Tax planning is a powerful tool for managing your financial future. At Clear View Business Solutions, we’ve seen firsthand how effective tax strategies can significantly impact our clients’ bottom lines.

Our tips for tax planning will help you navigate the complex world of taxes, whether you’re an individual, small business owner, or self-employed professional. By implementing these strategies, you’ll be better equipped to minimize your tax burden and maximize your financial potential.

Tax planning transcends the annual tax filing routine. It represents a strategic method to manage finances, leading to substantial savings and improved financial health. At Clear View Business Solutions, we observe the transformative impact of proper tax planning on our clients’ financial outlooks.

Tax planning requires a forward-thinking approach and informed decision-making throughout the year. This proactive stance allows individuals to capitalize on opportunities to reduce their tax liability legally. For instance, contributions to a 401(k) or IRA can decrease taxable income for the year.

A prevalent misconception suggests that tax planning benefits only the wealthy or proves too complex for average individuals. This notion couldn’t be further from the truth. Tax planning offers advantages to everyone, regardless of income level. Simple strategies (such as timing charitable donations or understanding applicable deductions) can create a significant impact on one’s tax situation.

Effective tax planning influences not only the current year’s tax bill but also shapes long-term financial prospects. The selection of appropriate retirement accounts, for example, can result in tax-free growth over decades.

Tax planning forms an integral component of comprehensive financial management. It doesn’t involve exploiting loopholes or cutting corners, but rather understanding the tax code and utilizing it advantageously. A well-executed tax planning strategy enables individuals to retain more of their hard-earned money and allocate it towards their financial objectives.

As we move forward, we’ll explore specific strategies that can enhance your tax planning efforts and help you achieve your financial goals more effectively.

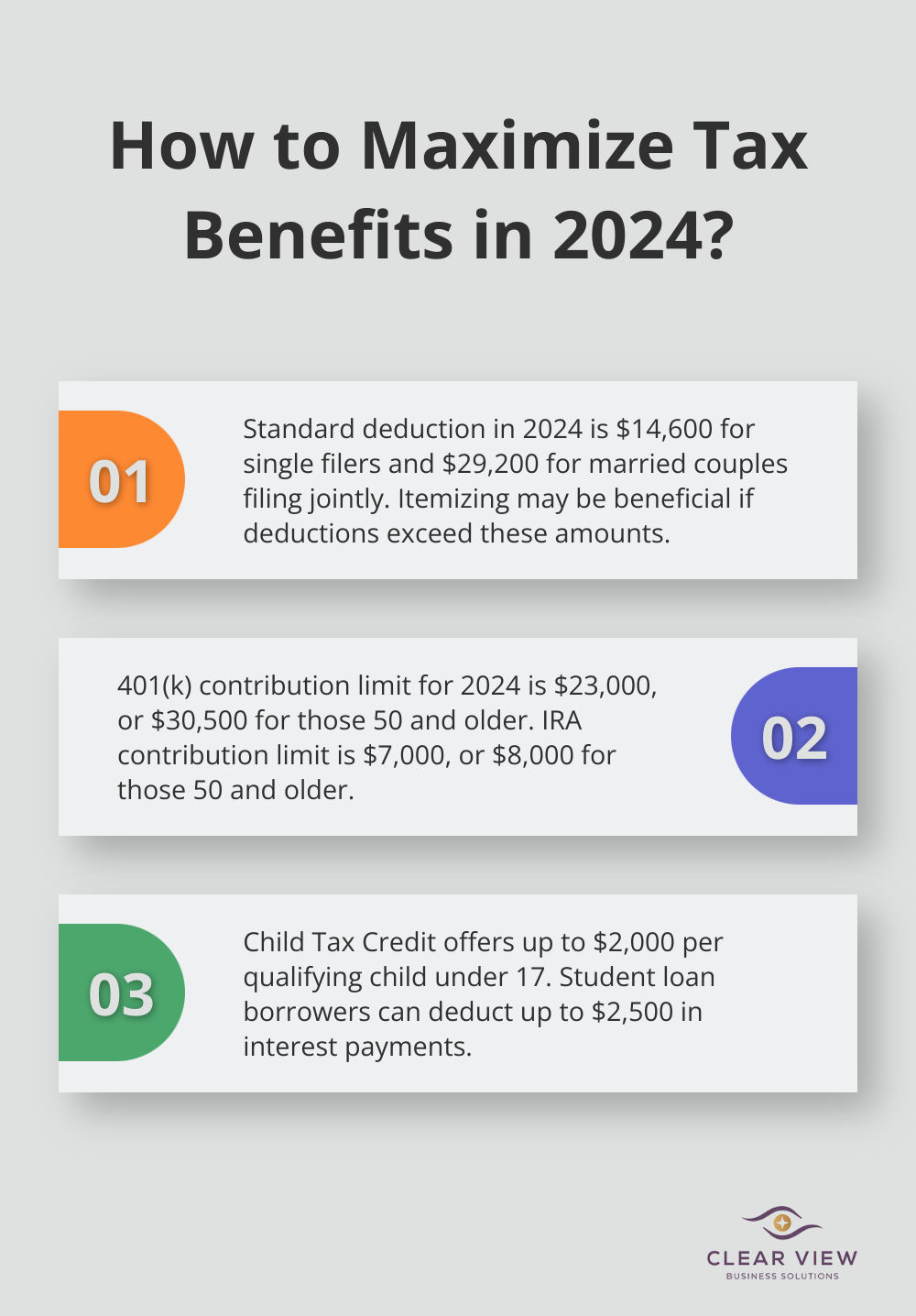

The IRS offers numerous opportunities to lower your taxable income. Many taxpayers overlook these potential savings. The standard deduction for 2024 is $14,600 for single filers and $29,200 for married couples filing jointly. However, itemizing deductions might benefit you more in some cases.

Don’t miss often-overlooked deductions such as student loan interest (up to $2,500 on qualified student loans). Self-employed individuals can deduct health insurance premiums and half of their self-employment tax. Homeowners can deduct mortgage interest on loans up to $750,000.

Tax credits directly reduce your tax bill dollar-for-dollar. The Child Tax Credit provides up to $2,000 per qualifying child under 17. The American Opportunity Tax Credit offers up to $2,500 per eligible student for qualified education expenses.

The timing of your income and expenses can significantly impact your tax liability. If you expect a higher income this year, consider deferring some income to the next tax year if possible. This strategy works particularly well if you’re on the edge of a higher tax bracket.

Business owners can lower their taxable income by accelerating expenses into the current tax year. Purchasing necessary equipment or paying outstanding invoices before year-end can increase your deductions for the current year.

Charitable contributions also offer an opportunity for strategic timing. If you plan a large donation, consider bunching your contributions into a single year to exceed the standard deduction and itemize for maximum tax benefit.

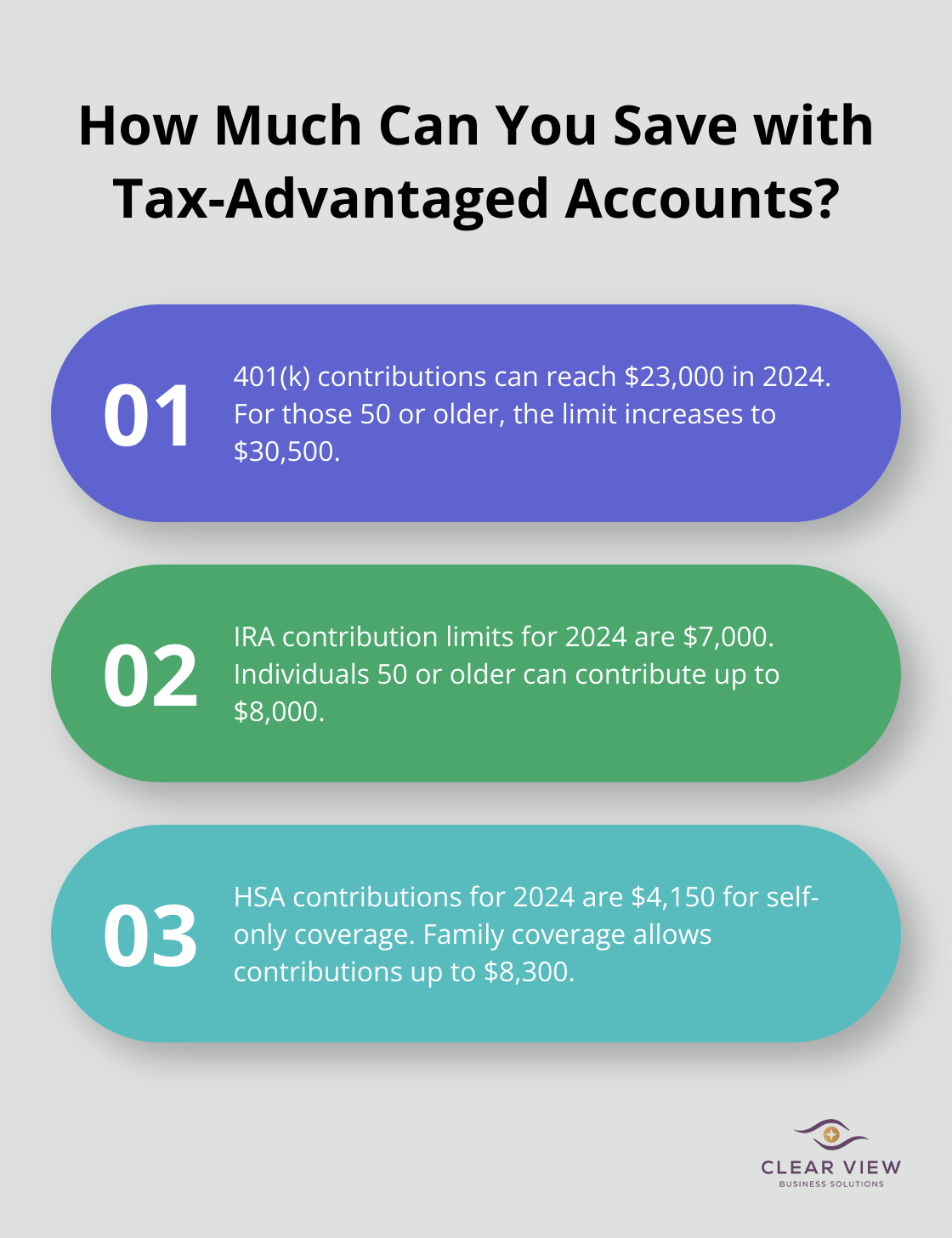

Tax-advantaged accounts reduce your tax burden while saving for the future. In 2024, you can contribute up to $23,000 to a 401(k) plan (or $30,500 if you’re 50 or older). These contributions come from pre-tax dollars, effectively lowering your taxable income for the year.

Individual Retirement Accounts (IRAs) offer similar benefits. For 2024, you can contribute up to $7,000 to an IRA (or $8,000 if you’re 50 or older). Traditional IRA contributions may be tax-deductible, depending on your income and whether an employer-sponsored retirement plan covers you.

Health Savings Accounts (HSAs) offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2024, you can contribute up to $4,150 to an HSA if you are covered by a high-deductible health plan just for yourself, or $8,300 if you have coverage for your family.

Investing with tax efficiency in mind can significantly impact your overall returns. Municipal bonds, for example, often provide tax-free interest income at the federal level (and sometimes at the state level too). This makes them particularly attractive for high-income earners in higher tax brackets.

Exchange-traded funds (ETFs) typically generate fewer capital gains distributions than actively managed mutual funds, making them more tax-efficient in many cases. Additionally, holding investments for more than a year qualifies you for long-term capital gains rates, which are generally lower than short-term rates.

Tax laws change frequently, and strategies that work well one year might not be as effective the next. Professional guidance can help you navigate these complexities and develop a tax strategy tailored to your unique financial situation. As we move forward, we’ll explore how to customize your tax planning approach based on your specific circumstances, whether you’re an individual, small business owner, or self-employed professional.

Tax planning for individuals focuses on optimizing deductions and credits. The standard deduction for 2024 stands at $14,600 for single filers and $29,200 for married couples filing jointly. Itemizing might prove more advantageous if your total deductions surpass these amounts.

Homeowners should leverage mortgage interest deductions (applicable to loans up to $750,000). Student loan borrowers can deduct up to $2,500 in interest payments. Parents benefit from the Child Tax Credit, offering up to $2,000 per qualifying child under 17.

Retirement planning plays a key role in individual tax strategies. Maximize your 401(k) contributions – up to $23,000 in 2024 (or $30,500 if you’re 50 or older). These contributions reduce your taxable income. Consider IRA contributions as well, with a 2024 limit of $7,000 (or $8,000 if you’re 50 or older).

Small business owners face unique tax planning challenges. Time your income and expenses strategically. If you anticipate higher profits this year, consider deferring some income to the next tax year or accelerating expenses into the current year.

Utilize Section 179 deductions, which allow you to deduct the full purchase price of qualifying equipment or software purchased or financed during the tax year.

Don’t overlook often-missed deductions like business insurance premiums, bank fees, and even a portion of your home expenses (if you have a home office). Maintain meticulous records of all business-related expenses to maximize your deductions.

Self-employed individuals must exercise particular diligence in tax planning. You bear responsibility for both employer and employee portions of Social Security and Medicare taxes, but you can deduct half of these self-employment taxes on your tax return.

Set up a Simplified Employee Pension (SEP) IRA or a solo 401(k) to reduce your taxable income. For 2024, you can contribute up to 25% of your net earnings from self-employment to a SEP IRA (up to a maximum of $69,000).

Make quarterly estimated tax payments to avoid penalties. The IRS provides guidelines on payment amounts based on your income.

Major life events significantly impact your tax situation. For newlyweds, consider whether filing jointly or separately will result in a lower tax bill. New parents should explore the Child Tax Credit and the Child and Dependent Care Credit.

Purchasing a home opens up new tax deductions (including mortgage interest and property taxes). However, state and local tax (SALT) deductions remain limited to $10,000 per year.

As retirement approaches, consider Roth IRA conversions. While you’ll pay taxes on the converted amount now, future withdrawals will be tax-free, potentially lowering your tax burden in retirement.

Effective tax planning requires a year-round approach to optimize your financial well-being. Our tips for tax planning can help you minimize your tax burden and maximize your financial potential. You should maximize deductions and credits, strategically time your income and expenses, and utilize tax-advantaged accounts.

Tax laws change frequently, so you must stay informed to maintain an effective tax strategy. What works one year might not benefit you the next. You should review and adjust your tax plan regularly to take advantage of new opportunities and avoid potential pitfalls.

Every financial situation is unique, so we recommend seeking professional advice for personalized tax planning. Our team at Clear View Business Solutions can help you navigate tax law complexities and develop a tailored strategy. Visit our website to learn more about our comprehensive financial advisory, tax services, accounting, and bookkeeping for individuals and small businesses in Tucson.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.