Income tax and tax planning are essential aspects of financial management that can significantly impact your bottom line. Many individuals and businesses overlook the potential savings that come from strategic tax optimization.

At Clear View Business Solutions, we’ve seen firsthand how effective tax planning can lead to substantial savings and improved financial health. This blog post will guide you through practical strategies to optimize your income tax and make the most of your hard-earned money.

Income tax planning is a strategic approach to manage finances with the goal of minimizing tax liability. It involves making informed decisions throughout the year that can positively impact your tax situation. Proper tax planning can lead to significant savings for individuals and businesses alike.

Taking a proactive stance on taxes yields substantial benefits. The IRS reports that in 2022, over 75% of taxpayers received a refund, with the average amount being $3,176. This statistic underscores the importance of accurate tax planning – without it, you might give the government an interest-free loan through large refunds.

A crucial aspect of tax planning is to understand and leverage deductions. The standard deduction for tax year 2024 is $14,600 for single filers and $29,200 for married couples filing jointly. However, itemizing deductions might prove more beneficial in some cases. A thorough analysis of each unique situation determines the most advantageous approach.

Another vital component is the strategic timing of income and expenses. Self-employed individuals might consider delaying billing for services until January to push income into the next tax year. Conversely, prepaying some expenses in December can increase deductions for the current year.

Utilizing tax-advantaged accounts is a powerful strategy. Tax-advantaged accounts are financial accounts that come with tax benefits, such as tax-deductible contributions, tax-free growth, and/or tax-free withdrawals. These accounts can significantly reduce your taxable income and provide long-term financial benefits.

Effective income tax planning requires ongoing attention and adjustment. As tax laws change and financial situations evolve, strategies should adapt accordingly. Staying current with tax law changes ensures that tax planning strategies remain optimal year after year.

Now that we’ve covered the basics of income tax planning, let’s explore specific strategies to optimize your income tax in the next section.

Above-the-line deductions directly reduce your adjusted gross income (AGI). For 2024, key above-the-line deductions include:

These deductions are particularly valuable because they reduce your AGI, which can help you qualify for other tax benefits that phase out at higher income levels.

Strategic timing of income and deductions can lead to substantial tax savings. If you’re self-employed or have control over when you receive income, consider:

For W-2 employees, timing strategies might include:

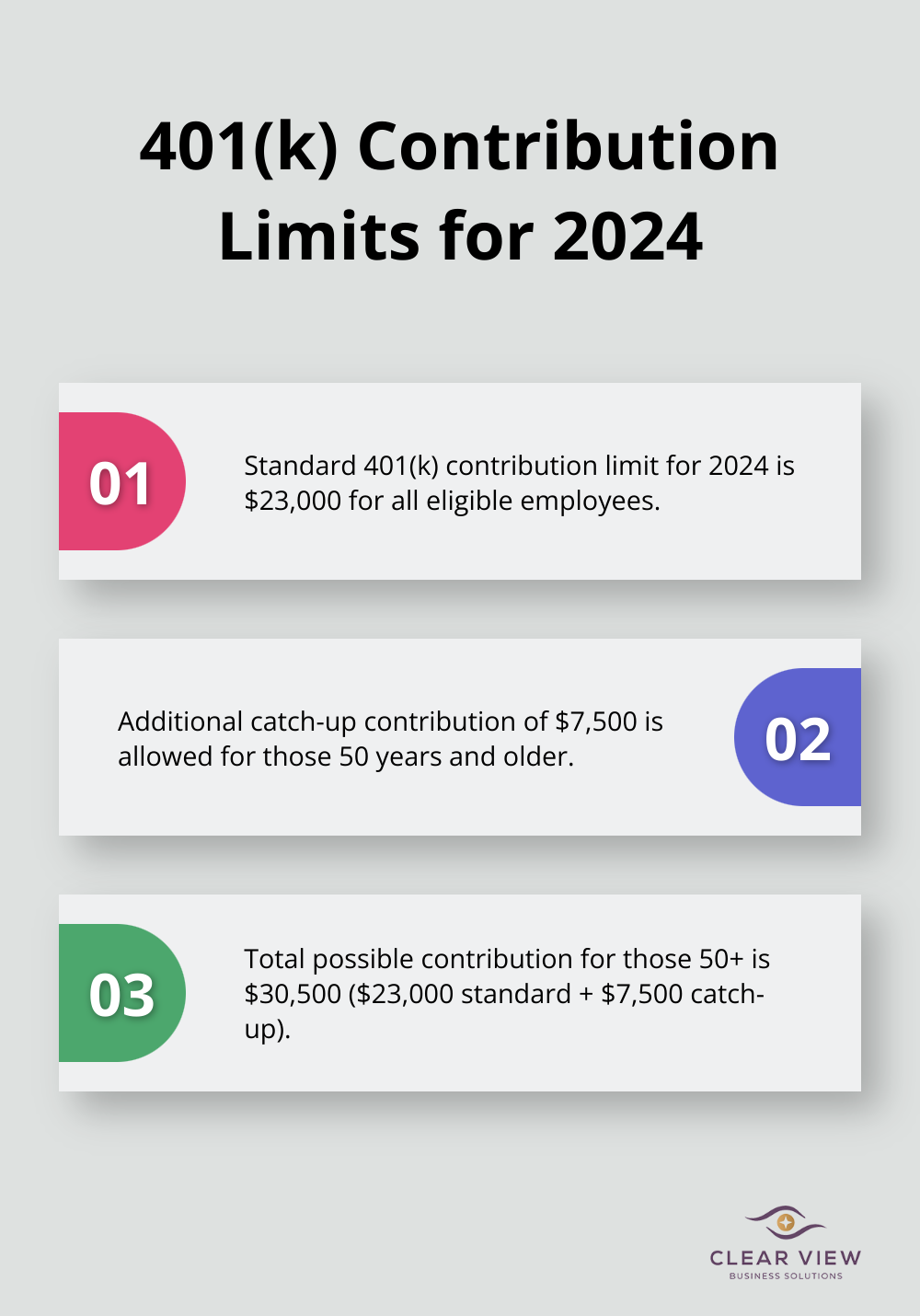

Retirement accounts offer excellent tax advantages. For 2024:

Traditional 401(k) and IRA contributions reduce your taxable income for the year, potentially lowering your tax bracket.

Invest with taxes in mind to significantly impact your after-tax returns. Some strategies include:

These strategies can potentially save thousands on your tax bill. However, tax laws are complex and ever-changing. Working with a professional tax advisor (like those at Clear View Business Solutions) is important to ensure you make the most of these opportunities while staying compliant with IRS regulations.

As we move forward, let’s explore how partnering with a tax professional can further enhance your tax optimization efforts.

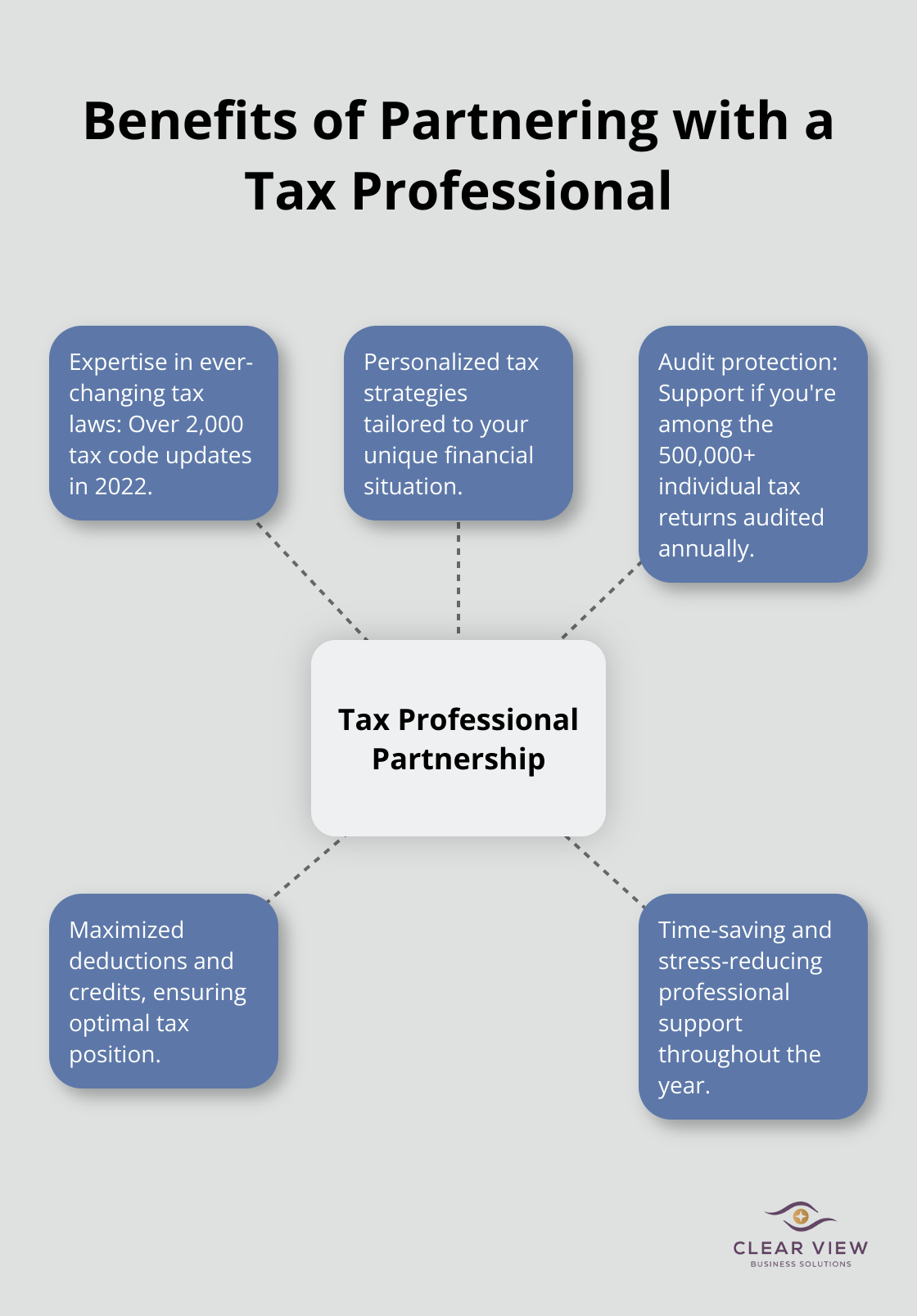

Tax laws change frequently. In 2022, the IRS made over 2,000 updates to the tax code. A tax professional stays current with these changes, ensuring you don’t miss out on new deductions or credits. The SECURE 2.0 Act brought substantial changes to retirement savings rules, affecting plans such as 401(k), 403(b), IRA, Roth accounts, and related tax breaks. A tax advisor can help you leverage these changes.

Every financial situation is unique. A tax professional analyzes your specific circumstances to develop tailored strategies. They might suggest an increase in your 401(k) contributions to reduce taxable income or recommend specific tax-efficient investments based on your risk tolerance and goals.

The IRS audited over 500,000 individual tax returns in 2022. If you face an audit, a tax professional can represent you before the IRS, handle correspondence, and negotiate on your behalf. This support can reduce stress and potentially minimize additional tax liabilities.

When you choose a tax advisor, consider their qualifications and experience. Look for credentials such as Certified Public Accountant (CPA) or Enrolled Agent (EA). These designations indicate a high level of expertise and adherence to ethical standards.

Ask potential advisors about their experience with situations similar to yours. If you own a small business, for example, you’ll want someone well-versed in business tax law. Don’t hesitate to ask about their fee structure and availability throughout the year.

To get the most out of your relationship with a tax professional, maintain open communication. Share significant life changes (such as marriage, home purchase, or job changes) promptly. These events can have substantial tax implications.

Keep detailed records of income, expenses, and potential deductions throughout the year. This organization helps your tax advisor work more efficiently and effectively on your behalf.

Effective income tax and tax planning strategies can significantly reduce your tax burden and contribute to long-term financial stability. These tools not only lead to immediate savings but also free up resources for other financial goals such as buying a home or building a robust retirement nest egg. Professional guidance becomes invaluable when navigating the complex world of taxes.

Clear View Business Solutions specializes in providing comprehensive financial advisory and tax services tailored to your unique situation. Our team of experts stays up-to-date with the latest tax laws and regulations, ensuring that you benefit from every available deduction and credit. We offer personalized tax planning strategies for both individuals and small businesses in Tucson, helping you optimize your tax position throughout the year.

Our friendly, personalized approach simplifies complex financial matters, empowering you to achieve your financial goals with confidence. Take control of your finances today and start reaping the benefits of strategic tax planning for years to come.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.