At Clear View Business Solutions, we know that mastering QuickBooks Point of Sale is essential for efficient retail management. This powerful software streamlines transactions, inventory control, and customer data management.

Our QuickBooks Point of Sale training tips will help you maximize the system’s potential for your business. From setup to daily operations, we’ll guide you through the key features that can boost your productivity and profitability.

Start by downloading QuickBooks POS from the official Intuit website. During installation, select one computer as the server-this will host your main database. Install the software on all workstations that will use POS, and connect them to the same network as the server.

After installation, launch the QuickBooks POS Setup Interview. This wizard guides you through basic configuration steps. Focus on setting your tax rates accurately, as these can be challenging to modify later.

Your company file serves as the core of QuickBooks POS. When you create it, enter precise business information, including your legal business name, address, and tax ID. This data will appear on receipts and reports.

Set up your chart of accounts to align with your business structure. If you use QuickBooks Financial, integrate it with POS at this stage to ensure smooth data flow between the two systems.

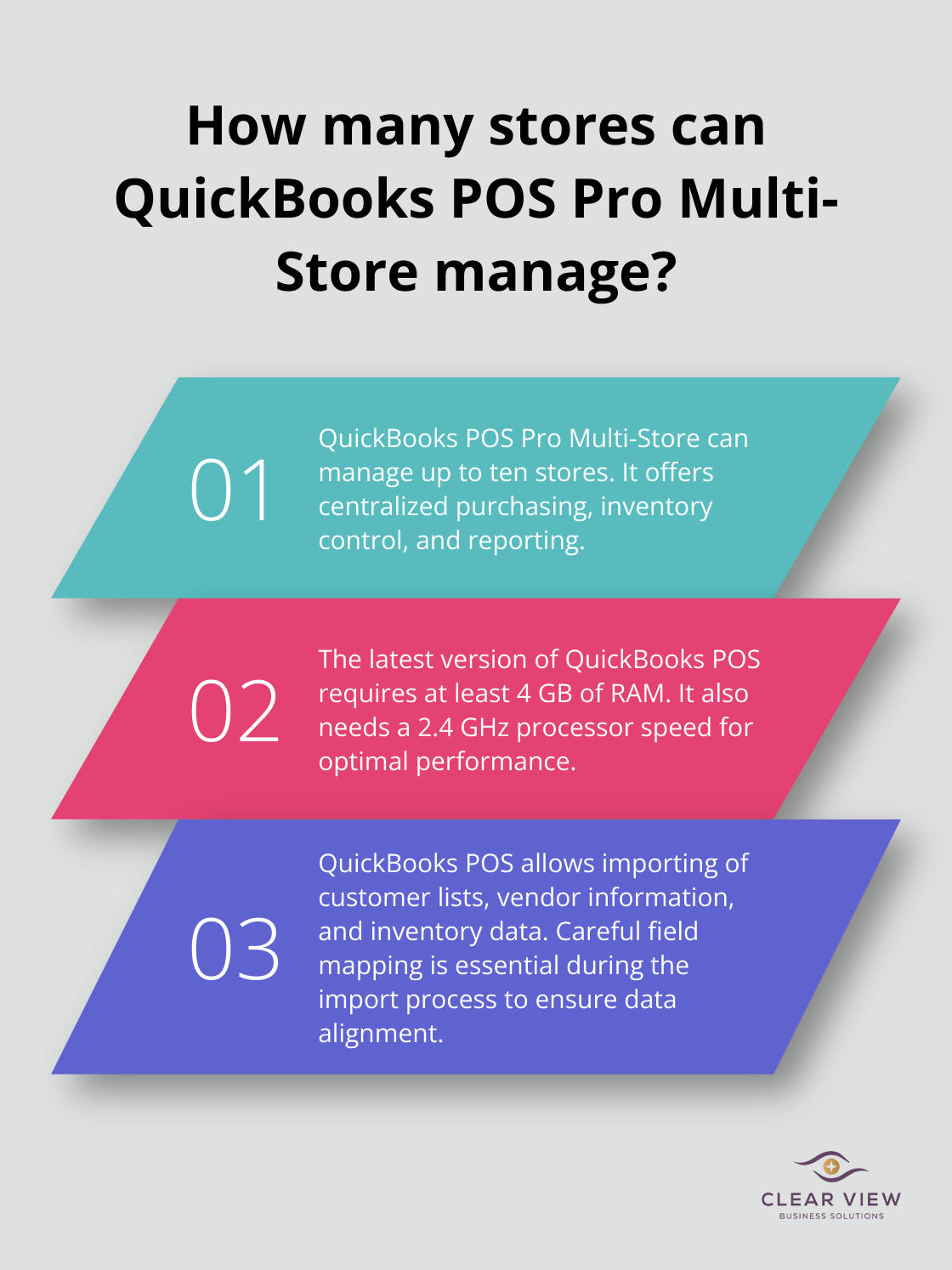

Proper inventory management is key to success. Begin by importing your existing inventory list if you have one. If not, manually input each item, including SKU, description, cost, and selling price.

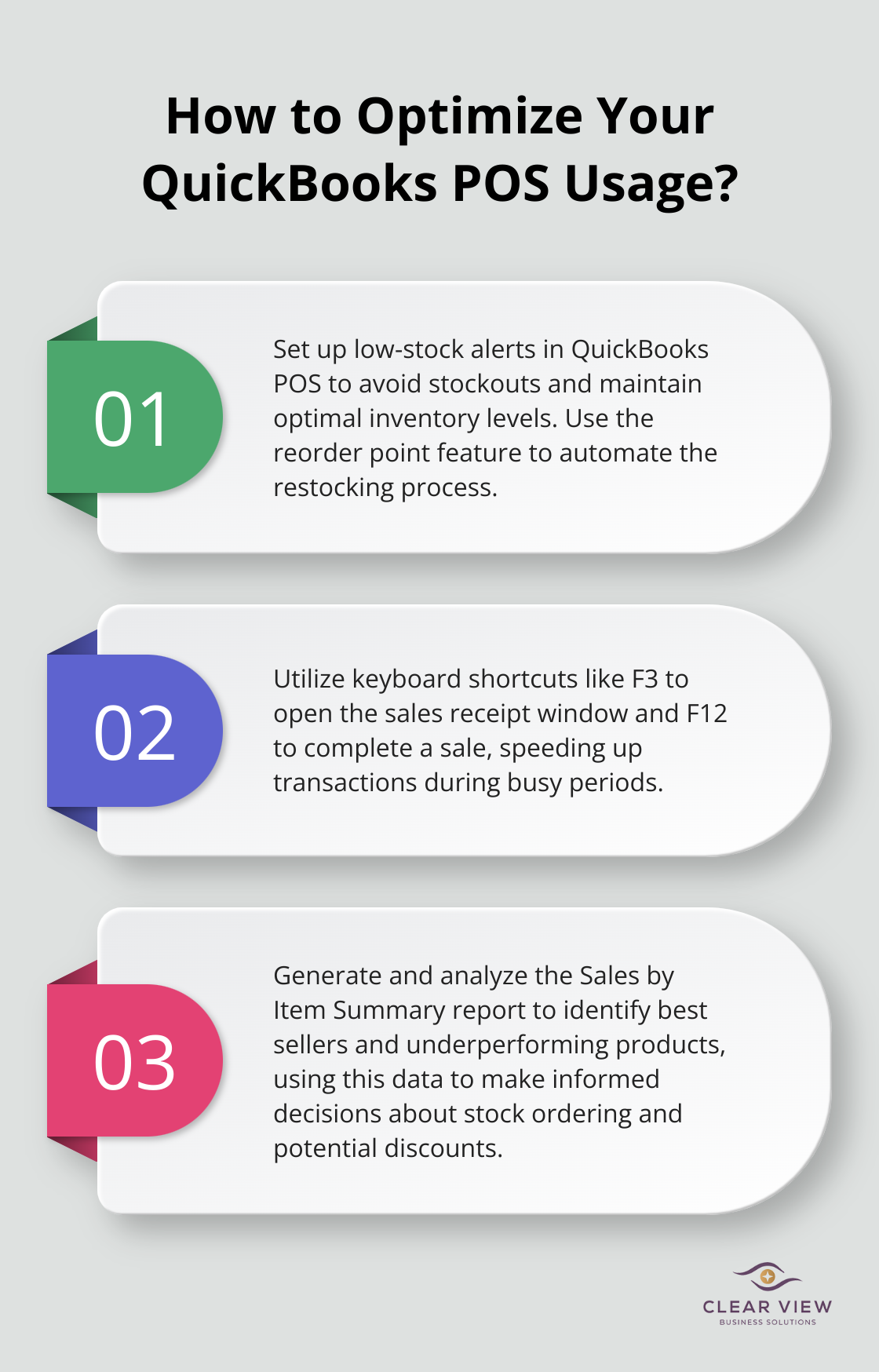

Use the ‘Item Styles’ feature for products with variations like size or color. Set reorder points for each item to prevent stockouts.

Tailor your sales receipts and invoices to strengthen your brand. Add your logo, adjust the layout, and include relevant information such as return policies or promotional messages.

Utilize the ‘Field Mapping’ feature to ensure that customer information displays correctly on these documents. This step often goes unnoticed but can prevent future complications.

A well-configured QuickBooks POS system forms the foundation for efficient retail management. Invest time in proper setup, and you’ll benefit from streamlined operations and accurate reporting. As we move forward, we’ll explore how to manage daily transactions effectively in QuickBooks POS.

QuickBooks POS optimizes the sales process, allowing you to complete transactions quickly and accurately. To process a sale, scan the item’s barcode or enter the SKU manually. The system automatically updates inventory levels and records the transaction in your financial records.

For returns, QuickBooks POS simplifies the process by allowing you to look up the original sale. This feature ensures accurate refunds and helps maintain precise inventory counts. Ask customers for their receipt or use their phone number to locate the transaction in the system.

QuickBooks POS supports multiple payment methods (cash, credit cards, and checks). Additionally, it supports contactless payments like Apple Pay and Google Pay, enabling faster, touch-free transactions that appeal to customers. For cash transactions, the system calculates change automatically, reducing errors. Credit card processing is integrated, eliminating the need for separate terminals and reducing reconciliation time.

When accepting checks, enter the check number in the designated field. This practice aids in tracking payments and simplifies the process if a check is returned. A 2023 Federal Reserve study found that 14% of businesses still use checks for transactions, making this feature valuable for many retailers.

Effective customer management builds loyalty. QuickBooks POS allows you to create and maintain detailed customer profiles. Use these profiles to track purchase history, preferences, and contact information. This data can inform your marketing strategies and improve customer service.

A study by Bain & Company found that increasing customer retention rates by 5% can increase profits by 25% to 95%. Use QuickBooks POS’s customer data to implement targeted retention strategies, such as personalized promotions or loyalty programs.

QuickBooks POS enables you to create and apply discounts strategically. Set up preset discounts for promotions or loyalty programs, and apply them easily during transactions. You can also create on-the-spot discounts for specific situations.

Monitor the impact of discounts on your bottom line using QuickBooks POS’s reporting features. This analysis helps you refine your pricing and promotional strategies for optimal profitability.

Mastering these daily transaction processes in QuickBooks POS enhances operational efficiency and customer satisfaction. The next chapter will explore how to effectively manage your inventory using QuickBooks POS, a critical aspect of retail success.

QuickBooks POS provides real-time visibility into your stock levels. The system allows you to manage your entire shop in real time, viewing, tracking, and reporting on sales, inventory, customer behavior, and P&L all in one place. This feature eliminates the need for manual tracking and reduces the risk of overselling or stockouts.

Review your inventory reports regularly. The Item QuickReport in QuickBooks POS offers a comprehensive view of each product’s sales history, current stock levels, and reorder points. Use this data to identify slow-moving items and top sellers, allowing you to make informed decisions about stock replenishment and product mix.

When you receive new inventory, accuracy is paramount. QuickBooks POS simplifies this process with its Purchase Order (PO) system. Create POs directly in the software, specifying item quantities and costs. When goods arrive, use the Receive Inventory function to match the delivery against the PO. This approach ensures that your stock levels and costs update correctly.

A common pitfall is the failure to record damaged or missing items during the receiving process. Always perform a thorough check of incoming inventory against the packing slip and PO. If discrepancies arise, use the Adjust Quantity/Value feature in QuickBooks POS to correct your records immediately. This practice maintains the integrity of your inventory data and financial reports.

Despite the accuracy of digital tracking, physical inventory counts remain essential. QuickBooks POS facilitates this process with its Physical Inventory Worksheet feature. It’s important to note that inventory valuation in QuickBooks POS is simply Quantity multiplied by Cost, which equals Value.

Conduct physical counts during off-hours to minimize disruptions. For larger inventories, consider cycle counting-regularly counting a portion of your stock-rather than full annual counts. This method (supported by QuickBooks POS) helps identify discrepancies more frequently and with less operational impact.

After you complete the count, enter the actual quantities into QuickBooks POS. The system will automatically adjust your inventory levels and generate a report highlighting any discrepancies. Investigate significant variances promptly to address potential issues like theft or data entry errors.

Set up reorder points for each item in your inventory to prevent stockouts. QuickBooks POS allows you to establish minimum and maximum stock levels for each product. When inventory falls below the reorder point, the system can automatically generate purchase orders (a time-saving feature for busy retailers).

Try to analyze sales trends and seasonality when setting reorder points. QuickBooks POS provides historical sales data that you can use to anticipate demand fluctuations. Adjust your reorder points accordingly to maintain optimal stock levels throughout the year.

QuickBooks POS offers a variety of inventory reports to help you make informed decisions. The Inventory Valuation Summary provides a quick overview of your current stock value, while the Inventory Stock Status report highlights items that need reordering.

Use these reports regularly (weekly or monthly, depending on your business volume) to identify trends, manage cash flow, and make strategic purchasing decisions. Pay special attention to reports that show your top-selling items and those with the highest profit margins.

QuickBooks Point of Sale transforms retail operations with its comprehensive features. The software streamlines daily transactions, provides real-time inventory insights, and offers valuable business performance data. Proficiency in QuickBooks POS will save time, reduce errors, and simplify accounting processes through integration with QuickBooks Financial software.

We recommend exploring Intuit’s official resources for QuickBooks Point of Sale training. These include video tutorials, user guides, and community forums to enhance your skills. Our team at Clear View Business Solutions offers personalized QuickBooks training and support to help you maximize the benefits of this powerful system.

For comprehensive financial advisory, tax services, and accounting support tailored to your business needs, visit our website. We can guide you through setup, provide ongoing support, and help you leverage QuickBooks POS to its full potential. QuickBooks Point of Sale training is an investment in your business’s future success.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.