Tax preparation and planning are two essential components of financial success. Many people view these tasks as separate entities, but they’re actually a powerful duo when combined.

At Clear View Business Solutions, we’ve seen firsthand how integrating these strategies can lead to significant benefits for individuals and businesses alike. By taking a proactive approach to your taxes, you can maximize savings, improve cash flow, and set yourself up for long-term financial stability.

The U.S. tax code is a labyrinth of rules and regulations. In 2022, the IRS implemented over 2,000 updates to the tax code. This constant flux makes it challenging for individuals and businesses to stay current. Professional tax preparation ensures compliance with all relevant laws, minimizing the risk of audits and legal complications.

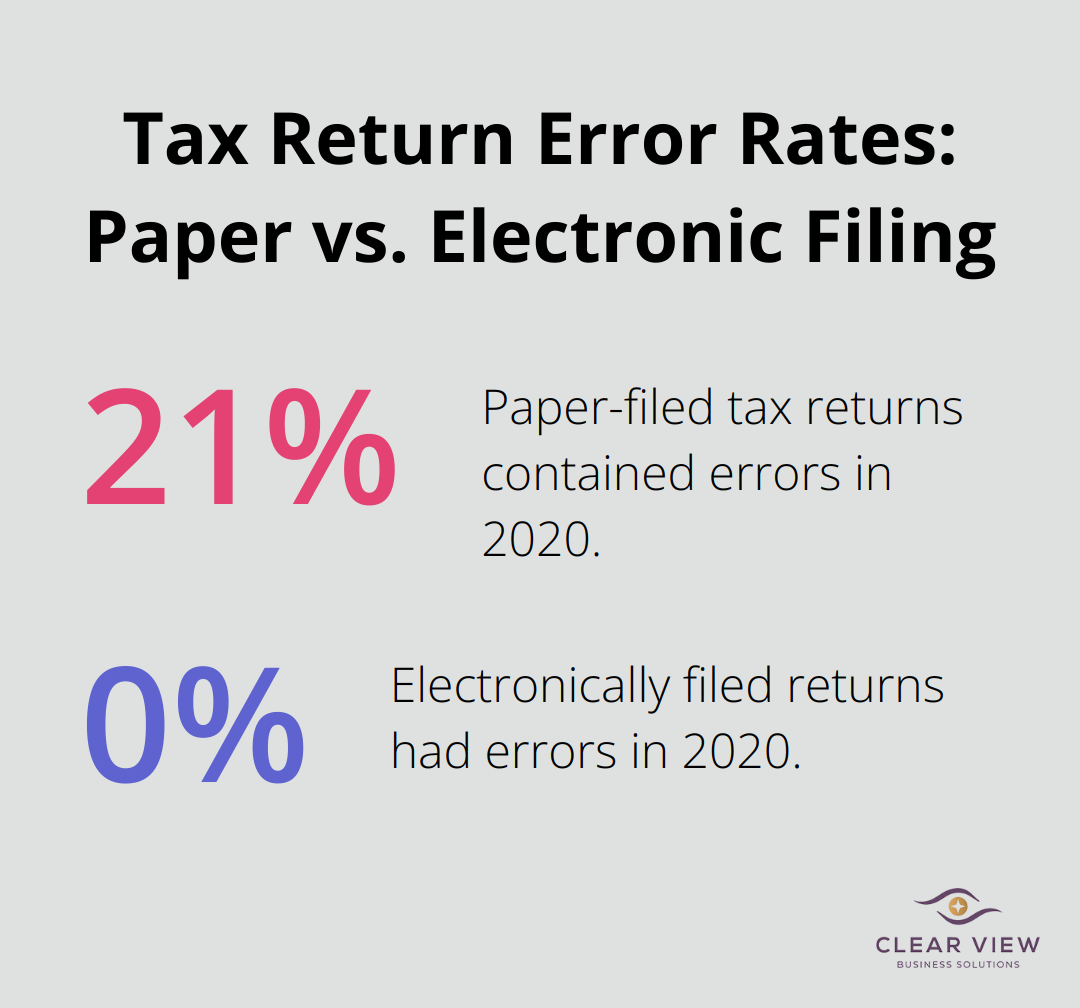

Errors on tax returns can lead to significant problems. The IRS reported that in 2020, approximately 21% of paper-filed tax returns contained mistakes, compared to just 0.5% of electronically filed returns. These errors often result in delayed refunds, additional paperwork, or penalties. Professional tax preparation catches these mistakes before they become issues, saving time, money, and stress.

Many taxpayers miss out on substantial deductions and credits each year. Thorough tax preparation involves a comprehensive review of your financial situation to identify all possible deductions and credits (which can potentially put more money back in your pocket).

Tax season often overwhelms small business owners who juggle multiple responsibilities. A survey by the National Small Business Association revealed that 40% of small businesses spend over 80 hours per year dealing with federal taxes. Outsourcing tax preparation to experts allows business owners to focus on running their operations while professionals handle the complexities of their tax returns.

Tax preparation isn’t just about filling out forms; it sets a solid foundation for your financial future. Whether you’re an individual taxpayer or a small business owner in Tucson, professional tax preparation yields significant benefits. Clear View Business Solutions provides personalized, expert tax preparation services that go beyond mere compliance to help achieve financial goals.

As we explore the importance of tax preparation, it becomes evident that this process intertwines closely with effective tax planning. Let’s examine how these two elements work together to create a powerful financial strategy.

Here’s the modified chapter with the requested changes:

Tax planning transcends mere compliance. It involves proactive decisions to optimize your financial position and minimize tax liabilities. Let’s explore how effective tax planning can transform your financial health.

Tax planning offers significant savings potential. Through year-round financial analysis, opportunities to reduce taxable income emerge. Timing income and expenses strategically can make a substantial difference. A Government Accountability Office study found that 21% of taxpayers who itemize deductions could save money by bunching charitable contributions in alternate years.

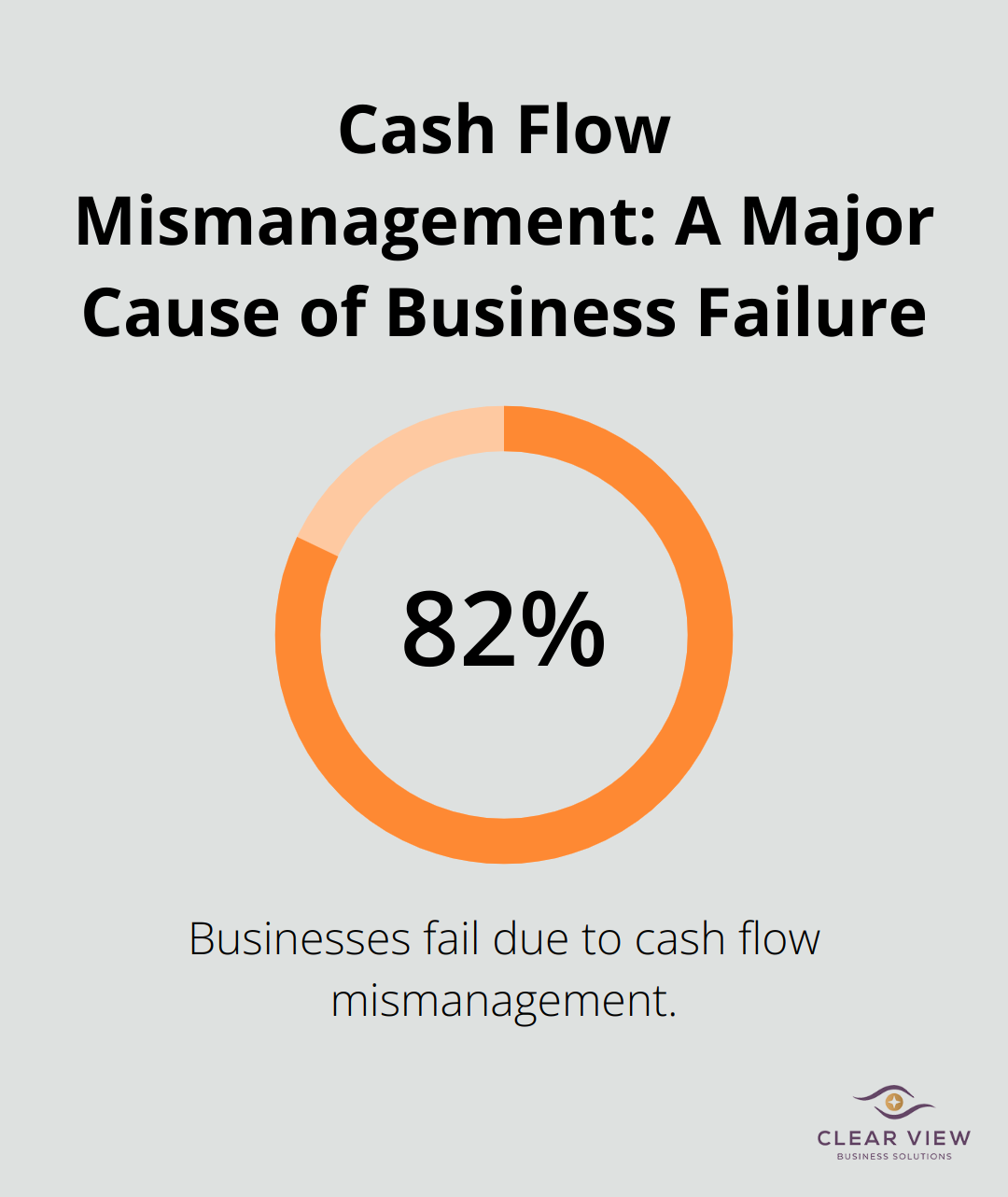

Tax planning directly impacts cash flow. Anticipation of tax obligations allows for better preparation, avoiding surprise tax bills that strain finances. This proves particularly crucial for small businesses. A U.S. Bank study revealed that 82% of businesses fail due to cash flow mismanagement. Proper tax planning enables better resource allocation and maintenance of healthy cash reserves.

Tax planning extends beyond the current year; it sets the stage for future success. Your tax strategy should align with goals such as retirement savings, business expansion, or major asset purchases. For instance, SEP IRA contributions provide immediate tax benefits while building retirement savings. In 2024, your total annual employee contributions to all plans can’t exceed $23,000.

Tax planning requires expertise and attention to detail. A tailored approach addresses unique financial situations and goals. Integration of tax planning with preparation creates a comprehensive strategy that maximizes financial benefits and minimizes stress.

Tax laws change frequently. Staying informed about these changes allows for strategy adjustments that maintain optimal tax positions. This proactive approach ensures you capitalize on new opportunities and avoid potential pitfalls.

Tax planning’s benefits extend far beyond immediate savings. It provides a foundation for long-term financial stability and growth. The next section will explore how combining tax preparation and planning creates a powerful synergy for financial success.

Tax management requires continuous attention. The National Association of Tax Professionals reports that taxpayers who engage in year-round tax planning save an average of 5-10% on their annual tax bill. This approach involves regular reviews of your financial situation, which allows timely adjustments to your tax strategy.

Small business owners in Tucson should track their quarterly earnings and adjust their estimated tax payments accordingly. This practice prevents underpayment penalties and ensures optimal cash flow management.

A proactive approach to tax savings yields substantial benefits. The IRS reports that in 2022, over 30 million taxpayers missed potential deductions by taking the standard deduction instead of itemizing. Working with a tax professional throughout the year helps you identify and capitalize on deduction opportunities as they arise.

Consider the timing of large charitable donations to maximize their impact on your tax liability. Donating appreciated stocks held for more than a year provides a double tax benefit (you avoid capital gains tax and can deduct the full market value of the stock).

The integration of tax preparation and planning enhances your ability to forecast and budget accurately. The U.S. Small Business Administration emphasizes that accurate financial projections play a vital role in business success, yet many small businesses struggle with this aspect.

Smart tax planning and compliance strategies can help small businesses stay compliant and save money. This level of precision supports better decision-making in areas such as investment, hiring, and expansion.

Every individual and business has unique financial circumstances. The integration of tax preparation and planning allows for the development of customized strategies that address specific needs and goals. This tailored approach maximizes tax benefits while aligning with long-term financial objectives.

Tax laws and regulations change frequently. An integrated approach to tax preparation and planning ensures that you stay informed about these changes and adapt your strategies accordingly. This proactive stance helps you capitalize on new opportunities and avoid potential pitfalls in the ever-evolving tax landscape.

Tax preparation and planning form the cornerstone of a robust financial strategy. These essential components extend far beyond tax season, providing a clear path to long-term financial success. Experienced tax professionals navigate the ever-changing landscape of tax regulations, offering valuable insights that lead to substantial savings and improved financial health.

Clear View Business Solutions understands the power of integrating tax preparation and planning. We offer comprehensive financial advisory, tax services, accounting, and bookkeeping for individuals and small businesses in Tucson. Our team of experts provides personalized solutions that address unique financial situations and goals (from ITIN setup to full-cycle bookkeeping with QuickBooks training).

Don’t leave your financial future to chance. Partner with Clear View Business Solutions to develop a comprehensive tax preparation and planning strategy that sets you up for long-term success. We help you navigate the complexities of tax management, so you can focus on growing your business and achieving your financial dreams.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.