Ultra high net worth tax planning is a complex field that demands expert knowledge and strategic thinking. With tax laws constantly evolving, staying ahead of the curve is essential for preserving wealth and minimizing tax liabilities.

At Clear View Business Solutions, we specialize in crafting tailored tax strategies for ultra high net worth individuals. Our blog post explores cutting-edge techniques and international considerations that can significantly impact your financial future.

Estate and gift tax planning forms the foundation of wealth preservation for ultra high net worth individuals. The lifetime gift tax exemption for 2025 stands at $13.99 million for individuals and $27.98 million for married couples. These limits will likely decrease significantly at the end of 2025 without Congressional intervention, creating a unique opportunity for strategic gifting.

We suggest you consider substantial gifts to family members or trusts before the potential exemption decrease. This strategy allows you to transfer assets likely to appreciate, effectively moving future growth out of your taxable estate. For example, gifting a $10 million business interest expected to double in value over the next decade could save millions in future estate taxes.

Charitable giving supports causes you care about and provides substantial tax benefits. Establishing a private foundation or a donor-advised fund optimizes long-term giving while maximizing tax advantages.

Donating appreciated securities to a donor-advised fund allows you to claim a tax deduction for the full market value while avoiding capital gains taxes. This strategy proves particularly effective in high-income years, potentially reducing your tax liability by up to 30% of your adjusted gross income for gifts of appreciated assets.

Smart investment and asset allocation strategies minimize tax liabilities while maximizing returns. A tax-aware investment approach considers the tax implications of each investment decision.

Tax-loss harvesting serves as an effective strategy. This technique involves selling underperforming investments to realize losses, which offset capital gains in other parts of your portfolio. Proper execution of this strategy can save hundreds of thousands in taxes annually for ultra high net worth individuals.

Separately Managed Accounts (SMAs) offer another valuable tool. These accounts provide greater control over tax events and allow for more personalized tax management strategies. Unlike mutual funds, SMAs help you avoid unwanted capital gains distributions and offer opportunities for targeted tax-loss harvesting.

For ultra high net worth individuals with global assets, international tax planning becomes essential. Understanding foreign tax credits and treaty benefits can significantly reduce your overall tax burden. Proper structuring of offshore trusts (when appropriate) can provide asset protection and potential tax advantages.

As we move into more advanced tax reduction techniques, it’s important to note that these strategies require careful consideration and expert guidance. The next section will explore sophisticated methods such as Private Placement Life Insurance and Opportunity Zone Investments, which can further enhance your tax planning efforts.

Ultra high net worth individuals often benefit from sophisticated tax reduction techniques that go beyond basic planning. These strategies can significantly impact overall tax liability. Let’s explore some advanced methods that have proven effective for many clients.

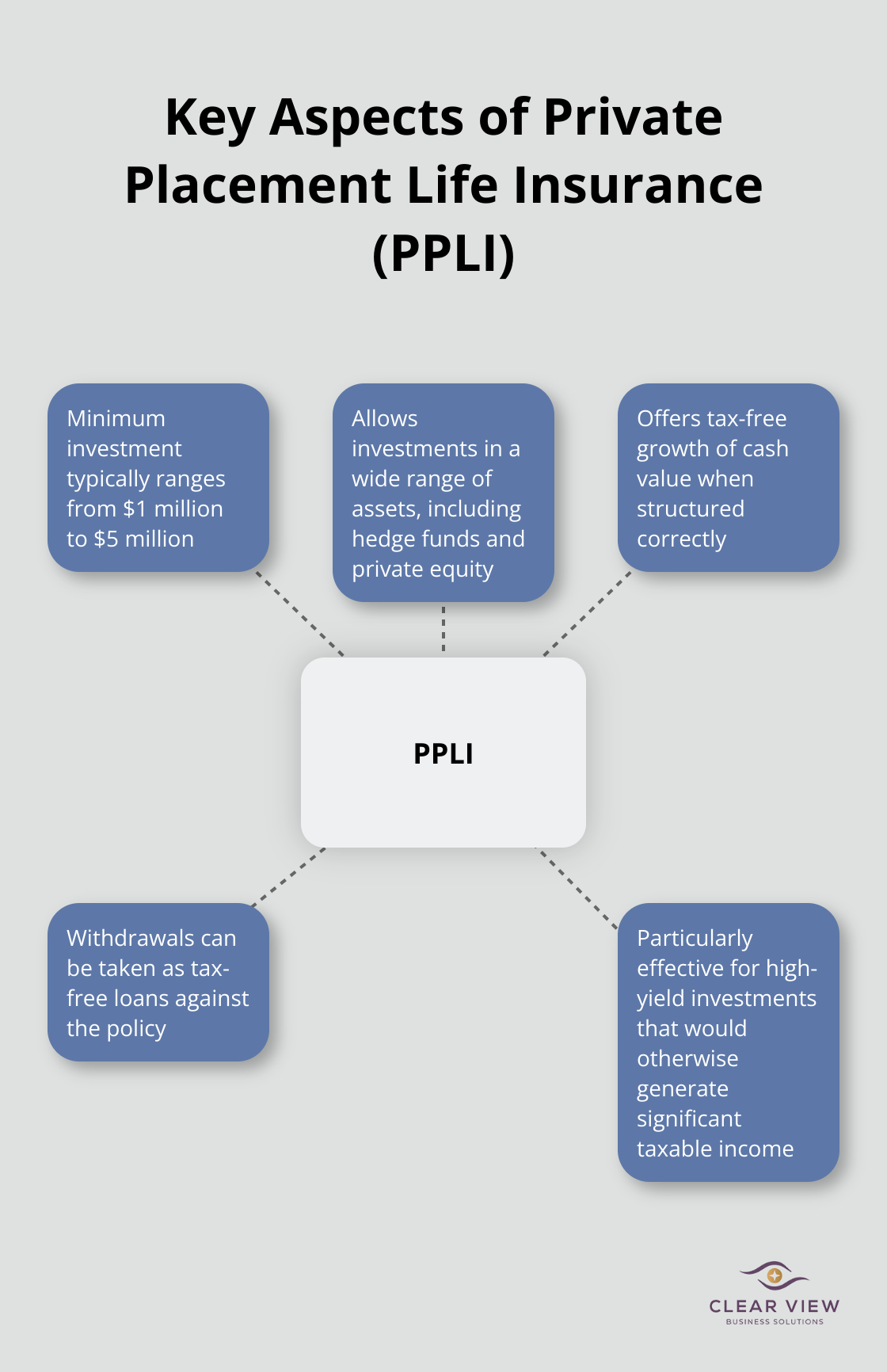

Private Placement Life Insurance (PPLI) is primarily designed to help very wealthy people pay less taxes on their investments. This specialized form of variable universal life insurance allows investments in a wide range of assets, including hedge funds and private equity, while offering tax-free growth and distributions (if structured correctly).

A typical PPLI policy requires a minimum investment of $1 million to $5 million. The primary advantage lies in the tax-free growth of cash value. When properly designed, withdrawals can be taken as tax-free loans against the policy. This strategy proves particularly effective for high-yield investments that would otherwise generate significant taxable income.

Opportunity Zone investments offer a unique combination of tax benefits and potential for social impact. These investments allow deferral of tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund (QOF). If held for 10 years, the appreciation on the Opportunity Zone investment becomes completely tax-free.

This strategy helps defer millions in capital gains taxes while investing in promising real estate and business ventures in economically distressed areas. For example, an investor recently deferred $15 million in capital gains by investing in an Opportunity Zone fund focused on developing affordable housing. This move not only postponed a significant tax bill but also positioned the investment for tax-free appreciation if held for the full 10-year period.

While traditional Roth IRA contributions often remain off-limits for ultra high net worth individuals due to income limitations, strategic Roth conversions can still provide significant long-term tax benefits. The key lies in timing these conversions to minimize the immediate tax impact while maximizing long-term tax-free growth.

The “backdoor Roth IRA” strategy proves effective for many high-income earners. This involves making non-deductible contributions to a traditional IRA and then immediately converting it to a Roth IRA. While this strategy requires careful execution to avoid IRS rule violations, it can allow high-income earners to effectively contribute to a Roth IRA despite income limitations.

For those with significant IRA balances, a long-term Roth conversion strategy often works well. This involves converting portions of traditional IRAs to Roth IRAs over several years, carefully managing the tax impact each year. A recent case involved converting a $5 million traditional IRA to a Roth IRA over five years, timing the conversions to coincide with years of lower income to minimize the tax burden.

These advanced tax reduction techniques require careful planning and execution. Professional guidance from experienced advisors (such as those at Clear View Business Solutions) can help tailor these strategies to unique financial situations and goals. The implementation of these sophisticated approaches has helped many ultra high net worth individuals save millions in taxes while positioning their wealth for long-term growth and efficient transfer to future generations.

As we move forward, it’s important to consider the international aspects of tax planning for ultra high net worth individuals. The next section will explore strategies for managing global assets and navigating complex international tax regulations.

For ultra high net worth individuals with international assets and income streams, navigating global tax complexities is crucial. Let’s explore some key strategies for optimizing your global tax position.

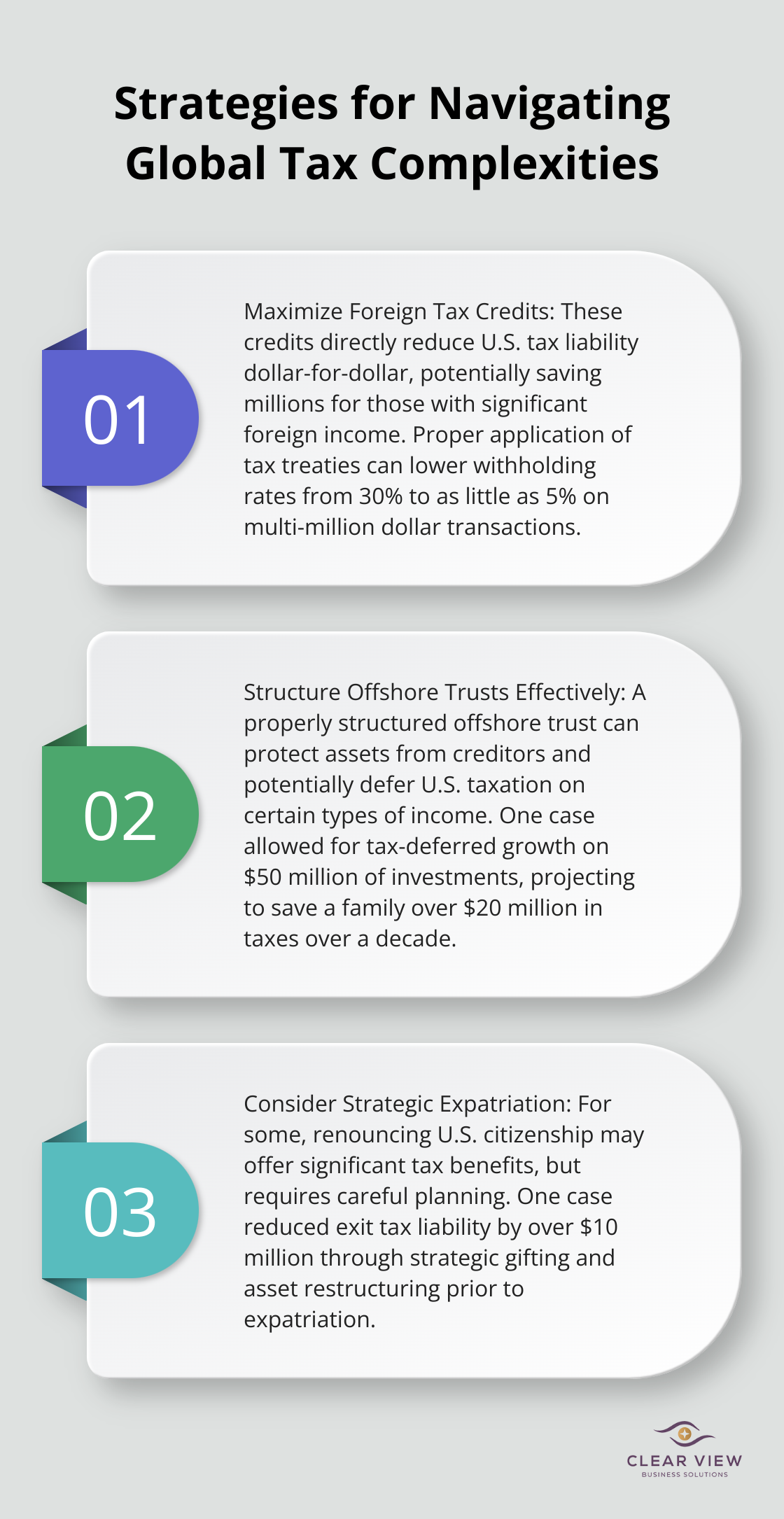

Foreign tax credits provide a powerful tool to avoid double taxation on income earned abroad. These credits directly reduce U.S. tax liability dollar-for-dollar, potentially saving millions for those with significant foreign income. The Foreign Tax Credit (FTC) allows a taxpayer that has paid taxes in another country to take a credit for those taxes against the taxpayer’s U.S. federal income tax.

Meticulous record-keeping of foreign taxes paid and understanding the nuances of each country’s tax treaty with the U.S. are essential. Some treaties offer additional benefits, such as reduced withholding rates on dividends or royalties. Proper treaty application has lowered withholding rates from 30% to as little as 5% on multi-million dollar transactions.

Offshore trusts, when structured correctly, offer asset protection and potential tax advantages. However, they require careful navigation of complex IRS reporting requirements. The Foreign Account Tax Compliance Act (FATCA) has significantly increased scrutiny on offshore holdings, making professional guidance essential.

A properly structured offshore trust can protect assets from creditors and potentially defer U.S. taxation on certain types of income. A trust established in a tax-neutral jurisdiction allowed for tax-deferred growth on $50 million of investments. This structure, combined with strategic distributions, projects to save a family over $20 million in taxes over the next decade.

For some ultra high net worth individuals, expatriation (renouncing U.S. citizenship or long-term residency) may offer significant tax benefits. However, this decision comes with substantial implications, including potential exit taxes.

The exit tax calculation assumes the individual sold all their assets on the day before expatriation. For covered expatriates (those with a net worth exceeding $2 million or average annual net income tax for the past five years exceeding $172,000 in 2023), proper planning becomes critical.

One case involved reducing an exit tax liability by over $10 million through strategic gifting and asset restructuring prior to expatriation. This strategy timed the renunciation to coincide with a year of lower asset valuations and implemented a series of gifts to non-U.S. family members.

Expatriation remains an irreversible decision with far-reaching consequences. It requires thorough analysis of long-term financial goals, family considerations, and potential future U.S. ties.

Understanding and utilizing tax treaties between countries can significantly reduce overall tax burdens. These agreements often provide relief from double taxation and offer reduced tax rates on certain types of income.

For example, the U.S.-UK tax treaty allows for a 0% withholding tax rate on interest payments between related companies. This provision can result in substantial savings for multinational corporations or individuals with cross-border investments.

The Controlled Foreign Corporation (CFC) rules present complex challenges for ultra high net worth individuals with foreign business interests. These rules aim to prevent tax deferral on certain types of passive income earned by foreign corporations controlled by U.S. shareholders.

Careful structuring of foreign entities and income streams can mitigate the impact of CFC rules. In some cases, reorganizing business operations or changing the nature of income can help avoid triggering these provisions, potentially saving millions in U.S. taxes.

Ultra high net worth tax planning requires a multifaceted approach that combines domestic and international strategies. Each strategy plays a vital role in preserving and growing wealth, from estate planning to advanced techniques like Private Placement Life Insurance. The importance of international considerations cannot be overstated, with foreign tax credits and offshore trusts offering significant opportunities for tax optimization.

Personalized tax planning is paramount for ultra high net worth individuals. Each financial situation demands tailored strategies that align with specific goals, risk tolerance, and global asset distribution. What works for one individual may not suit another, underscoring the need for a customized approach.

Professional guidance proves indispensable in navigating the complex landscape of ultra high net worth tax planning. At Clear View Business Solutions, we offer comprehensive financial advisory and tax services to help individuals and businesses maximize their tax benefits. Our team specializes in providing personalized service, simplifying complex financial matters, and empowering clients to make informed decisions.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.