Corporate tax planning is a critical aspect of financial management for businesses of all sizes. At Clear View Business Solutions, we’ve seen how effective tax strategies can significantly impact a company’s bottom line.

In this post, we’ll explore key strategies to optimize your corporate tax planning, from maximizing deductions to leveraging cutting-edge technologies.

Corporate tax planning is a strategic approach to manage a company’s financial obligations. It aims to minimize tax liabilities while maintaining compliance with tax laws. Effective tax planning can significantly boost a company’s financial health and support long-term growth.

Timing involves the strategic recognition of income and expenses to optimize tax outcomes. Companies can lower their immediate tax burden by deferring income to a future tax year or accelerating deductions into the current year.

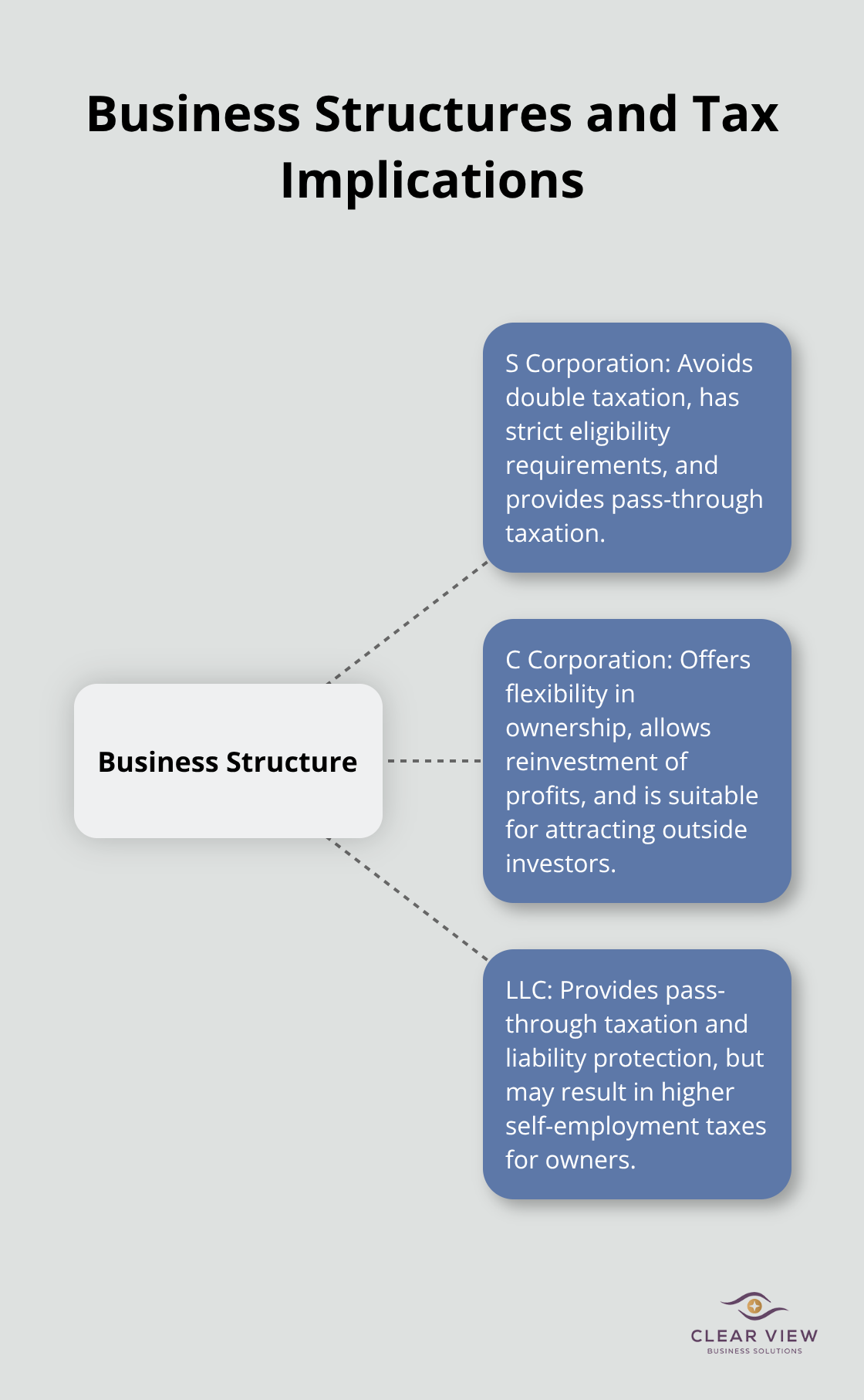

The choice of entity structure (C corporation, S corporation, or LLC) has profound tax implications. Each structure offers different tax treatments, and selecting the right one can lead to substantial savings.

Where a business establishes itself can affect its tax obligations due to varying state and local tax rates. Some areas offer tax incentives for certain industries, which companies can leverage for significant savings.

The tax landscape evolves constantly, and staying informed is essential for effective planning. The Tax Cuts and Jobs Act (TCJA) of 2017 brought sweeping changes to corporate taxation:

International tax planning has become more complex due to global initiatives aimed at preventing tax base erosion and profit shifting. The OECD’s Base Erosion and Profit Shifting (BEPS) project refers to tax planning strategies used by multinational enterprises that exploit gaps and mismatches in tax rules to avoid paying tax.

As we move forward, it’s clear that corporate tax planning requires a comprehensive approach. The next section will explore effective strategies to optimize your tax position and maximize financial benefits.

Companies can reduce their tax burden significantly by utilizing available tax credits and deductions. The Research Credit offers substantial savings for businesses that invest in innovation. The IRS provides updated interim guidance on claims for refund that include a claim for credit for increasing research activities.

Small businesses can benefit from the Section 179 deduction, which allows for immediate expensing of qualifying equipment purchases. This deduction can dramatically reduce taxable income in the year of purchase.

The selection of a business structure profoundly impacts tax obligations. S corporations help owners avoid double taxation on corporate income but come with strict eligibility requirements. C corporations offer more flexibility in ownership and can advantage businesses planning to reinvest profits or attract outside investors. LLCs provide pass-through taxation and liability protection but may result in higher self-employment taxes for owners.

Aligning your business structure with long-term goals and financial situation is essential. Professional advice can help navigate these choices to find the optimal structure for specific needs.

International tax planning becomes critical for businesses operating across borders. The OECD’s Base Erosion and Profit Shifting (BEPS) project has transformed how multinational companies approach tax planning.

Transfer pricing (the pricing of goods and services between related entities) remains a key focus area. To mitigate risks and optimize tax positions, companies should implement robust documentation processes and consider advance pricing agreements with tax authorities. These strategies provide certainty and help avoid costly disputes.

Strategic timing of income recognition and expense incurrence can potentially lower overall tax burden. Cash-basis taxpayers can defer income to the following tax year by delaying billings or accelerate expenses by prepaying certain costs to reduce the current year’s tax liability. However, these strategies must balance with cash flow needs and overall financial goals.

Accrual-basis taxpayers face different considerations. They might focus on the economic performance rule, which determines when an expense can be deducted. Understanding these nuances leads to significant tax savings over time.

As we move forward, it’s important to consider how technology and tools can enhance these tax planning strategies. The next section will explore cutting-edge solutions that streamline tax planning processes and improve accuracy.

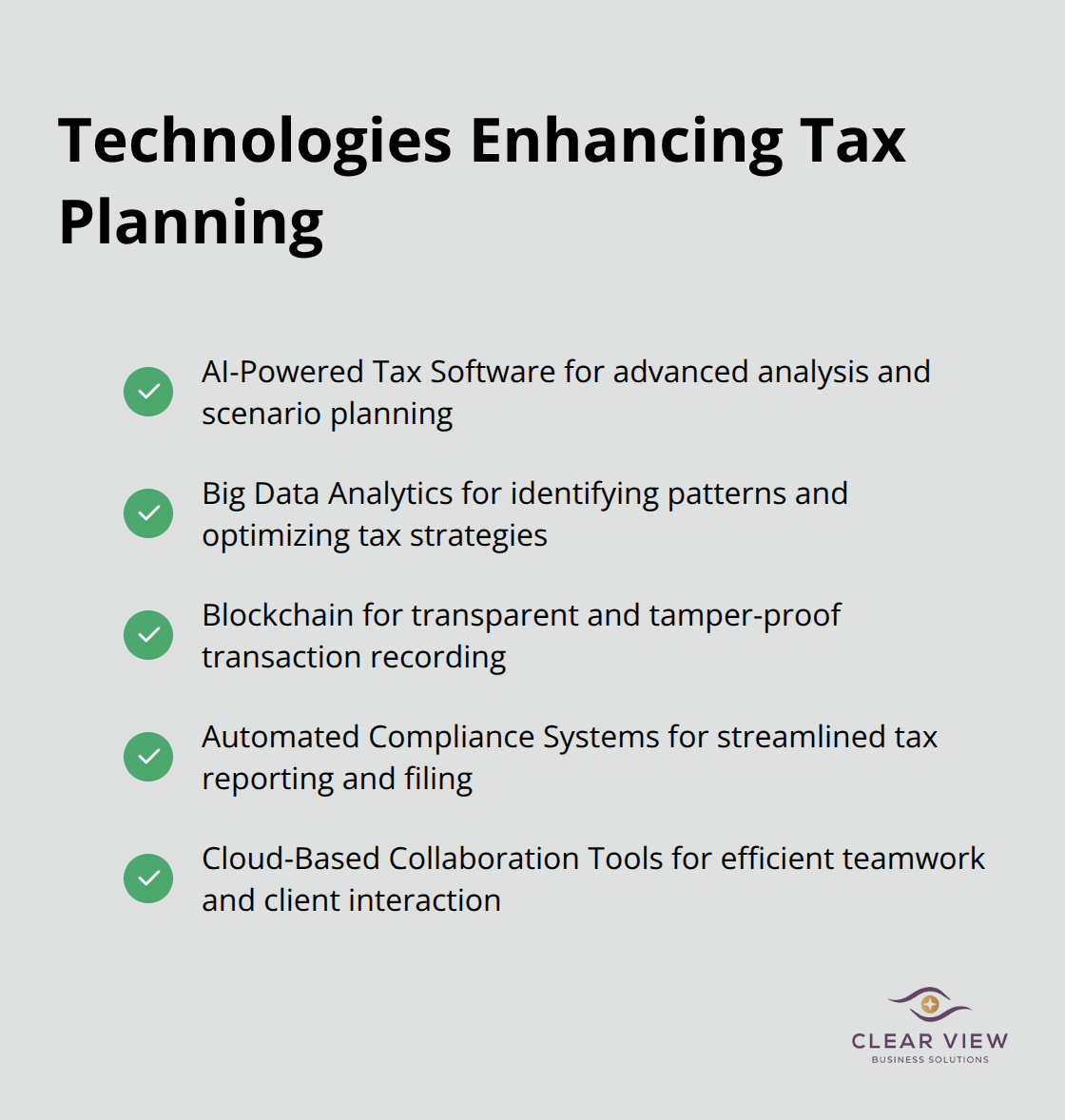

Technology transforms corporate tax strategies in today’s digital landscape. We’ll explore innovative tools that revolutionize tax planning processes.

AI is being applied in tax and accounting, providing real-world examples, practical applications, and critical insights. Advanced systems analyze vast financial data quickly, identifying potential deductions and credits human accountants might miss.

AI-driven software excels at scenario planning. It models different tax outcomes based on various business decisions rapidly, allowing companies to make more informed choices. This predictive capability proves particularly valuable when considering major transactions or structural changes.

Big data analytics serves as another powerful tool for tax planners. Companies uncover patterns and insights that lead to more effective tax strategies by analyzing large datasets. Data analytics helps identify the most tax-efficient locations for business expansion or pinpoints areas where a company might overpay taxes.

The Internal Revenue Service (IRS) also leverages big data analytics to improve tax compliance. The remainder of the conference included sessions on innovations in the use of tax data, tax avoidance, tax audits, and reducing the filing. This fact underscores the importance of using similar technologies defensively to ensure compliance and avoid costly audits.

Blockchain technology stands poised to revolutionize tax reporting and compliance. Its immutable ledger system provides a transparent and tamper-proof record of transactions, which can streamline audits and reduce disputes with tax authorities.

Some countries already explore blockchain for tax purposes. China tests blockchain-based invoicing systems to combat tax fraud. While widespread adoption remains in the future, forward-thinking companies explore how blockchain can enhance their tax planning and reporting processes.

Automated compliance systems streamline the tax planning process. These tools monitor changes in tax laws and regulations across multiple jurisdictions, ensuring companies stay compliant. They can automatically update tax calculations and filings, reducing the risk of errors and penalties.

For multinational corporations, automated compliance systems prove especially valuable. They help navigate the complex web of international tax laws and reporting requirements (such as country-by-country reporting under BEPS).

Cloud-based accounting software enhances tax planning efficiency. These platforms allow tax professionals to work together seamlessly, regardless of their physical location. They provide real-time access to tax data and documents, facilitating faster decision-making and more agile tax strategies.

Clear View Business Solutions (and other forward-thinking firms) use these tools to provide better service to clients. They enable more frequent and meaningful interactions between tax advisors and clients, leading to more effective tax planning outcomes.

Corporate tax planning requires strategic approaches and continuous adaptation. Companies must maximize deductions, choose optimal entity structures, and leverage international opportunities to reduce tax burdens while maintaining compliance. Technology plays a pivotal role in modern tax planning, with AI, big data analytics, and automated systems revolutionizing how businesses approach tax strategies.

Professional expertise remains essential in navigating complex tax scenarios. Clear View Business Solutions offers comprehensive financial advisory and tax services to help individuals and small businesses in Tucson optimize their tax positions. We provide tailored strategies to ensure compliance and support long-term financial success.

Corporate tax planning is an ongoing process that demands attention and strategic thinking. It combines sound strategies, technological tools, and professional guidance to create a competitive advantage. Effective tax planning supports long-term growth and financial stability for businesses of all sizes.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.