Tax planning is a powerful tool for managing your finances and reducing your tax burden. At Clear View Business Solutions, we’ve seen firsthand how effective strategies can lead to significant savings for our clients.

Our comprehensive guide, including a downloadable tax planning strategies PDF, will help you navigate the complex world of tax optimization. We’ll explore essential techniques that can benefit individuals, families, and business owners alike.

Tax planning is a strategic approach to manage finances with the goal of minimizing tax liability. This process involves the analysis of your financial situation to minimize tax liability within the bounds of the law. It’s not about evading taxes, which is illegal, but rather about making smart financial decisions that take advantage of available tax benefits.

It’s essential to distinguish between tax planning and tax evasion. Tax planning uses legal methods to reduce tax liability, such as claiming legitimate deductions or timing income recognition. Tax evasion, on the other hand, involves illegal practices like underreporting income or inflating deductions. The IRS reported that the gross tax gap, which represents the amount of true tax liability that is not paid voluntarily and timely, is a significant issue.

Effective tax planning can yield substantial benefits. For small business owners, it can mean the difference between profit and loss. A survey by the National Small Business Association found that 67% of small businesses spend over $1,000 annually on tax preparation. With proper planning, this cost can often decrease, and tax savings can redirect towards business growth or personal financial goals.

For individuals, tax planning can lead to increased retirement savings, more money for education expenses, or simply a lower tax bill. The IRS reports that the average tax refund in 2024 was $3,167. While a refund might seem like a windfall, it actually represents an interest-free loan to the government. Proper tax planning can help you keep more of your money throughout the year.

At Clear View Business Solutions, we work with our clients to develop comprehensive tax strategies that align with their financial goals. Whether you’re a small business owner who wants to maximize deductions or an individual who tries to optimize your retirement contributions, we can help you navigate the complex tax landscape and make informed decisions that benefit your bottom line.

As we move forward, let’s explore some essential tax planning strategies that can help you take control of your financial future and minimize your tax burden.

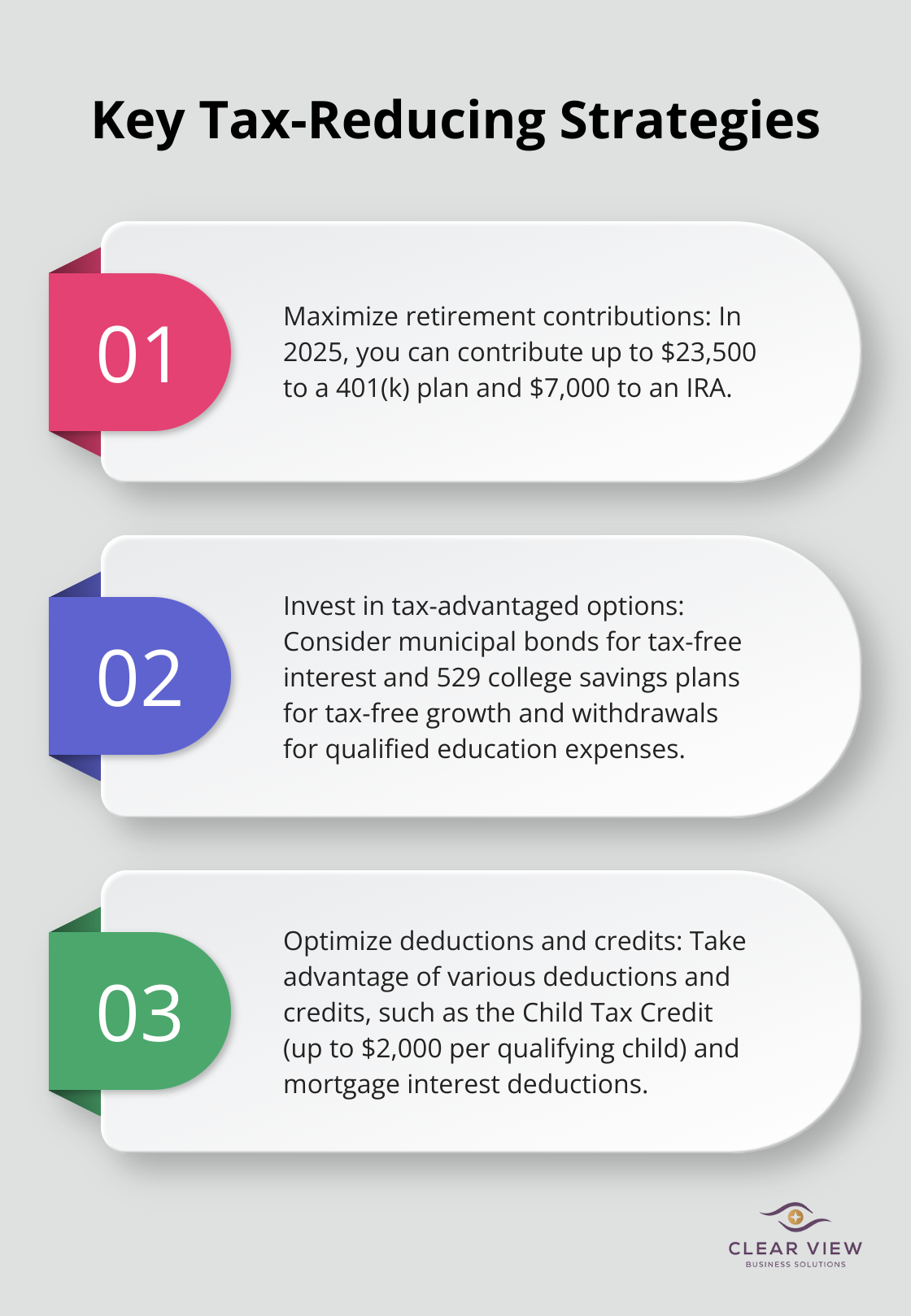

One of the most effective ways to reduce your taxable income is to maximize contributions to retirement accounts. In 2025, you can contribute up to $23,500 to a 401(k) plan. For IRAs, the limit remains $7,000. These contributions not only secure your future but also lower your current tax bill.

Consider investing in municipal bonds, which offer tax-free interest at the federal level (and often at the state level for residents). Additionally, 529 college savings plans provide tax-free growth and withdrawals for qualified education expenses. For those in higher tax brackets, investments in qualified opportunity zones can defer and potentially reduce capital gains taxes.

The IRS offers numerous deductions and credits that can significantly reduce your tax liability. For instance, the Child Tax Credit can provide up to $2,000 per qualifying child. Homeowners can deduct mortgage interest on loans up to $750,000. If you’re self-employed, track all business expenses meticulously – even small deductions add up. Don’t overlook often-missed deductions like student loan interest or charitable contributions.

Timing plays a key role in tax planning. If you expect a lower income year, consider converting traditional IRA funds to a Roth IRA, paying taxes on the conversion at a lower rate. For business owners, accelerate expenses into the current year or delay income until the next to manage tax liability. However, always ensure these decisions align with your overall financial strategy.

Tax laws change frequently, and your financial situation evolves over time. A professional tax advisor can help you identify opportunities that many overlook. They don’t just prepare your taxes; they work year-round to ensure you make the most of every tax-saving opportunity available to you.

As we move forward, let’s explore how to tailor these strategies to your specific financial situation, whether you’re an individual, a family, or a small business owner.

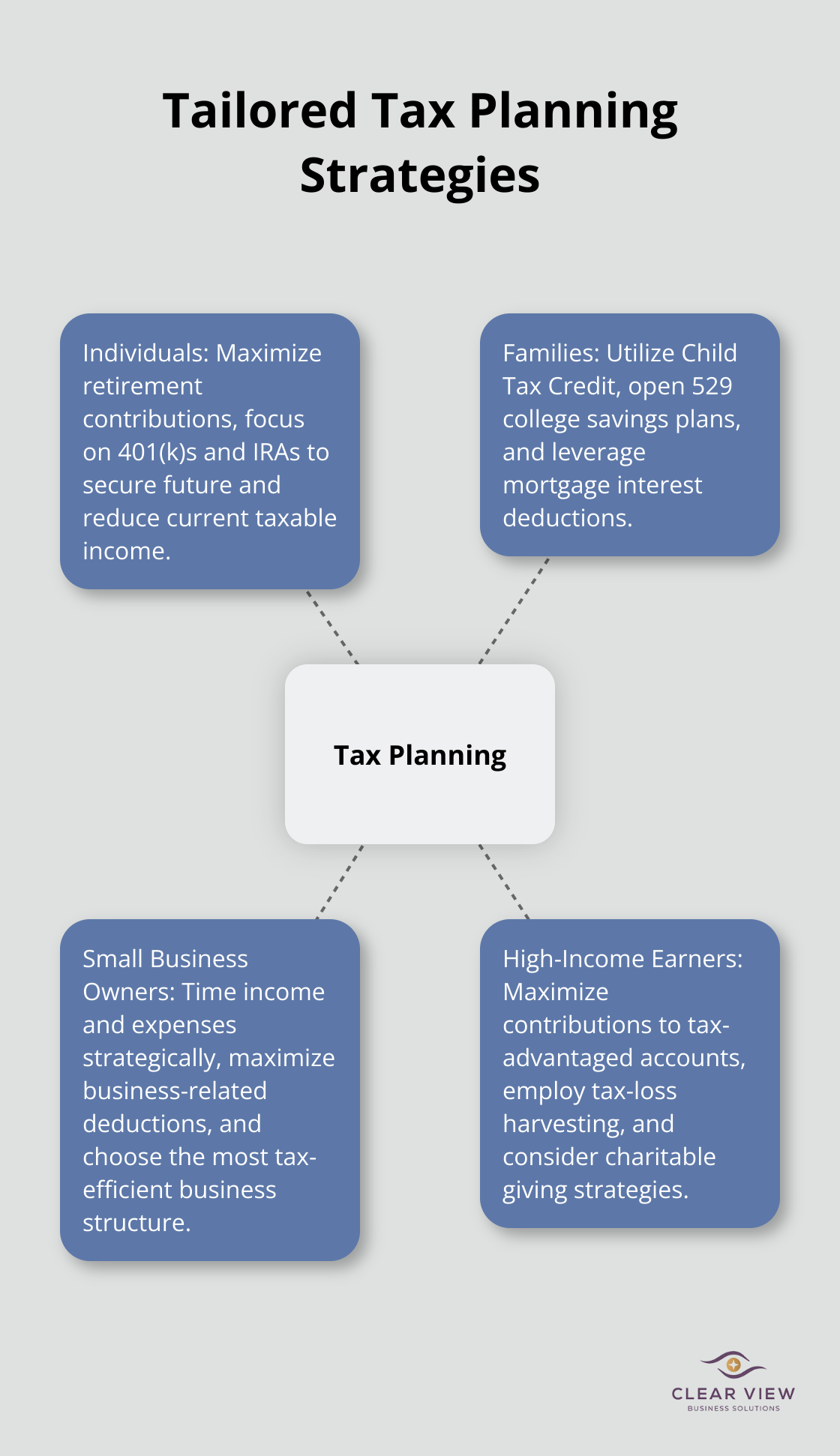

Tax planning requires a personalized approach. Each client’s financial situation demands unique strategies, whether you’re a single professional, a growing family, or a small business owner.

For individuals and families, tax planning often aligns with life stages and major events. If you’re at the start of your career, focus on maximizing contributions to retirement accounts like 401(k)s and IRAs. This approach secures your future and reduces your taxable income now.

Families with children benefit from the Child Tax Credit. You can claim this credit for each qualifying child who has a Social Security number that is valid for employment in the United States. Consider opening a 529 college savings plan, which offers tax-free growth and withdrawals for qualified education expenses.

Homeowners should leverage mortgage interest deductions. For loans taken out after December 15, 2017, you can deduct interest on up to $750,000 of qualified residence loans. Property tax deductions can also significantly reduce your tax burden.

Small business owners face distinct tax challenges and opportunities. One key strategy involves careful timing of income and expenses. If you expect higher profits this year, consider accelerating deductible expenses into the current year to offset income.

Maximize business-related deductions, including home office expenses, vehicle use for business purposes, and professional development costs. Keep detailed records of all business expenses, no matter how small. These deductions can result in substantial tax savings over time.

Your business structure significantly impacts your tax situation. Different entities (sole proprietorships, LLCs, and S-corporations) have varying tax implications. A tax professional can help determine the most tax-efficient structure for your specific situation.

High-income earners often encounter additional tax complexities. One effective strategy involves maximizing contributions to tax-advantaged retirement accounts. For 2025, you can contribute up to $23,500 to a 401(k), with an additional $7,500 catch-up contribution if you’re 50 or older.

Tax-loss harvesting in your investment portfolio can offset capital gains from other investments. This involves selling investments at a loss and using those losses to offset gains in other investments.

Charitable giving plays a significant role in tax planning for high-income earners. Establishing a donor-advised fund allows you to take an immediate tax deduction for contributions while spreading out the actual charitable gifts over time.

Tax planning requires regular attention and adjustment. As your financial situation evolves, your tax strategies should adapt. Work closely with a tax professional to ensure your tax plans remain optimized year-round (not just during tax season).

Effective tax planning reduces your tax burden and enhances financial success. We at Clear View Business Solutions offer expert guidance to navigate complex tax laws and optimize your strategy. Our comprehensive services cover tax planning, bookkeeping, and IRS representation for individuals and small businesses in Tucson.

Tax planning requires ongoing attention and regular adjustments. We provide personalized service to simplify financial matters and empower informed decision-making. Our team stays current with tax regulations to ensure your strategy remains optimized year-round (including our tax planning strategies PDF resource).

Clear View Business Solutions acts as your dedicated financial ally, not just a tax preparer. We help you achieve financial stability and growth while maximizing tax benefits and ensuring full compliance. Let us assist you in taking control of your financial future and leveraging every available tax-saving opportunity.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.