Receiving an IRS audit letter triggers immediate stress for most taxpayers. The notice doesn’t mean you’ve done anything wrong, but it does require prompt action.

We at Clear View Business Solutions help clients navigate these situations daily. Professional IRS audit representation can make the difference between a smooth resolution and costly mistakes.

The key is understanding your options and responding within the required timeframes.

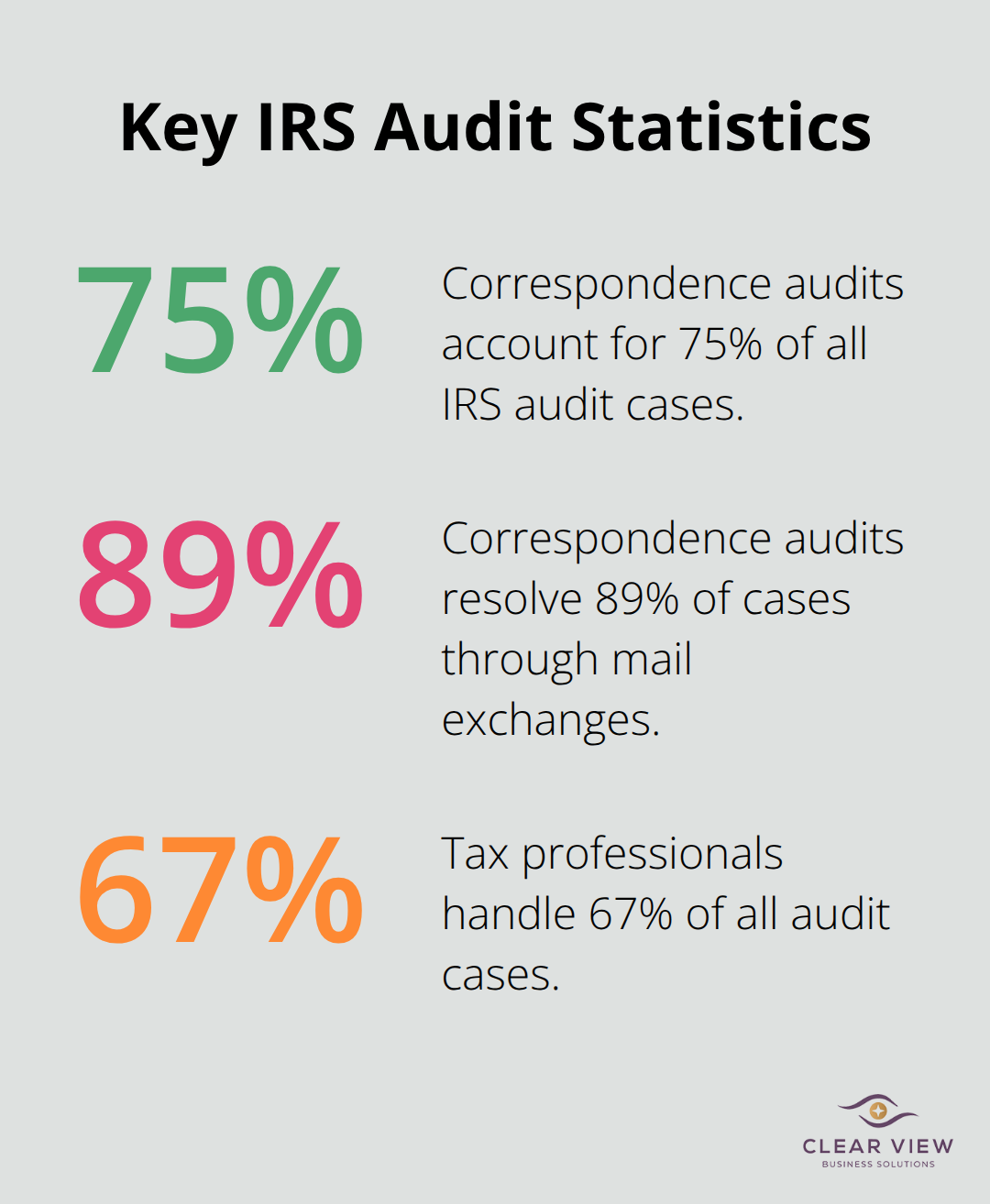

The IRS sends approximately 1.3 million audit letters annually, which represents less than 1% of all filed returns according to IRS Data Book statistics. Your audit letter specifies one of three audit types: correspondence audits (conducted entirely by mail) affect 75% of all cases, office audits require an IRS office visit to handle more complex issues, and field audits involve IRS agents who visit your location for the most comprehensive reviews.

The letter clearly identifies which tax year faces examination, the specific items the IRS questions, and the documentation you must provide. Form letters like CP2000 indicate income discrepancies between your return and third-party reports, while detailed examination letters target specific deductions or business expenses.

Computer algorithms flag returns through the discriminant function system, which compares your deductions against statistical norms for similar income levels. High itemized deductions that exceed 2% of your income bracket, significant charitable contributions above average thresholds, or business expenses disproportionate to reported revenue trigger automatic reviews.

The IRS also audits returns connected to other taxpayers under examination, particularly business partners or investment participants. Random selection affects some returns, but most audits result from mathematical discrepancies or unusual patterns that IRS programs detect when they compare your reported income against Forms W-2, 1099, and K-1.

Your audit letter specifies exact response deadlines-typically 30 days from the notice date for correspondence audits and specific appointment dates for office or field examinations. When you miss these deadlines, the IRS automatically accepts proposed changes, which results in additional taxes, penalties, and interest charges.

The IRS grants one automatic 30-day extension for correspondence audits if you request it before the original deadline, but Notice of Deficiency cases allow no extensions. Document your response with certified mail and delivery confirmation to prove timely submission, as the IRS considers the postmark date for compliance purposes.

Once you understand what your audit letter means and the deadlines you face, you need to take immediate action to protect your interests and respond appropriately.

Your first action after you receive an IRS audit letter must be to pull out the exact tax return year under examination and compare every questioned line item against your original documentation. Most taxpayers make the error of relying on memory instead of actual records, which leads to incomplete responses that expand audit scope. The IRS targets specific deductions, income items, or credits for a reason – their computer systems detected discrepancies between your reported figures and third-party documentation like W-2s, 1099s, or K-1 forms.

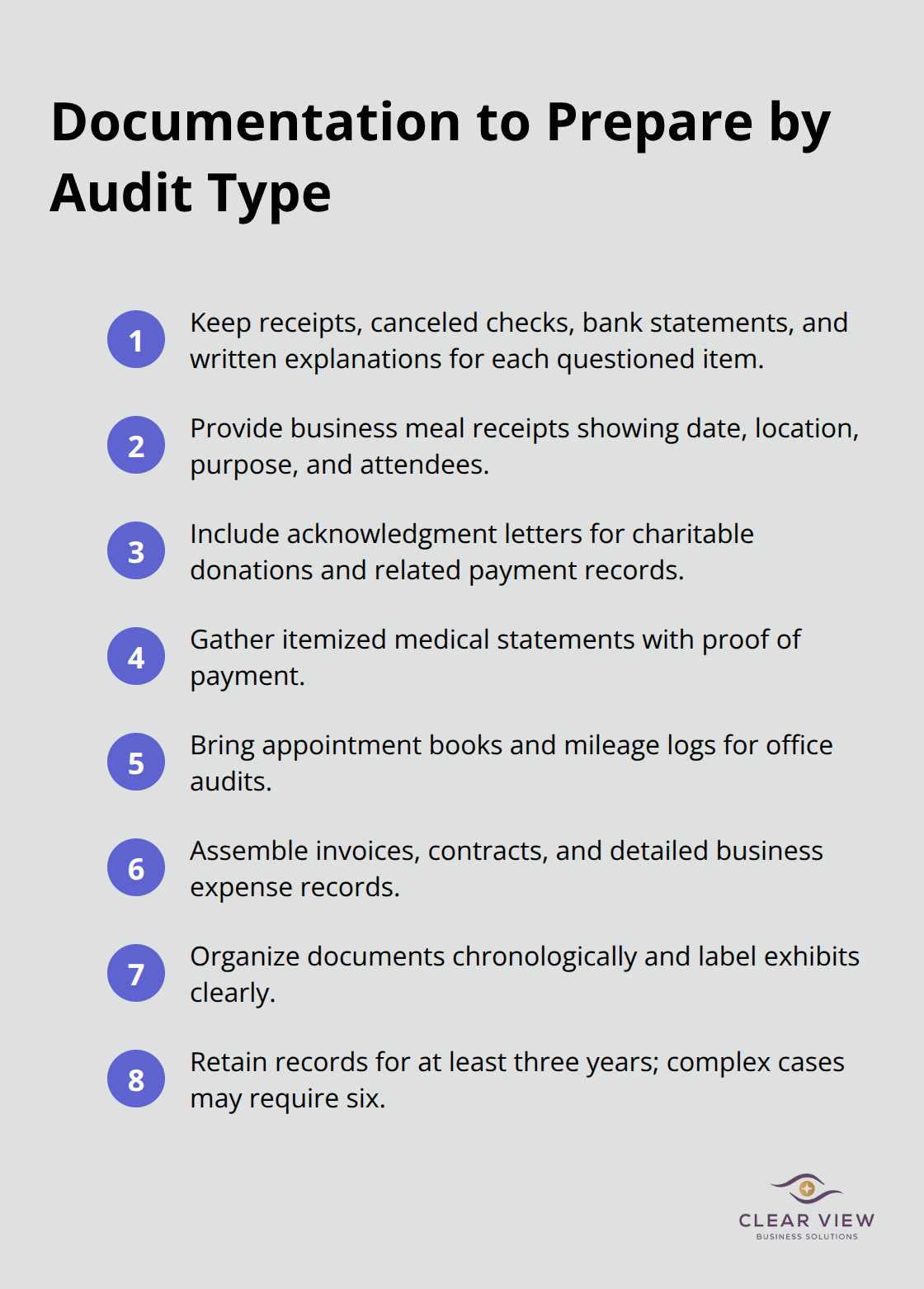

Start to organize documents immediately by creating separate folders for each questioned item. Correspondence audits typically request receipts, canceled checks, bank statements, and written explanations for specific deductions. Office audits require more comprehensive documentation including appointment books, mileage logs, and detailed business expense records.

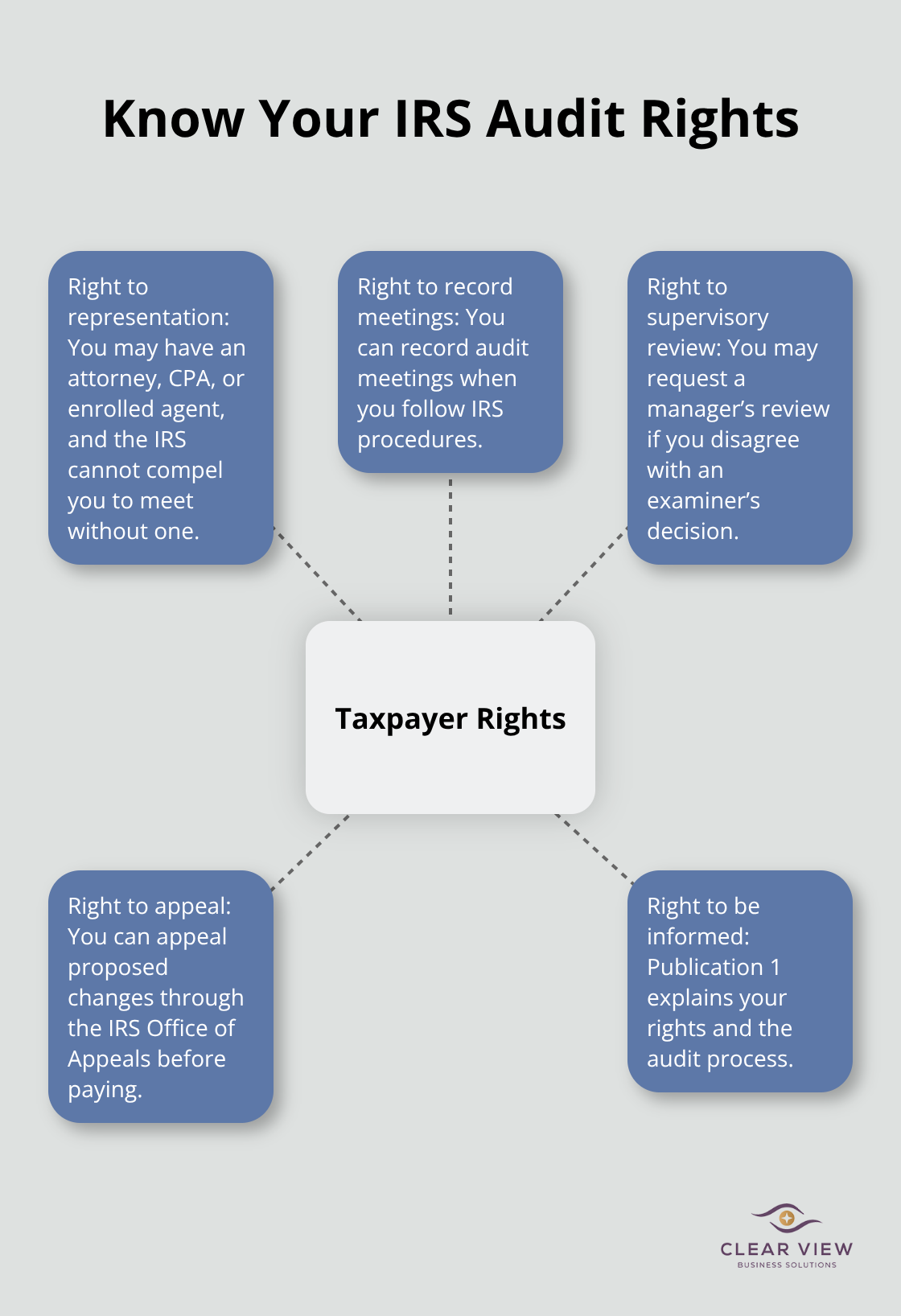

The IRS must inform you of your rights under Publication 1, but most taxpayers ignore this information. You have the absolute right to professional representation – the IRS cannot force you to meet without an attorney, CPA, or enrolled agent present. You also have the right to record audit meetings, request supervisory review of examiner decisions, and appeal any proposed changes through the Office of Appeals before you pay additional taxes.

The Taxpayer Advocate Service provides free assistance when IRS procedures create significant hardship or when normal channels fail to resolve issues within reasonable timeframes. Low Income Taxpayer Clinics offer representation for individuals who earn below 250% of federal poverty guidelines (which equals $73,240 for a family of four in 2024).

Tax professionals handle 67% of all audit cases according to IRS statistics, and represented taxpayers achieve better outcomes than those who represent themselves. Enrolled agents, CPAs, and tax attorneys understand IRS procedures, know which documentation satisfies examiner requirements, and can limit audit scope through strategic communication. Professional fees typically range from $150-400 per hour, but representation often reduces proposed tax assessments by thousands of dollars while it prevents costly procedural mistakes that trigger expanded examinations.

Field audits demand complete financial records that span the entire tax year under review. You must collect bank statements, credit card records, invoices, contracts, and any supporting documentation that validates your reported income and deductions. The IRS expects you to maintain records for at least three years from the return due date, but complex business situations may require documentation that goes back six years.

Once you understand your rights and begin to organize your documentation, you need to develop a strategic approach for how you will communicate with the IRS and what type of audit process you can expect.

Professional documentation organization separates successful audit outcomes from costly disasters. Create chronological files for each questioned item with original receipts, bank statements, and canceled checks arranged by date. The IRS expects complete paper trails that connect every deduction to actual payments – missing documentation for even small amounts triggers expanded examination scope.

Correspondence audits require specific forms of proof that validate your claims. Business meals need receipts that show date, location, business purpose, and attendees. Charitable donations need acknowledgment letters from qualified organizations plus payment records.

Medical expenses need itemized statements from healthcare providers with corresponding payment documentation.

Office audits demand more comprehensive records including appointment books, mileage logs, and detailed business expense records. Field audits require complete financial records that span the entire tax year under review, including bank statements, credit card records, invoices, and contracts.

Written responses to IRS correspondence audits must address only the specific items mentioned in the audit letter. Additional information often prompts examiners to question unrelated deductions or income items. Include a cover letter that summarizes your position and references attached documentation by exhibit numbers.

Office audits require different tactics – answer examiner questions directly without volunteering extra information about other tax years or unreported items. Revenue agents who conduct field audits receive specialized training to identify additional audit issues through casual conversation, so limit discussions to requested documentation only.

Correspondence audits resolve 89% of cases through mail exchanges, typically concluding within 4-6 months when taxpayers provide complete documentation. Office audits last 6-12 months and examine multiple deduction categories simultaneously, often resulting in proposed adjustments.

Field audits represent the most intensive examination level. Revenue agents conduct thorough reviews of complete financial records and may interview business associates or family members about your financial activities. These comprehensive examinations can extend beyond one year depending on case complexity. A CPA can represent clients before the IRS during these complex proceedings, providing professional guidance throughout the audit process.

IRS audit letters demand immediate attention and strategic responses. Statistics show that 75% of audits resolve through correspondence, but proper documentation and timely responses determine successful outcomes. When you miss deadlines, the IRS automatically accepts proposed changes and adds taxes plus penalties that you could have avoided.

Professional IRS audit representation becomes essential when you face office or field audits, complex business deductions, or multiple tax years under examination. Tax professionals achieve better outcomes because they understand IRS procedures and can limit audit scope through strategic communication. The investment in professional help typically pays for itself through reduced assessments and avoided penalties.

Future audit risk decreases when you maintain complete records, report all income accurately, and keep deductions reasonable compared to your income level (document business expenses immediately with detailed receipts and maintain files by tax year). Clear View Business Solutions provides comprehensive tax services to help clients navigate complex tax situations while they maintain compliance. We help Tucson individuals and small businesses maximize benefits through professional guidance.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.