Most business owners and high earners leave thousands of dollars on the table each year by relying solely on basic tax preparation instead of strategic planning.

Advanced tax planning strategies can reduce your tax burden by 15-30% annually when implemented correctly. We at Clear View Business Solutions see clients save substantial amounts through proactive planning rather than reactive filing.

The key lies in understanding timing, entity structures, and year-round optimization techniques that go far beyond standard deductions.

Tax preparation records what already happened during the previous year, while tax planning actively shapes your financial decisions to minimize future tax liabilities. The IRS reports that taxpayers who engage in strategic planning typically save 20-25% more than those who only prepare returns reactively.

Tax preparation looks backward at fixed transactions, but tax planning looks forward to optimize upcoming financial moves. Most accountants charge $300-500 for basic preparation, yet advanced tax planning strategies can save high earners $15,000-50,000 annually through strategic timing and structure optimization.

High-income earners face marginal federal rates up to 37%, with California residents potentially paying over 50% combined rates. Smart timing means you accelerate deductions into high-income years and defer income when possible.

The 2024 contribution limits allow $23,000 in 401k deferrals ($30,500 if over 50), while HSAs provide triple tax advantages with $4,300 individual limits. Business owners can time equipment purchases through Section 179 deductions up to $1,220,000, or accelerate depreciation through bonus depreciation rules.

December bonuses can be deferred to January, while January expenses can be prepaid in December to shift tax years strategically.

Sole proprietors pay 15.3% self-employment tax on all profits, while S-corporation owners only pay this tax on reasonable salary portions. Converting from sole proprietorship to S-corp typically saves $3,000-8,000 annually once profits exceed $60,000.

C-corporations face double taxation but offer greater benefit flexibility and potential 21% corporate rates. LLCs provide flexibility with pass-through taxation while protecting personal assets.

The Section 199A qualified business income deduction allows up to 20% deduction for pass-through entities, but phases out at higher income levels and requires careful planning to maximize benefits. These structural decisions form the foundation for implementing specific tax reduction strategies throughout the year.

High earners should max out all available retirement accounts before they consider taxable investments. The 2024 limits allow $23,000 in 401k contributions plus $7,000 in IRAs, but many miss the backdoor Roth strategy that bypasses income restrictions. You convert traditional IRA funds to Roth accounts when you have lower-income years and lock in current tax rates while you create tax-free growth forever.

Mega backdoor Roth conversions through after-tax 401k contributions can add another $46,000 annually for those with compatible plans. HSAs provide triple tax benefits and you should max them at $4,300 for individuals. Cash balance plans allow business owners to contribute $200,000+ annually while they reduce current taxes dramatically.

Tax-loss harvesting offsets capital gains when you sell underperforming investments and saves up to $3,000 annually against ordinary income. Asset location places tax-inefficient investments in tax-deferred accounts while you keep tax-efficient holdings in taxable accounts. Municipal bonds generate tax-free interest for high earners in top brackets and often provide better after-tax returns than corporate bonds.

You must follow the wash sale rule (which prohibits repurchasing the same security within 30 days) to maintain your tax benefits. Smart investors rotate between similar but not identical funds to maintain market exposure while they capture losses.

Section 179 allows immediate deduction of equipment purchases up to $1,220,000, while bonus depreciation covers 100% of qualifying assets in the first year. Business meals remain 100% deductible through 2024, and home office deductions save $1,500+ annually when you have legitimate workspace usage. Vehicle expenses through actual cost or mileage methods can generate $6,000+ deductions for business owners who track properly.

You can accelerate depreciation on qualifying property and defer income through installment sales when appropriate. These tactical moves require careful documentation and professional guidance to implement the comprehensive timeline and best practices that maximize your tax savings year-round.

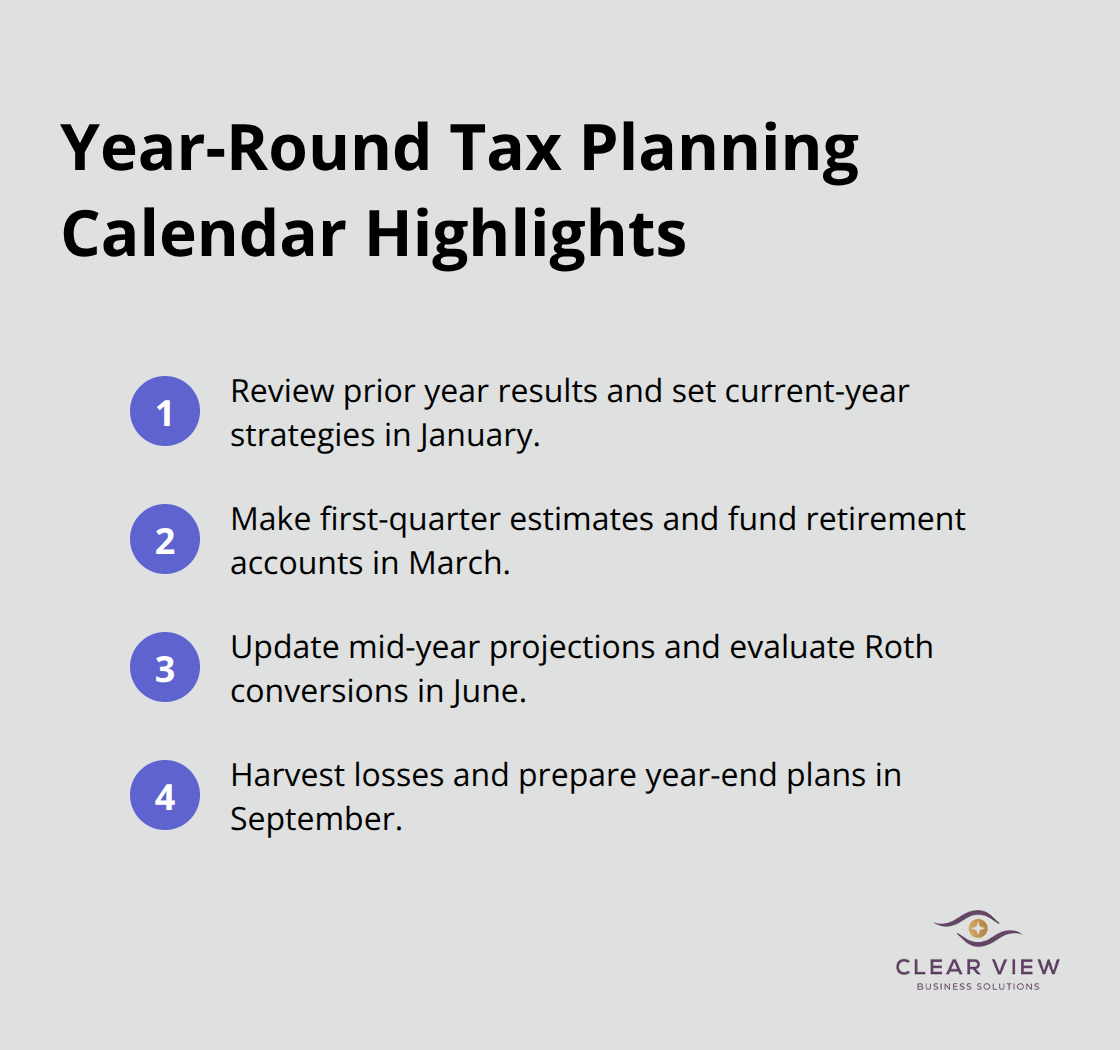

Effective tax planning operates on a structured timeline that begins January 1st and extends through December 31st, not just during tax season. Quarterly planning sessions provide significant tax savings compared to annual-only meetings.

January starts with prior year result reviews and current year strategy development. March focuses on first quarter estimated payments and retirement contributions. June brings mid-year income projections and Roth conversion opportunities, while September dedicates time to tax-loss harvesting and year-end planning preparation.

Generic tax preparers charge $300-500 for basic returns, but strategic tax advisors who provide year-round planning typically charge $2,000-5,000 annually while they save clients $15,000-50,000 in taxes. The key difference lies in proactive communication patterns.

Top advisors schedule quarterly check-ins, send monthly tax updates, and respond to major financial decisions within 48 hours. Look for advisors who ask about upcoming income changes, business purchases, and family situations rather than just collect documents.

CPAs with Personal Financial Specialist credentials understand both tax strategy and investment implications. Enrolled Agents specialize in IRS representation and complex tax situations (making them valuable for audit protection).

The IRS requires contemporaneous documentation for business expenses, which means you must record details when transactions occur, not months later during tax preparation. Digital receipt management through apps like Receipt Bank or Expensify saves 3-4 hours monthly compared to paper systems.

Mileage logs must include date, destination, business purpose, and odometer readings to withstand IRS scrutiny. Incomplete logs result in 100% deduction denial. Investment tracking requires purchase dates, costs, and reinvested dividends to calculate accurate capital gains.

Charitable contributions need receipts for amounts over $250 and appraisals for non-cash donations that exceed $5,000 (professional appraisals become mandatory at this threshold).

Advanced tax planning strategies deliver measurable results when you implement them systematically throughout the year. High earners who embrace proactive planning typically reduce their tax burden by 15-30% annually, which translates to $15,000-50,000 in savings compared to reactive tax preparation approaches. The combination of strategic timing, entity optimization, retirement account maximization, and proper documentation creates a comprehensive framework for long-term wealth preservation.

These strategies require consistent execution and professional oversight to maintain compliance while you maximize benefits. Qualified tax professionals become essential as your financial situation grows more complex. The investment in year-round advisory services pays for itself through strategic guidance and audit protection (especially during IRS examinations).

We at Clear View Business Solutions provide comprehensive tax planning services that integrate with your overall financial goals. Your next step involves scheduling a strategic planning session to evaluate your current tax position and identify immediate optimization opportunities. The sooner you begin to implement these advanced tax planning strategies, the greater your cumulative tax savings will become over time.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.