Tax planning for high net-worth individuals is a complex but essential process. At Clear View Business Solutions, we understand the unique challenges faced by wealthy clients in managing their tax obligations.

Effective strategies can significantly impact wealth preservation and growth, making it crucial for high net-worth individuals to stay informed and proactive. This guide will explore key tax planning approaches and the importance of professional guidance in navigating the intricate tax landscape.

High net-worth individuals (HNWIs) are persons who maintain liquid assets at or above a certain threshold. This group faces unique financial challenges, particularly in the realm of taxation.

HNWIs often manage diverse income sources and complex investment portfolios, which create intricate tax situations. A HNWI might receive income from business ventures, real estate investments, and stock dividends (each with its own tax implications). This complexity necessitates strategic tax planning for wealth preservation.

Well-executed tax strategies can significantly reduce a HNWI’s tax burden. Proper planning doesn’t just save money-it frees up capital for further investments, philanthropy, or legacy planning.

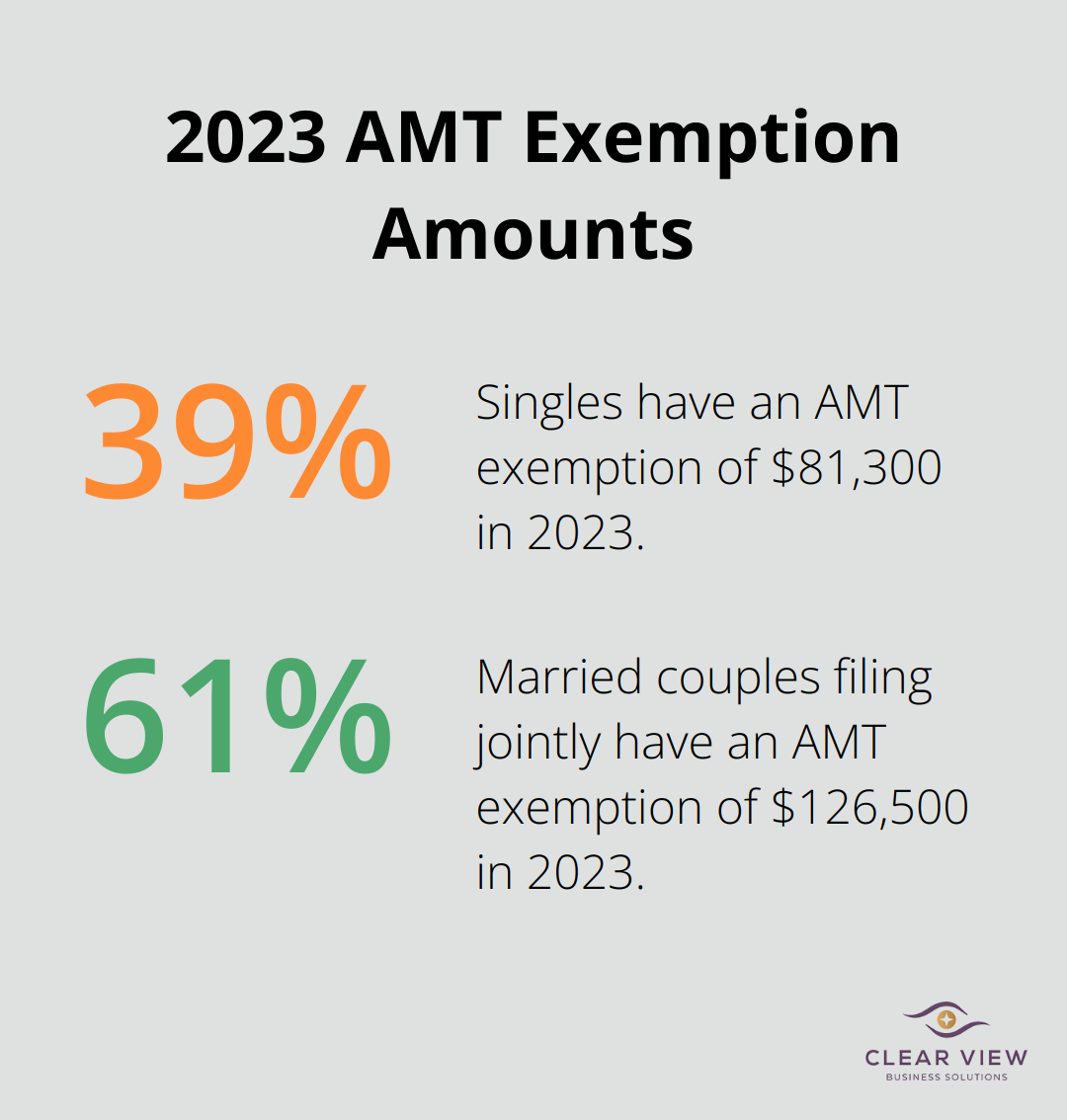

The AMT ensures high-income individuals pay a minimum amount of tax, regardless of deductions. In 2023, the AMT exemption amount stands at $81,300 for singles and $126,500 for married couples filing jointly (according to IRS data).

This 3.8% tax applies to certain investment income for individuals with modified adjusted gross income over $200,000 ($250,000 for married couples filing jointly). The NIIT can significantly influence investment strategies.

While the federal estate tax exemption is high ($12.92 million for individuals in 2023), many HNWIs must plan carefully to minimize estate taxes, especially in states with lower exemptions.

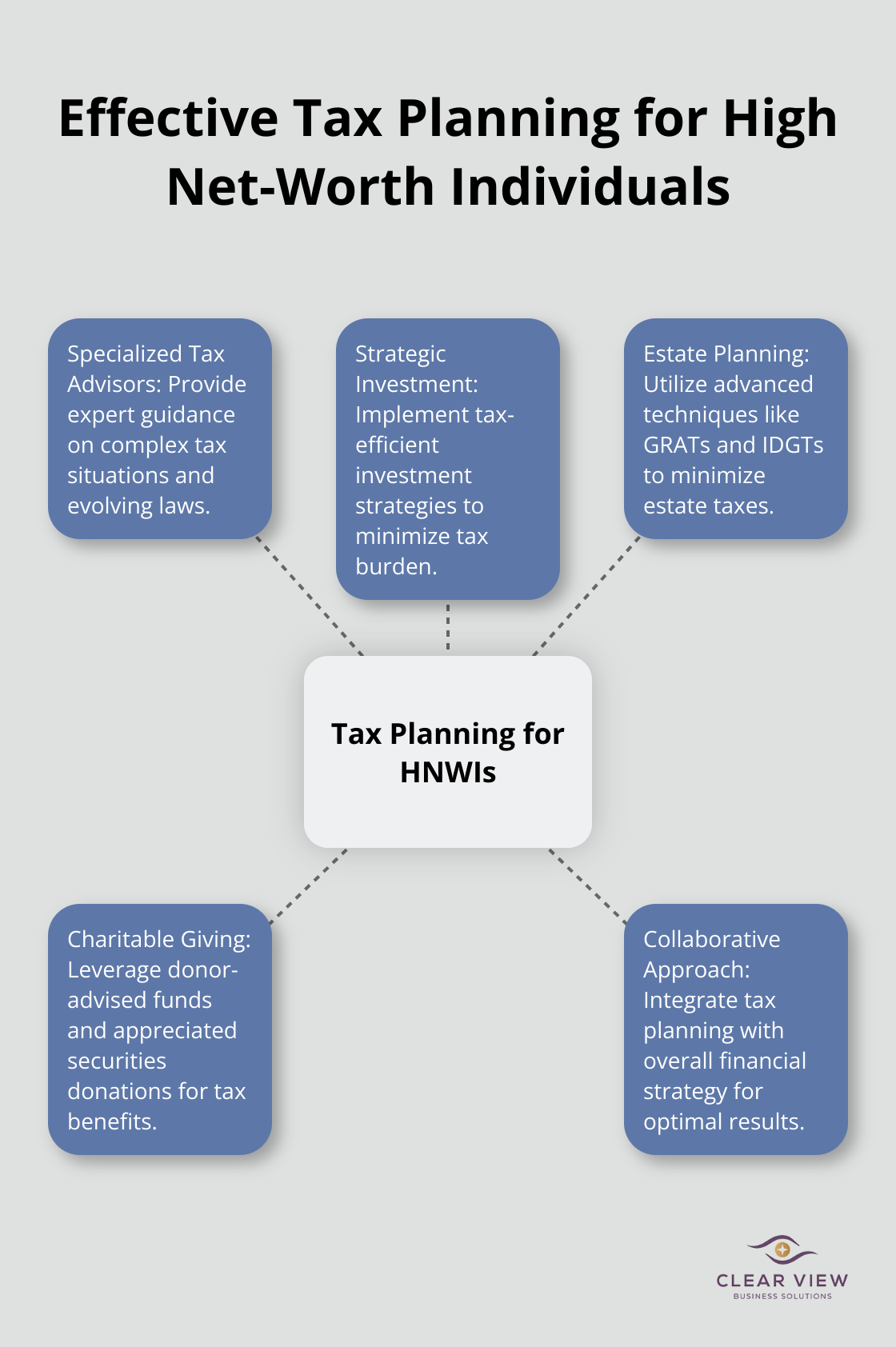

The complexities of HNWI tax planning underscore the importance of professional guidance. Tax professionals use sophisticated software to model different scenarios, helping clients make informed decisions about their wealth. They also stay current with the latest tax laws to provide tailored strategies.

As we move forward, we’ll explore specific tax planning in wealth management strategies that can help HNWIs navigate these challenges and optimize their financial positions.

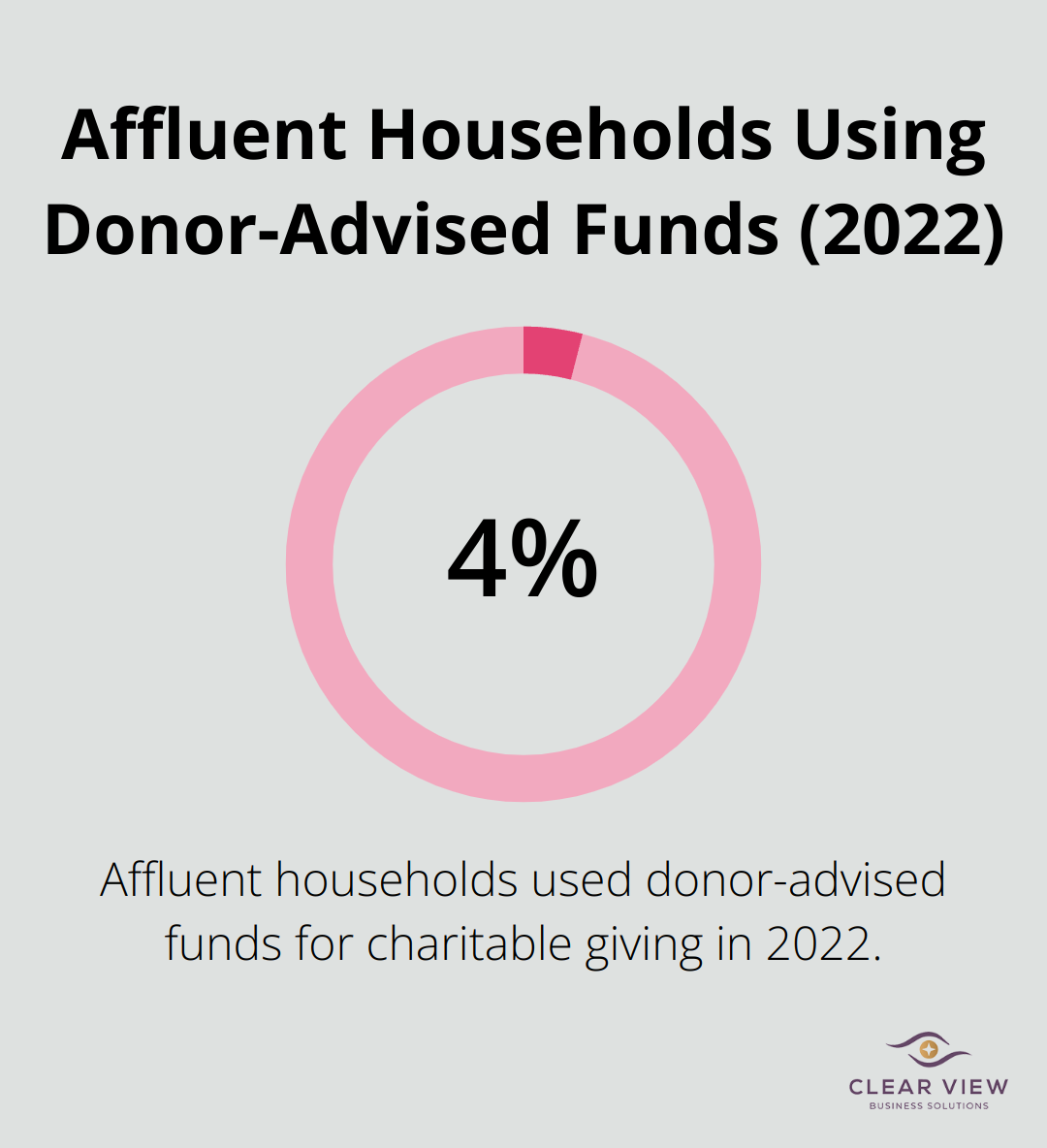

High net-worth individuals can use charitable giving to optimize their tax positions. Donor-advised funds (DAFs) allow for large, tax-deductible donations in high-income years while distributing funds to charities over time. In 2022, 4.9% of affluent households used a donor-advised fund to facilitate their giving, with tax considerations and ease of use being among the top reasons for doing so.

Donating appreciated securities directly to charities offers another effective strategy. This approach helps donors avoid capital gains taxes on appreciation while claiming a deduction for the full market value of the securities. The resulting tax savings can reduce your tax bill by thousands of dollars.

Tax-efficient investing plays a vital role for high net-worth individuals. Municipal bonds offer tax-free interest at the federal level (and often at the state level for in-state residents). While yields might be lower than taxable bonds, the tax-equivalent yield can be significantly higher for those in high tax brackets.

Asset location represents another key strategy. Placing tax-inefficient investments like REITs or high-yield bonds in tax-advantaged accounts (such as IRAs or 401(k)s) can minimize the tax drag on your portfolio.

Estate planning forms a critical component of tax strategy for high net-worth individuals. Grantor retained annuity trusts (GRATs) allow the transfer of appreciation on assets to beneficiaries with minimal gift tax consequences. With a GRAT, the grantor gives up control of the assets for the term of the trust while receiving a regular annuity payment, and the appreciation on the trust assets can be transferred to beneficiaries with minimal gift tax impact.

Intentionally defective grantor trusts (IDGTs) provide another powerful tool. This type of trust allows the grantor to pay income taxes on trust assets, effectively making additional tax-free gifts to beneficiaries. For large estates, the tax savings can potentially reduce estate taxes by millions.

The effectiveness of these strategies depends on individual financial situations. High net-worth individuals should work with experienced professionals who understand the nuances of tax law and can apply these strategies appropriately. Tax laws change frequently, and staying current with these changes can make a significant difference in the overall tax burden.

The next chapter will explore the importance of professional guidance in implementing these strategies and navigating the complex tax planning process for high net-worth individuals.

Professional tax guidance can significantly impact high net-worth individuals’ financial outcomes. The tax landscape for HNWIs presents intricate challenges with high stakes. Specialized tax advisors offer knowledge that extends beyond general tax preparation. They maintain current understanding of evolving tax laws and identify opportunities that may elude the untrained eye. Recent data suggests that non-credentialed preparers often target lower-income taxpayers and produce individual income tax returns that may not meet the same standards as those prepared by credentialed professionals.

These professionals provide strategic advice on complex issues such as international tax planning, estate tax minimization, and business succession planning. They also help navigate the intricacies of alternative minimum tax (AMT) and net investment income tax (NIIT), which often affect high net-worth individuals disproportionately.

Credentials matter when choosing a tax professional. High net-worth individuals should look for certified public accountants (CPAs), enrolled agents (EAs), or tax attorneys who specialize in high net-worth tax planning. These professionals undergo rigorous training and adhere to strict ethical standards.

Experience in specific financial situations proves crucial. Entrepreneurs should seek professionals with strong backgrounds in business taxation. Those with international investments need advisors well-versed in global tax treaties and foreign income reporting requirements.

Potential clients should ask advisors about their experience with similar financial situations. They should inquire about the advisor’s approach to tax planning and methods for staying updated on tax law changes. A competent tax professional explains complex concepts in understandable terms and provides proactive strategies to minimize tax burdens.

Tax planning works most effectively when integrated with overall financial strategy. Collaboration between tax professionals and other financial advisors becomes essential (e.g., investment managers, estate planners).

A coordinated approach ensures that investment decisions, charitable giving, and estate planning work in harmony to optimize tax positions. For example, a financial advisor might recommend selling certain investments to rebalance a portfolio. The tax professional can then advise on the optimal timing of these sales to minimize capital gains tax.

This collaborative approach emphasizes comprehensive financial strategy that addresses all aspects of wealth management, including tax optimization. The goal extends beyond minimizing the current year’s tax bill; it creates a long-term strategy that aligns with overall financial objectives.

Modern tax professionals utilize advanced software tools to model different scenarios and analyze complex tax situations. These tools allow for more accurate projections and help identify potential tax-saving opportunities.

High net-worth individuals benefit from advisors who embrace these technological advancements. The combination of human expertise and cutting-edge software results in more precise and effective tax planning strategies.

Tax planning for high net-worth individuals requires expert guidance and continuous management. Professional advisors possess the knowledge to navigate complex tax situations and identify opportunities for substantial savings. These specialists use advanced tools to model scenarios and provide tailored solutions that align with overall financial objectives.

Clear View Business Solutions offers comprehensive financial advisory and tax services for individuals and small businesses in Tucson. We specialize in tax planning for high net-worth clients, providing personalized strategies to maximize benefits while ensuring compliance. Our team works to simplify complex financial situations, enabling clients to make informed decisions about their wealth.

Effective tax planning for high net-worth individuals protects wealth, minimizes liabilities, and achieves long-term financial goals. It demands expertise, diligence, and a forward-thinking approach (not a one-time event). Professional guidance proves essential in navigating the intricate tax landscape and optimizing financial positions for wealthy clients.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.