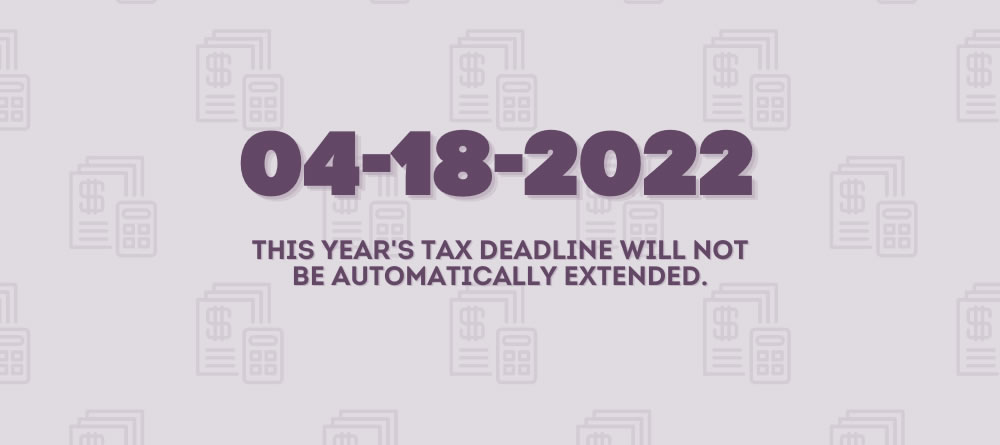

While Tax Day is typically in mid-April, the IRS lengthened the tax deadline in 2020 and 2021 in response to the COVID-19 pandemic. However, in 2022, you must file your federal tax return or request an extension by April 18. If you owe money, you need to make your income tax payments by this date to avoid having to pay interest and penalties – even if you file for an extension.

When Tax Day falls on a weekend or holiday, it gets pushed to the next business day. Since April 15, 2022, is Good Friday and the beginning of Passover, that means Monday, April 18, is the final day to file your federal tax return on time.

It’s crucial to note that filing an extension doesn’t push back the deadline for when you need to pay the IRS. You’ll still need to pay an estimate of what you owe to avoid late penalties. An extension merely gives you more time to complete your tax return.

Freelancers, independent contractors, solopreneurs and small business owners should make quarterly estimated tax payments throughout each year. Failure to pay by these dates can result in penalties. If your income fluctuates and you have trouble estimating how much you owe, you must make up any shortfall when you file your federal tax return.

Treasury officials have warned of delayed refunds and other challenges this year because of IRS budget cuts, federal stimulus measures and pandemic-related issues. Filing electronically, choosing direct deposit and submitting an accurate tax return are the best ways to avoid these hiccups and ensure you get your refund on time.

Though you can contact the IRS by phone, you may experience long wait times to talk to someone, due to understaffed call and processing centers. If you need help filing your taxes, your best bet is to reach out to an experienced tax professional or try to find the answers yourself on the IRS website, since the agency is currently experiencing a significant backlog.

Tax season can be complicated, since the IRS introduces changes every year. That’s why it’s crucial to have an experienced team on your side. At Clear View Business Solutions, our knowledgeable advisors specialize in small business tax planning for entrepreneurs, self-employed people and nonprofits. Let us help you by taking all the guesswork out of the process, translating the intricacies of business finance and taxes into terms you can easily understand.

By working with us, you can enjoy less stress and more time to focus on what you do best. Contact one of our two convenient Tucson-area offices to learn more about starting a partnership today!

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.