Most taxpayers leave money on the table by missing strategic opportunities throughout the year. The IRS collected $4.7 trillion in 2023, yet proper planning could have reduced much of this burden legally.

We at Clear View Business Solutions see businesses and individuals paying 20-30% more than necessary due to reactive approaches. Smart tax planning strategies implemented year-round can dramatically reduce your liability while maximizing wealth-building opportunities.

Tax preparation happens once yearly when you file returns, while tax planning operates continuously throughout the year to minimize your tax burden. Year-round planning provides significant advantages over last-minute preparation approaches.

Tax preparation looks backward at completed transactions, but tax planning looks forward to optimize future decisions. Most Americans spend 13 hours on tax preparation according to the IRS, yet invest zero hours in strategic planning that could reduce their liability by thousands.

Effective tax planning rests on three core principles that separate successful taxpayers from those who overpay. First, strategic timing of income and expenses can shift you between tax brackets. Second, maximized tax-advantaged accounts like 401(k)s and IRAs compound savings over decades.

Consistent retirement planning shows positive outcomes for most Americans, with 67% of workers confident they will have enough money for retirement.

Third, understanding your marginal tax rate guides every financial decision throughout the year.

The biggest mistake taxpayers make involves waiting until December to consider tax implications. The IRS Taxpayer Advocate Service identifies poor record-keeping as the top reason people miss deductions worth thousands.

Another critical error involves ignoring state tax consequences when making federal tax decisions. States like California and New York can add 13.3% to your tax rate (making year-round planning even more valuable). Many taxpayers lose substantial savings when they fail to coordinate tax planning with major life events like marriage, home purchases, or business formation.

Successful tax planning requires consistent attention throughout the year rather than December panic sessions. Quarterly reviews allow you to adjust withholdings, maximize contributions, and time major transactions for optimal tax treatment.

The difference between proactive and reactive approaches becomes clear when you examine specific strategies that reduce your overall tax burden while building long-term wealth.

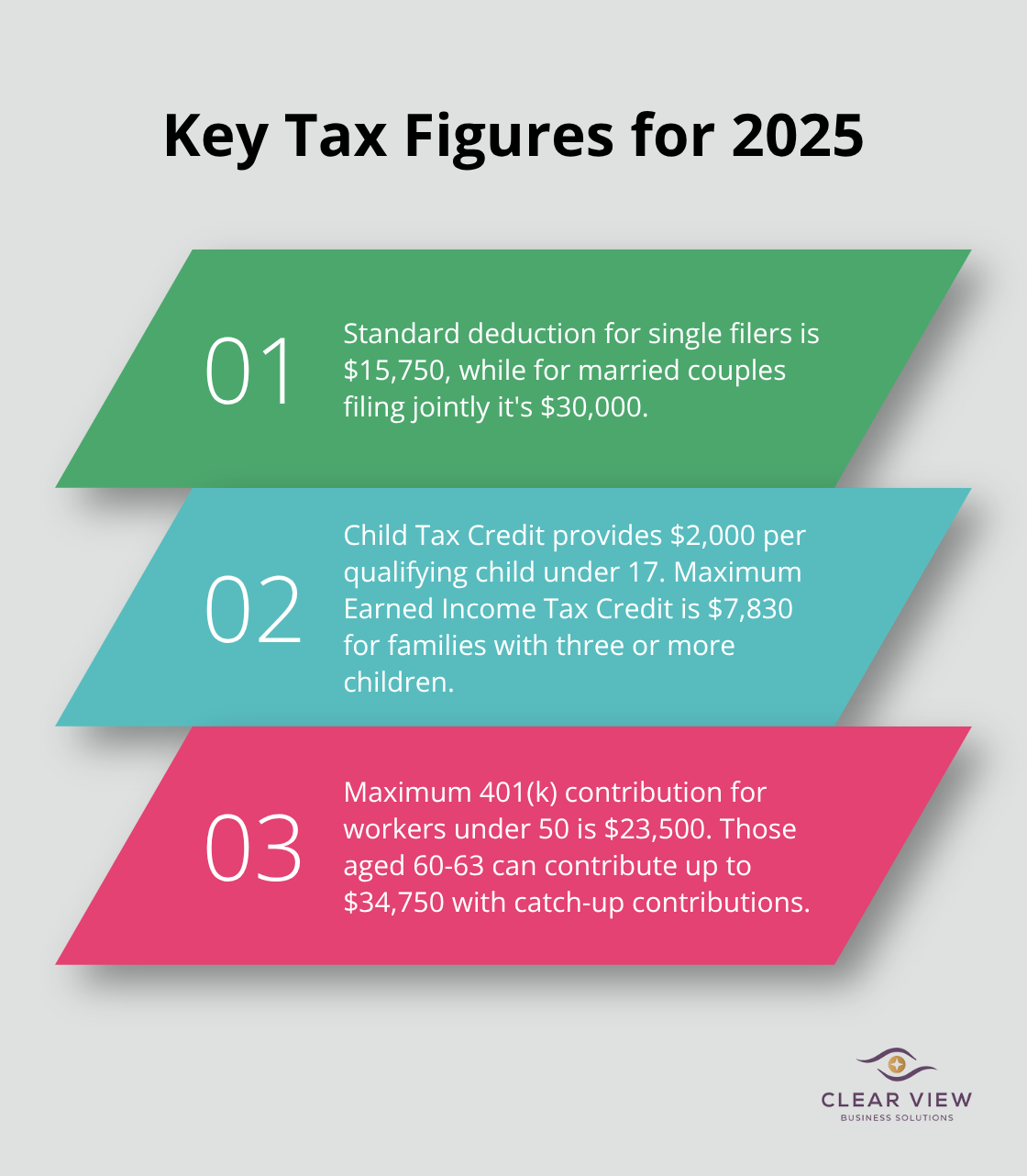

The standard deduction for 2025 reaches $15,750 for single filers and $30,000 for married couples filing jointly. Itemized deductions become worthwhile only when they exceed these amounts. Mortgage interest, state and local taxes (capped at $10,000), and charitable contributions form the foundation of most itemization strategies.

The Child Tax Credit provides $2,000 per qualifying child under 17. The Earned Income Tax Credit offers up to $7,830 for families with three or more children in 2025. These credits reduce your tax bill dollar-for-dollar rather than just lowering taxable income.

Maximum 401(k) contributions for 2025 allow $23,500 for workers under 50. Catch-up contributions bring the total to $34,750 for those aged 60-63. Traditional IRA contributions of $7,000 annually ($8,000 for those 50 and older) reduce taxable income dollar-for-dollar when income limits permit.

Health Savings Accounts provide triple tax advantages with $4,300 limits for individuals and $8,550 for families in 2025. These accounts allow tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses throughout your lifetime.

Pass-through entities like S-corporations and LLCs can claim the 20% qualified business income deduction. This provision potentially saves thousands annually before it expires after 2025. Section 179 equipment deductions allow businesses to expense up to $1,220,000 in equipment purchases immediately rather than depreciate them over years.

Sole proprietors can deduct home office expenses at $5 per square foot up to 300 square feet. The actual expense method often provides larger deductions for dedicated business spaces with proper documentation.

Flexible Spending Accounts allow $3,300 in pre-tax medical expenses for 2025. Dependent Care FSAs help parents defer taxes on up to $5,000 of childcare expenses annually. These accounts reduce your current tax burden while covering necessary expenses.

529 college savings plans offer state tax breaks in many jurisdictions (though federal deductions aren’t available). These plans grow tax-free when used for qualified education expenses.

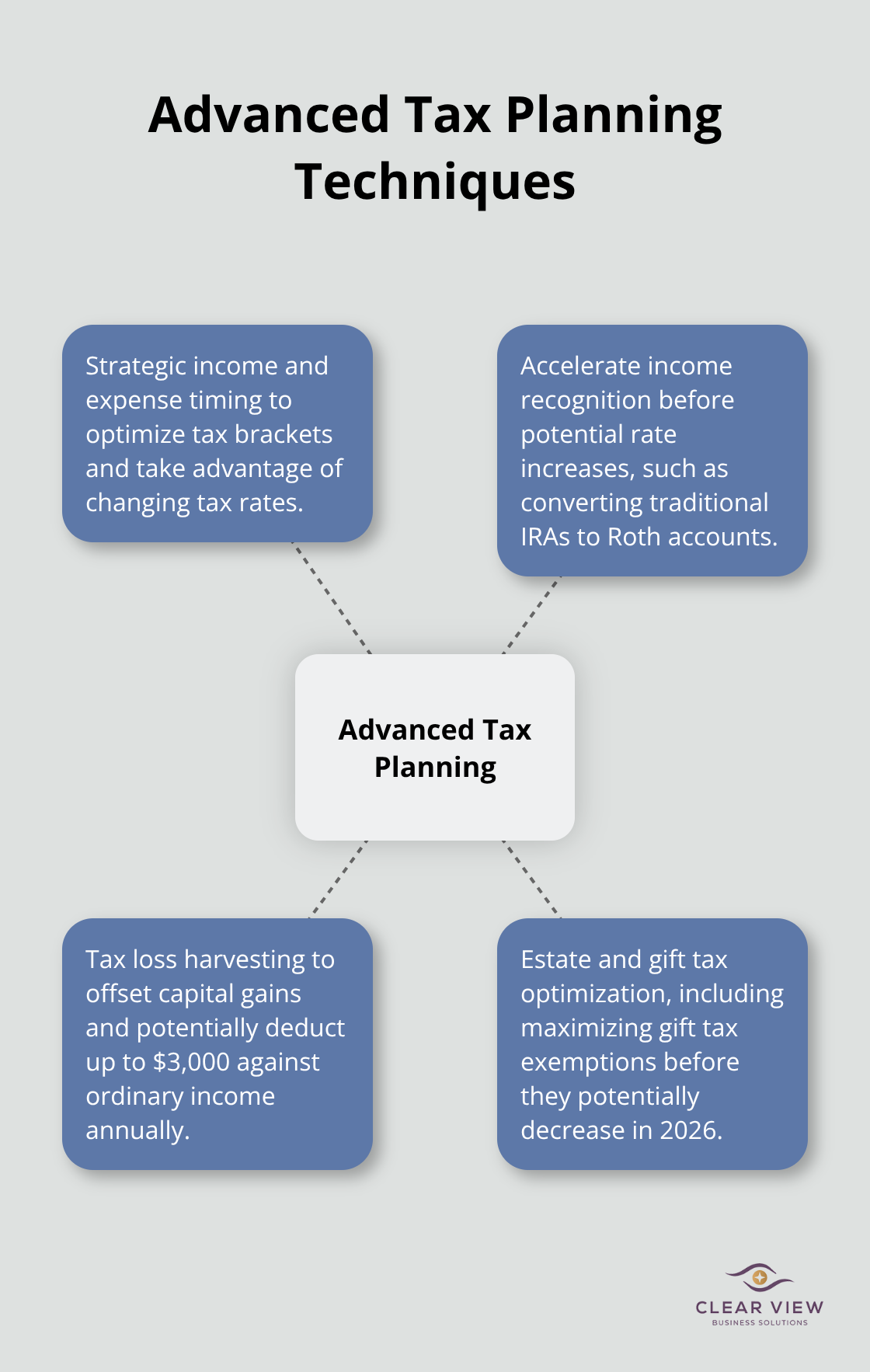

Advanced techniques like strategic income timing and tax loss harvesting can further optimize your tax position throughout the year.

Strategic income and expense timing becomes powerful when marginal tax rates change between years. The Tax Cuts and Jobs Act provisions expire December 31, 2025, potentially pushing rates from current levels to pre-2017 brackets. High earners who face 37% rates today could see increases to 39.6% in 2026. This creates opportunities to accelerate income recognition in 2024 and 2025 while rates remain lower.

Bonus payments, consulting fees, and business income can shift between years with proper planning. Convert traditional IRA funds to Roth accounts to lock in current tax rates while you eliminate future required minimum distributions. The American Institute of CPAs reports that Roth conversions during low-income years or market downturns maximize long-term benefits.

Capital gains harvesting works best when you expect higher rates ahead. Sell appreciated assets now rather than wait for potential rate increases. This strategy proves particularly valuable for business owners who anticipate higher income brackets in future years.

Tax loss harvesting allows investors to sell losing positions that offset capital gains dollar-for-dollar. The IRS permits $3,000 annual deductions against ordinary income with unlimited carryforwards for excess losses. Wash sale rules prevent repurchase of identical securities within 30 days, but similar assets maintain portfolio allocation.

Municipal bonds from different issuers or broad market index funds from different providers avoid wash sale violations while they preserve investment strategy. This approach maintains your desired asset allocation while you capture tax benefits from temporary market declines.

Current gift tax exemptions reach $13.61 million per person in 2025 before they drop to approximately $7 million in 2026. Wealthy families should maximize gifts of appreciating assets before exemption reductions take effect. Gift non-voting business interests with valuation discounts to transfer future growth while you maintain operational control.

Generation-skipping transfer tax exemptions also sunset after 2025, making multi-generational wealth transfers time-sensitive. Annual exclusion gifts of $18,000 per recipient require no exemption usage and compound tax-free wealth transfers over decades.

Proactive tax planning strategies deliver measurable results that reactive approaches cannot match. Taxpayers who implement year-round strategies typically reduce their tax liability by 20-30% compared to those who wait until tax season. The Tax Cuts and Jobs Act provisions expire in 2025, which creates urgent opportunities for income acceleration and strategic conversions.

Professional guidance becomes essential when you navigate complex tax code changes and optimization techniques. The IRS processes over 160 million individual returns annually, yet most taxpayers miss valuable deductions and credits worth thousands of dollars. Expert advisors identify opportunities that software and DIY approaches overlook (particularly for complex financial situations).

Start your tax strategy immediately rather than wait for December. Review your withholdings quarterly, maximize retirement contributions monthly, and track deductible expenses throughout the year. We at Clear View Business Solutions provide comprehensive tax services that help clients maximize tax benefits while they maintain full compliance with changing regulations.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.