Small businesses lose an average of $50,000 annually due to poor financial record keeping, according to recent industry data. Professional bookkeeping services can prevent these costly mistakes while freeing up valuable time for business growth.

We at Clear View Business Solutions understand that managing finances shouldn’t consume your entire day. This guide covers everything you need to know about selecting the right bookkeeping partner for your business.

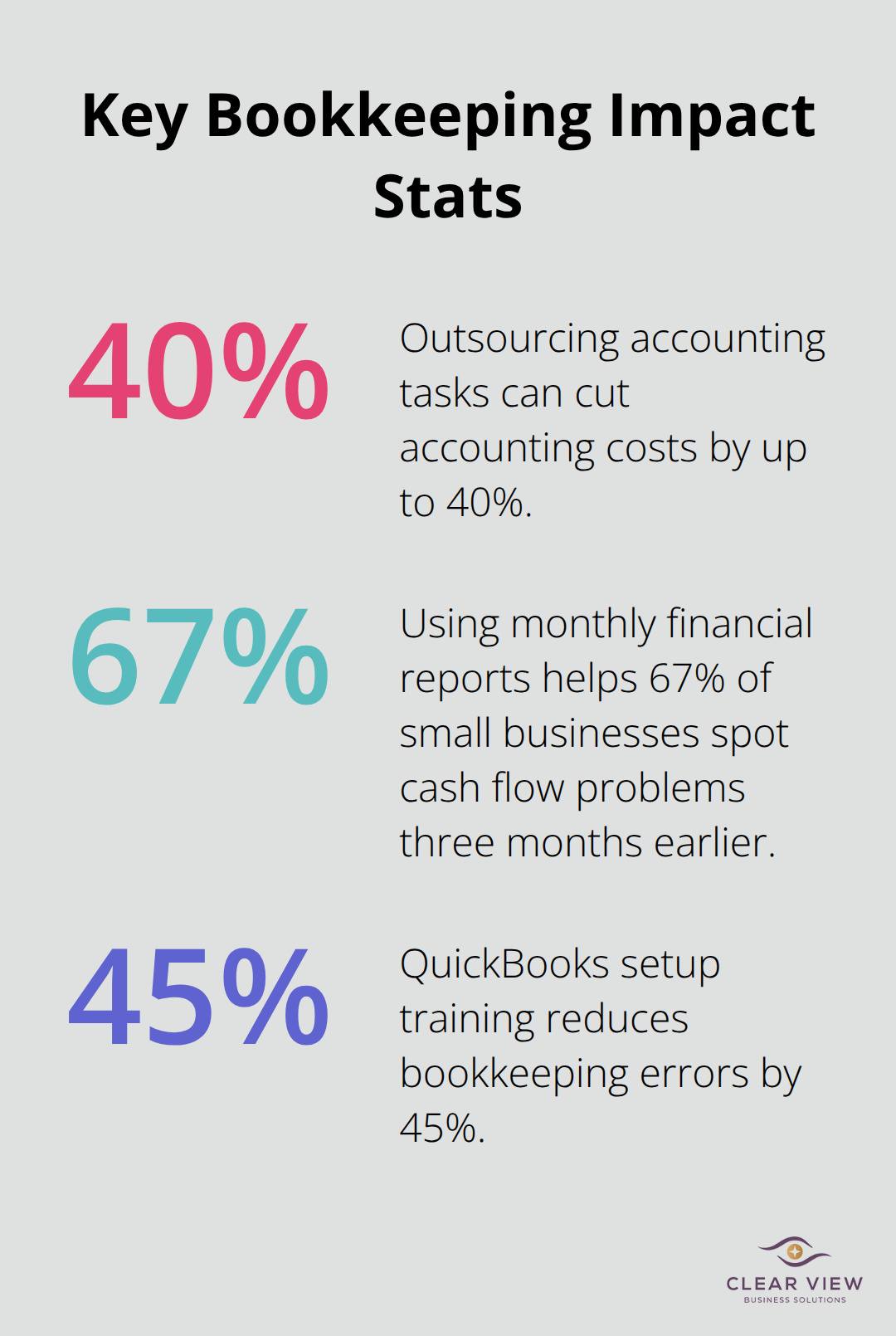

Bookkeeping services handle the systematic recording and organization of your business financial transactions. These professionals track every dollar that flows in and out of your business, categorize expenses, reconcile bank statements, and maintain accurate ledgers. Outsourcing accounting tasks to virtual bookkeepers can save businesses up to 40% on accounting costs compared to in-house teams.

Professional bookkeepers record transactions, process invoices, and organize receipts with precision that manual methods cannot match. They create standardized charts of accounts that categorize every expense and revenue stream in your business. These experts reconcile bank statements monthly, identify discrepancies, and correct errors before they compound into larger problems. Modern bookkeeping professionals use cloud-based software that syncs with your financial accounts and provides real-time visibility into your cash flow.

Daily transaction processing prevents the financial backlogs that affect 73% of small businesses (according to QuickBooks research). Professional bookkeepers import bank transactions automatically, flag duplicates, and categorize expenses according to tax codes. They maintain detailed records of accounts payable and receivable, track inventory costs, and monitor cash flow patterns. This systematic approach creates audit trails that satisfy regulatory requirements and support business decision-making with accurate bookkeeping.

Small businesses face multiple tax obligations throughout the year, with payments due on the 15th day of the 4th, 6th, and 9th months of your tax year and on the 15th day of the 1st month after your tax year ends. Professional bookkeepers maintain documentation that satisfies IRS requirements and track deductible expenses throughout the tax year. The IRS reports that businesses with organized records face 40% fewer audits and penalties. These services handle sales tax calculations, payroll tax deposits, and 1099 contractor reporting that business owners often miss until deadlines approach.

Professional bookkeeping creates the foundation for strategic financial planning, but the specific services available vary significantly between providers and business needs.

Most small businesses need more than basic transaction recording to stay financially healthy. Full-service bookkeeping packages typically include daily transaction processing, monthly bank reconciliations, accounts payable and receivable management, and comprehensive financial statement preparation. Professional bookkeeping services help businesses maintain accurate financial records and focus on their core operations. These comprehensive packages generate profit and loss statements, balance sheets, and cash flow reports that reveal your business performance patterns monthly rather than wait for year-end summaries.

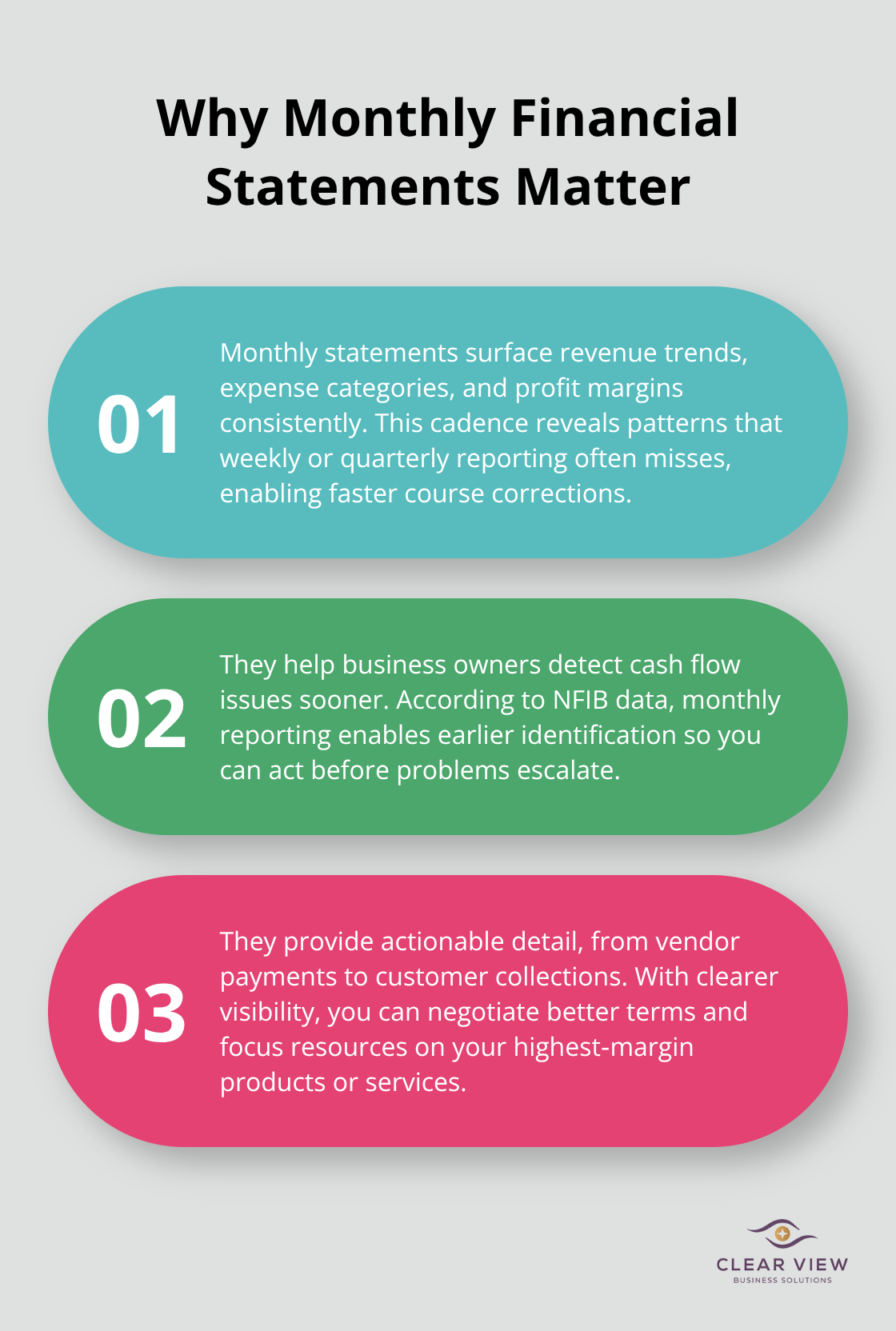

Professional monthly financial statements show revenue trends, expense categories, and profit margins that weekly or quarterly reports often miss. The National Federation of Independent Business found that 67% of small businesses that use monthly financial reports identify cash flow problems three months earlier than businesses that rely on quarterly statements. Monthly packages include detailed expense categorization, vendor payment tracking, and customer payment analysis that helps you negotiate better terms with suppliers and customers. These reports highlight which products or services generate the highest margins and which expenses drain your profitability most severely.

Payroll processing mistakes cost small businesses an average of $845 per error, which makes professional payroll services financially worthwhile for businesses with even two employees. Professional payroll services handle federal and state tax withholdings, quarterly tax deposits, unemployment insurance calculations, and worker compensation reports automatically. They process direct deposits, generate pay stubs, and maintain employee tax records that satisfy Department of Labor requirements during audits. Year-end services include W-2 preparation, 1099 contractor reports, and state unemployment tax filings that business owners frequently handle incorrectly.

QuickBooks setup training reduces bookkeeping errors by 45% when business owners learn proper chart of accounts setup and transaction categorization methods. Professional implementation includes customized chart of accounts creation, bank account integration, and automated rule setup that categorizes recurring transactions correctly. Training covers invoice creation, expense tracking, and report generation that transforms raw financial data into actionable business intelligence. Most implementation services include three months of follow-up support to address questions and refine processes as your business transactions increase in volume and complexity.

The right bookkeeping service provider makes all the difference in how effectively these services support your business growth and financial accuracy.

Small business owners waste significant time annually when they vet inappropriate bookkeeping providers, according to the Small Business Administration. The right provider should demonstrate measurable success with businesses your size, integrate seamlessly with your existing systems, and offer transparent pricing that scales with your growth. Start with providers who specialize in your industry sector – restaurant bookkeepers understand food cost calculations differently than retail specialists who track inventory turnover rates.

Demand specific client references from businesses with similar revenue levels and transaction volumes to yours. A bookkeeper who handles million-dollar manufacturing companies may struggle with the daily cash flow management that retail shops require. Ask potential providers about their average client retention rate – quality bookkeepers maintain 75-85% client retention annually, while mediocre services lose clients frequently. Request examples of monthly reports they generate and verify these reports include cash flow projections, expense trend analysis, and profit margin breakdowns by product line. The National Association of Certified Public Bookkeepers reports that specialized industry experience reduces financial errors by 60% compared to generalist providers.

Your bookkeeper must work with your existing business software rather than force expensive system changes. QuickBooks Online connects with over 750 business applications, while Xero integrates with 1,000+ tools (including payment processors, inventory systems, and customer relationship management platforms). Test their cloud-based access capabilities – you should view updated financial reports within 24 hours of any transaction. Avoid providers who use desktop-only software or manual data entry processes that delay report generation by weeks.

Modern bookkeeping services sync bank transactions automatically and flag unusual spending patterns immediately rather than wait for monthly reconciliation periods.

Monthly retainer pricing works best for most small businesses because it creates predictable expenses and unlimited consultation access. Hourly billing often results in rushed conversations and delayed responses when you need financial guidance urgently. The average monthly cost ranges from $300 for basic transaction recording to $800 for comprehensive financial management (including payroll processing). Reject providers who charge setup fees above $200 or require annual contracts – quality bookkeepers earn retention through performance rather than contractual obligations.

Professional bookkeeping services transform small business operations and eliminate the $50,000 average annual losses from poor financial record maintenance. These services provide real-time financial visibility, reduce tax preparation stress, and free up 5-10 hours monthly that business owners can redirect toward revenue activities. The 40% reduction in costs and 45% decrease in financial errors make professional bookkeeping a smart investment rather than an expense.

Accurate financial records support strategic decisions and attract lenders who prefer businesses with organized documentation. Monthly financial statements reveal profit trends three months earlier than quarterly reports (which provides competitive advantages in cash flow management and expense optimization). Professional payroll processing prevents the $845 average cost per payroll error while maintaining compliance with federal and state regulations.

Start your search with providers who demonstrate proven small business experience in your industry sector. Verify their technology integrations work with your existing systems and request client references with similar transaction volumes. We at Clear View Business Solutions offer comprehensive bookkeeping services that include QuickBooks training, tax planning, and personalized support to help small businesses maximize growth opportunities.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.