Tax planning for high income earners is a complex but essential task. At Clear View Business Solutions, we understand the unique challenges faced by those in higher tax brackets.

Effective strategies can significantly reduce your tax burden and maximize your wealth retention. This guide will explore key approaches to optimize your tax situation and make the most of your hard-earned income.

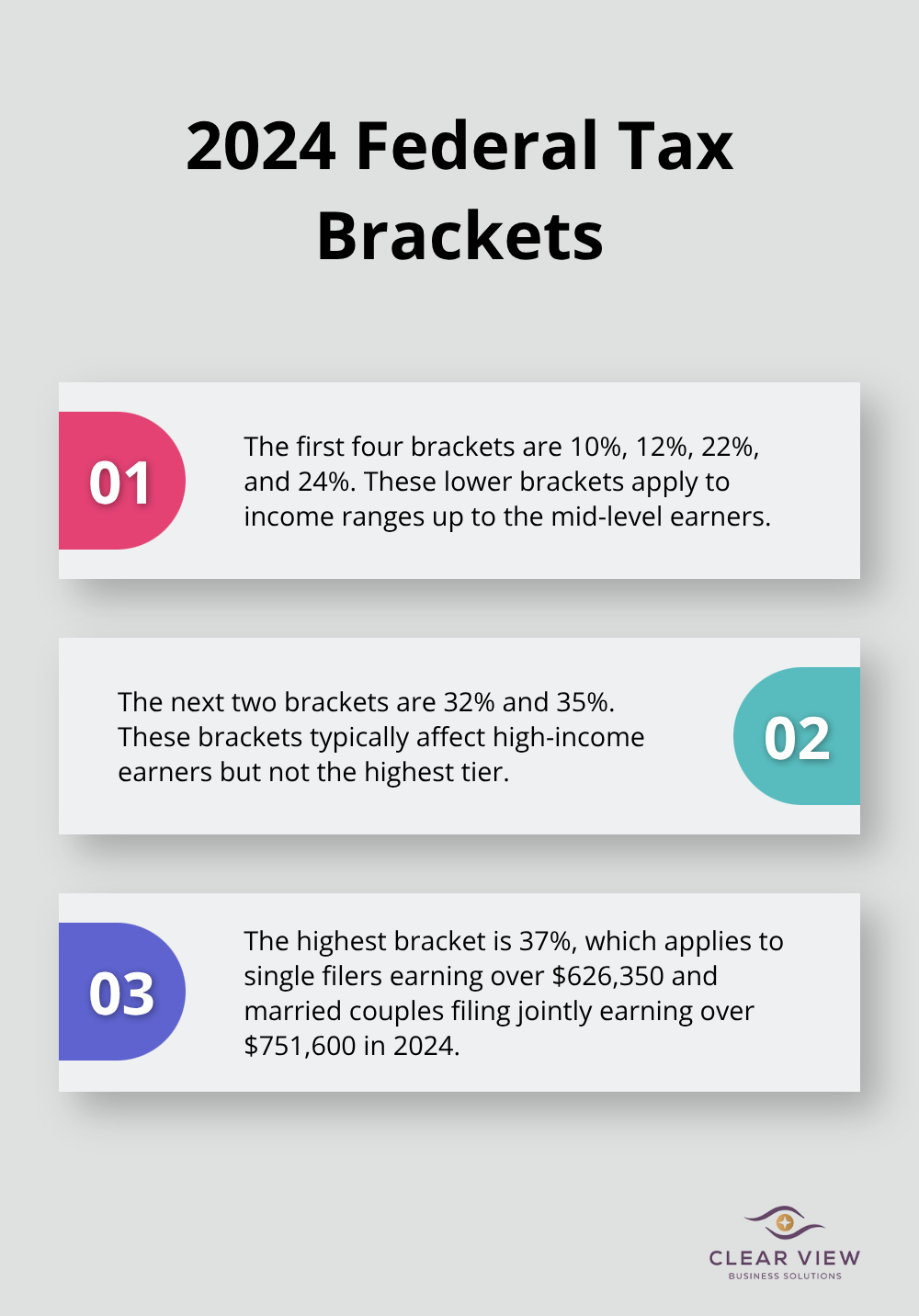

The U.S. tax system operates on a progressive scale, where tax rates increase as income rises. For 2024, the federal tax system consists of seven brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The highest rate of 37% applies to single filers earning over $626,350 and married couples filing jointly earning over $751,600.

Many taxpayers misunderstand how tax brackets work. Two key concepts help clarify this:

A single filer earning $650,000 in 2025 falls into the 37% bracket. However, their effective tax rate will be lower due to the progressive nature of the system.

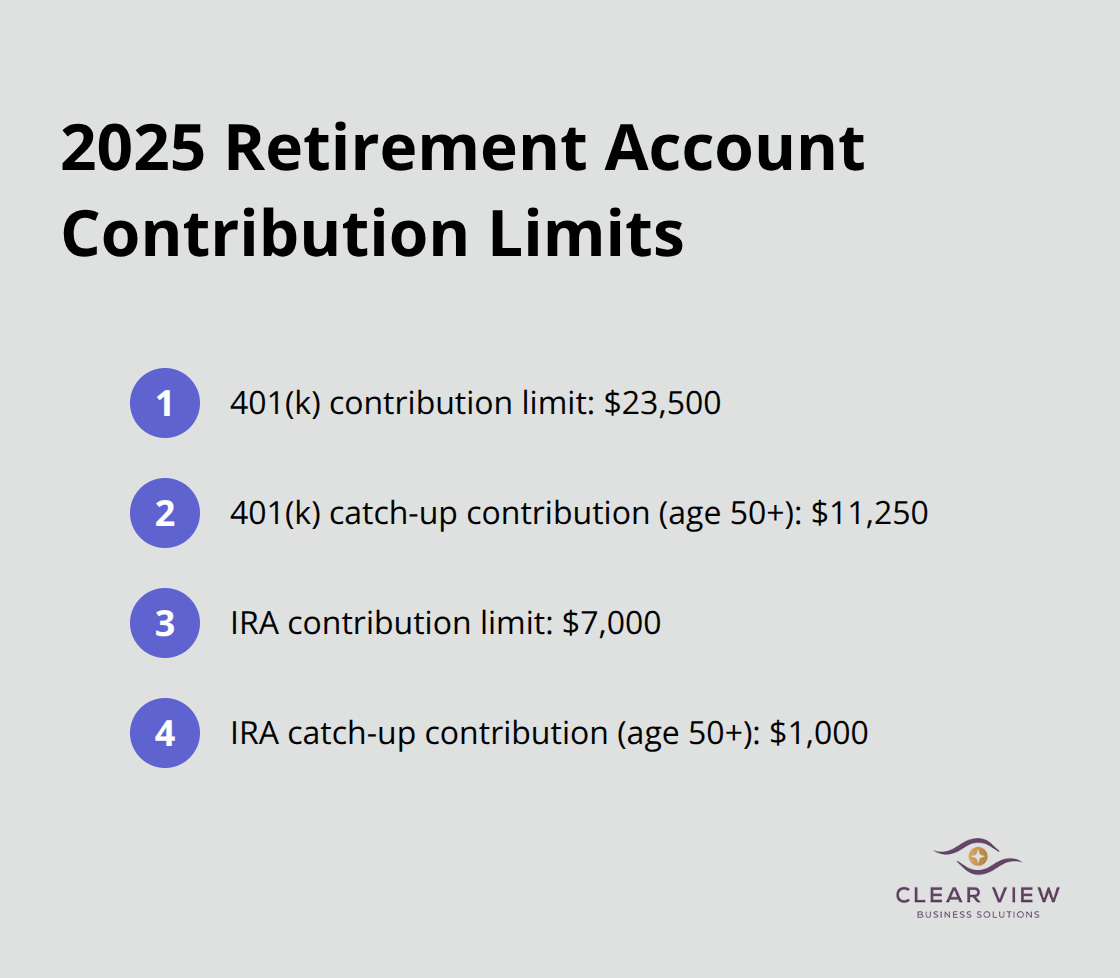

High-income earners can benefit from strategies that reduce their taxable income. Maximizing contributions to tax-advantaged accounts like 401(k)s (limit: $23,500 in 2025, plus $7,500 catch-up for those 50+) can push income into lower brackets.

Timing income and deductions becomes critical. Deferring income or accelerating deductions near year-end can potentially keep you in a lower bracket, thus reducing your overall tax burden.

High-income earners must also consider the Alternative Minimum Tax (AMT). This parallel tax system ensures that taxpayers with high incomes pay a minimum amount of tax, regardless of deductions. For tax year 2025, the maximum AMT exemption is $88,100 for individuals.

Federal taxes are just one piece of the puzzle. State and local taxes can significantly impact your overall tax picture. Some states (like Florida and Texas) have no income tax, while others (such as California and New York) have high rates that can substantially increase your total tax burden.

Understanding these complexities proves vital for optimizing your tax situation. The progressive system presents opportunities for strategic planning. Working with experienced professionals can help you navigate these brackets effectively and minimize your tax liability within legal bounds.

As we move forward, let’s explore specific strategies for maximizing deductions and credits, which can further reduce your tax burden as a high-income earner.

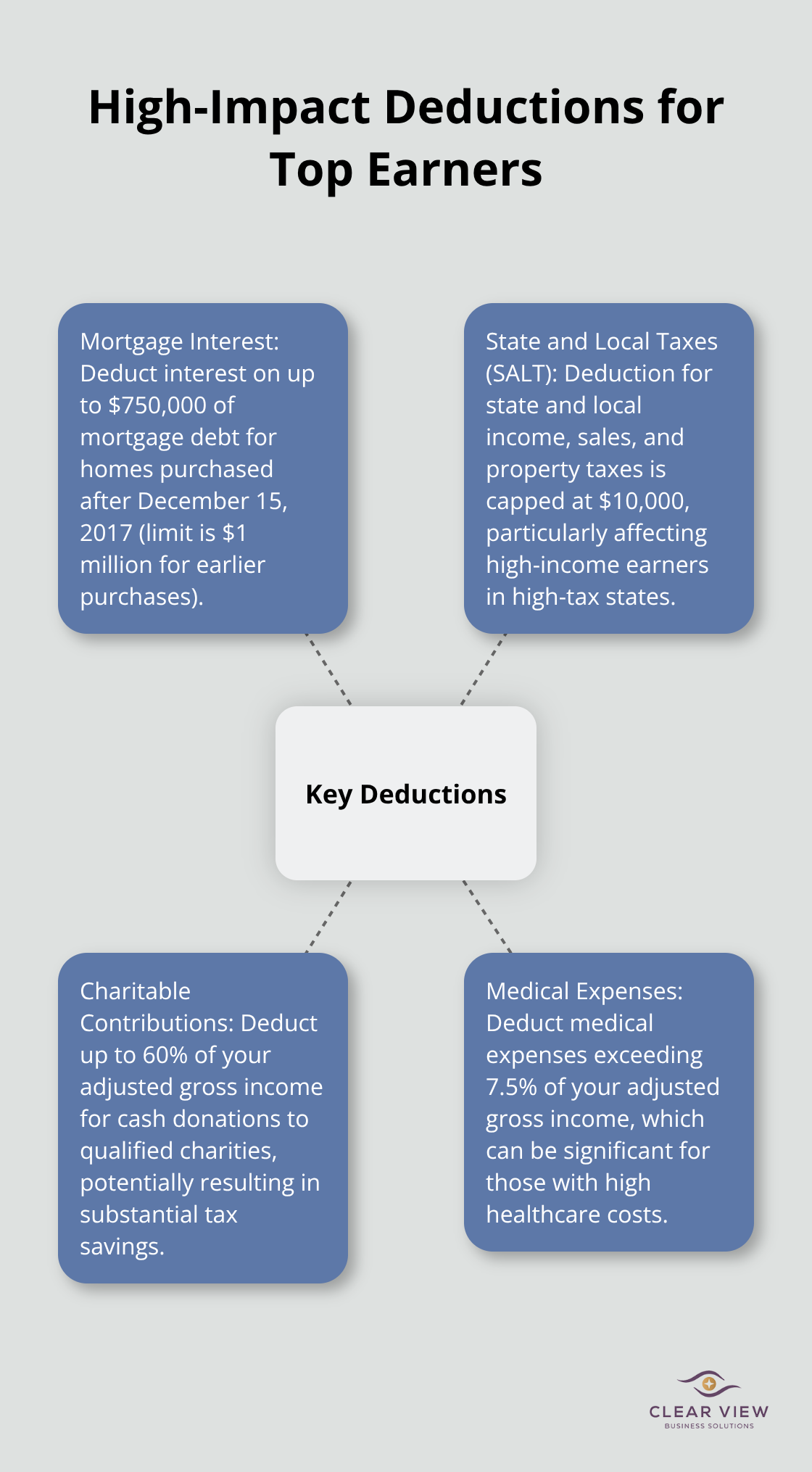

For 2025, the standard deduction stands at $13,850 for single filers and $27,700 for married couples filing jointly. High-income earners often benefit more from itemizing deductions. To determine the best approach, add up your potential deductions. If they exceed the standard deduction, itemizing will likely yield greater tax savings.

You can deduct interest on up to $750,000 of mortgage debt for homes purchased after December 15, 2017 (for homes bought before this date, the limit is $1 million).

The deduction for state and local income, sales, and property taxes has a cap of $10,000. This cap particularly affects high-income earners in high-tax states.

You can deduct up to 60% of your adjusted gross income for cash donations to qualified charities. For high-income earners, this can result in substantial tax savings.

If your medical expenses exceed 7.5% of your adjusted gross income, you can deduct the amount over this threshold. This deduction can prove significant for those with high healthcare costs.

While many tax credits phase out at higher income levels, some remain available to high earners:

This credit, now called the Residential Clean Energy Credit, offers 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032.

You can receive up to $7,500 for purchasing a qualifying new electric vehicle, or up to $4,000 for a qualifying used electric vehicle (though income limits apply).

While this credit phases out at lower income levels, it’s worth considering if you’re just on the cusp of high-income status.

Timing plays a critical role in tax planning. Consider accelerating deductions into the current tax year and deferring income to the next year when possible. This strategy can prove particularly effective if you anticipate being in a lower tax bracket next year.

For instance, you might prepay your January mortgage payment in December to claim the interest deduction in the current year. Similarly, you could delay receiving a year-end bonus until January to push that income into the next tax year.

Tax planning requires ongoing attention, as the most effective strategies can change year to year based on your financial situation and changes in tax legislation. As we move forward, let’s explore investment strategies that can further enhance your tax efficiency and potentially boost your overall financial picture.

Tax-efficient investing can boost your after-tax returns significantly. One of the most powerful tools for this purpose is to fully fund your retirement accounts. In 2025, you can contribute up to $23,500 to a 401(k), with an additional $11,250 catch-up contribution if you’re 50 or older. For IRAs, the limit is $7,000, with a $1,000 catch-up.

Traditional 401(k)s and IRAs offer immediate tax deductions, while Roth options provide tax-free growth and withdrawals in retirement. High earners often benefit from a mix of both to manage current and future tax liabilities.

Self-employed individuals can take advantage of SEP IRAs and Solo 401(k)s, which offer even higher contribution limits.

Tax-loss harvesting is when you sell investments at a loss and use those losses to offset gains in other investments. This strategy can reduce your tax bill while maintaining your overall investment strategy.

It’s important to be aware of the wash-sale rule, which prohibits repurchasing a substantially identical security within 30 days of the sale. To maintain your investment strategy, you should consider buying a similar but not identical investment.

Municipal bonds offer tax-exempt interest income at the federal level and often at the state level for residents. While the yields might seem lower than taxable bonds, the tax-equivalent yield can be significantly higher for high-income earners.

For instance, a municipal bond yielding 3% could be equivalent to a taxable bond yielding 4.76% for someone in the 37% tax bracket. This tax advantage makes municipal bonds an attractive option for high-income investors seeking stable, tax-efficient income.

ETFs often provide better tax efficiency compared to mutual funds. This is because ETFs typically generate fewer capital gains distributions, which can result in lower tax bills for investors. The structure of ETFs allows for in-kind redemptions, which can minimize taxable events within the fund.

Asset location involves placing investments in the most tax-advantaged accounts based on their tax characteristics. For example, you might hold high-yield bonds or REITs (which generate taxable income) in tax-deferred accounts like IRAs. Meanwhile, you could keep more tax-efficient investments like index funds or growth stocks in taxable accounts.

The key to successful tax-efficient investing is to integrate these strategies into a comprehensive financial plan. You should work closely with a financial advisor to create personalized investment strategies that align with your financial goals and tax situation.

Tax planning for high income earners requires a strategic approach to maximize wealth retention. The tax code offers numerous opportunities to reduce tax liability through deductions, credits, and investment strategies. Professional guidance can help navigate the complexities of tax laws and create a personalized plan tailored to individual financial goals.

Clear View Business Solutions specializes in comprehensive tax services for individuals and small businesses. Our expertise can help you develop effective strategies to minimize your tax burden within legal boundaries. We strive to turn tax planning into a powerful tool for financial success.

Tax laws change frequently, so regular reviews and adjustments to your tax strategy are essential. Proactive planning can lead to significant long-term benefits, including more efficient wealth building and a secure financial future. Contact us today to explore how we can optimize your tax planning approach.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.