide personalized advice tailored to your unique financial situation. They can help you navigate complex tax laws, identify potential deductions, and develop a comprehensive tax strategy.

At Clear View Business Solutions, we offer comprehensive tax planning services for individuals and small businesses in Tucson. Our team specializes in maximizing tax benefits while ensuring compliance with all relevant regulations. We provide friendly, personalized service to help simplify complex financial matters and empower our clients to make informed decisions.

Smart tax planning empowers salaried employees to boost their take-home pay and secure their financial future. You can reduce your tax burden through strategic use of deductions, credits, and pre-tax contributions to retirement accounts. Employer-sponsored benefits like HSAs and FSAs offer additional avenues for tax savings (while strategic timing of income and deductions can further optimize your tax situation).

Effective tax planning requires a year-round approach. You must maintain accurate records, adjust withholdings, and stay informed about tax law changes to manage your tax liability effectively. These tax planning tips for salaried employees can lead to substantial savings over time, allowing you to keep more of your hard-earned money and work towards your financial goals.

Navigating the complex world of taxes challenges many individuals. At Clear View Business Solutions, we provide comprehensive tax planning services for individuals and small businesses in Tucson. Our team of experts can help you develop a personalized tax strategy, ensure compliance with regulations, and maximize your tax benefits.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.