Cash flow problems kill more small businesses than any other financial issue. According to the U.S. Bank study, 82% of business failures stem from poor cash flow management.

We at Clear View Business Solutions see this challenge daily. Small business cash flow management requires systematic approaches and proven strategies that work in real-world scenarios.

Manual cash flow tracking wastes time and creates dangerous blind spots in your business finances. QuickBooks Online and Xero offer automated bank feeds that update your cash position every morning and provide real-time visibility into your financial health. FreshBooks delivers daily cash flow summaries that arrive in your inbox at 8 AM, while Wave Accounting offers free automated tracking for businesses under $50,000 in annual revenue. These platforms connect directly to your bank accounts and credit cards and eliminate the guesswork that destroys small businesses.

Set cash balance alerts at $5,000 and $2,000 to trigger immediate action before you hit zero. QuickBooks sends text message warnings when your checking account drops below your threshold and prevents costly overdraft fees that average $35 per incident (according to Bankrate data). Monitor your weekly cash burn rate through automated reports that show exactly where money flows out fastest. Most accounting software generates these reports automatically, but you must review them every Monday morning to catch problems early.

Smart business owners also track their cash conversion cycle weekly and measure how long it takes to turn inventory investments into actual cash in the bank. This foundation of daily cash flow visibility sets the stage for accurate forecasting that extends beyond daily snapshots.

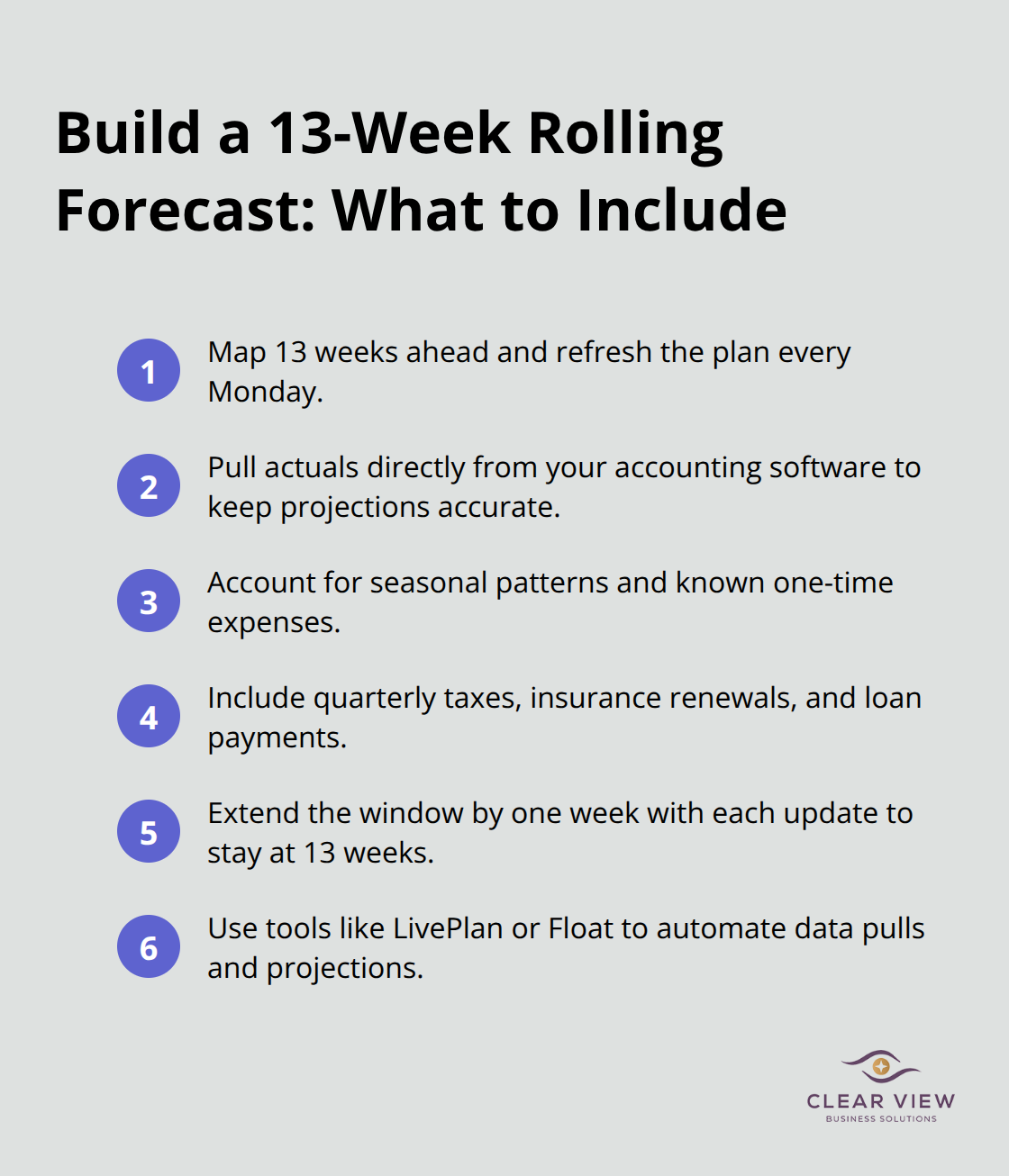

Most small businesses fail because they react to cash problems instead of predicting them. A 13-week rolling forecast maps your cash position for the next three months and updates every Monday with fresh data from the previous week. Excel templates work fine, but LivePlan and Float provide automated forecasting that pulls data directly from QuickBooks and generates weekly projections without manual data entry. Business owners report significant ROI from automated forecasting tools that predict cash shortages weeks in advance.

Your forecast must include seasonal patterns that repeat annually and one-time expenses that blindside unprepared business owners. Retail businesses typically see significant portions of annual sales between November and December, while landscaping companies generate 70% of revenue from March through October. Construction companies face equipment replacement costs that destroy cash flow when unplanned. Include quarterly tax payments, insurance renewals, and loan payments in your projections because these fixed obligations never disappear.

Update your forecast every Monday morning with actual numbers from the previous week and extend the forecast one additional week to maintain the 13-week window. This rolling approach catches trends early and prevents the cash flow disasters that kill profitable businesses. Once you establish accurate forecasting, you can focus on the payment terms that control when cash actually hits your bank account.

Net 60 payment terms destroy small business cash flow and create unnecessary financial stress. Smart business owners implement net 15 or net 30 terms that accelerate cash collections and reduce the time between service delivery and payment. Short payment terms bring faster cash inflows, which can significantly boost working capital. Construction companies and professional service firms report the strongest improvements when they switch from extended payment periods to shorter collection cycles. Present these terms as standard business practice rather than negotiate each contract individually.

Early payment discounts generate immediate cash flow improvements and reduce collection headaches. Offer 2% discounts for payments within 10 days to motivate customers to prioritize your invoices over competitors who demand full payment later. Manufacturing companies report collection improvements of 40% when they implement structured discount programs compared to standard payment terms (versus companies that maintain traditional payment schedules). Include late payment penalties of 1.5% monthly interest in your contracts because customers respect deadlines when financial consequences exist. Document these terms clearly in written agreements and invoice templates to eliminate confusion and establish professional payment expectations.

Once you establish favorable payment terms with customers, you can focus on the collection strategies that turn those agreements into actual cash in your bank account.

Slow invoice delivery costs small businesses thousands in lost cash flow annually. Send invoices within 24 hours of service completion because customers who receive invoices immediately pay 23% faster than those who receive delayed bills (according to Atradius Payment Practices Barometer research). FreshBooks and Invoice2go automate this process and send invoices instantly when you mark jobs complete in their mobile apps. Electronic invoices through these platforms reduce payment times from 45 days to 28 days compared to mailed paper invoices.

Professional service firms that implement same-day invoice delivery report cash flow improvements of 30% within 90 days.

Systematic collection procedures prevent small balances from becoming major cash flow problems. Call customers on day 31 for overdue accounts because phone calls recover 30% more overdue payments compared to mail-based communications. Send formal collection letters on day 45 and engage collection agencies after 90 days to maintain professional relationships while protecting your cash flow. Invoice factoring through companies like Fundbox or BlueVine provides immediate cash for outstanding invoices, though rates can reach up to 68% APR for some packages. Manufacturing companies and contractors use factoring to convert 30-60 day payment terms into same-day cash access when growth opportunities require immediate funding.

Smart collection strategies work hand-in-hand with strategic payment timing to suppliers, which creates the foundation for optimized cash flow management.

Early payment discounts from suppliers can save small businesses money when cash flow permits strategic action. Home Depot offers contractors 2% discounts for payments within 10 days, while office supply companies like Staples provide similar terms that add up to thousands in annual savings for businesses with regular purchases. Calculate the annualized return on these discounts because paying early for a 2% discount on net 30 terms equals approximately a 36.5% annualized return. Track your cash position weekly to identify periods when early payment discounts make financial sense versus times when extended payment terms preserve working capital. Office supply purchases, equipment rentals, and material costs often qualify for early payment savings that exceed typical investment returns.

Strategic payment schedules protect vendor relationships while you optimize cash flow. Pay critical suppliers like utilities and rent on the exact due date to avoid late fees, but extend payment to trade creditors during cash-tight periods when relationships can withstand temporary delays. Negotiate net 45 or net 60 terms with key suppliers during seasonal slow periods because most vendors prefer extended terms over lost customers entirely (construction suppliers and professional service vendors often accommodate payment extensions for established customers who communicate proactively). Document these arrangements in written agreements to prevent misunderstandings and maintain professional relationships that support long-term business growth. Smart payment strategies work together with cash reserves to create the financial stability that protects your business during unexpected challenges.

Small businesses need cash reserves equal to six months of operating expenses because unexpected costs destroy unprepared companies within weeks. Calculate your monthly fixed costs and multiply by six to determine your target reserve amount. A restaurant with $15,000 monthly operating expenses needs $90,000 in reserves, while a consulting firm with $8,000 monthly costs should maintain $48,000 in accessible cash.

Keep emergency funds in high-yield savings accounts or money market accounts that provide immediate access without investment risk. Today’s best rates include Varo Bank savings offering 5.00% on balances up to $5,000 when certain requirements are met, and Axos Bank savings at 4.51%, while traditional business checking accounts pay virtually nothing on idle cash. Never invest emergency funds in stocks, bonds, or business equipment because these assets become illiquid during the exact moments when you need cash most. Growth opportunities will always exist, but businesses that drain cash reserves for expansion often collapse when sales decline or major repairs become necessary.

Smart business owners treat cash reserves as insurance policies that protect against bankruptcy costs while they focus on inventory management strategies that free up additional working capital.

Excess inventory ties up cash that small businesses need for operations and growth opportunities. Just-in-time inventory management reduces waste, improves cash flow, increases flexibility, optimizes human resources and encourages team collaboration while freeing up thousands of dollars in working capital that would otherwise sit on shelves. Auto parts retailers who use JIT systems report inventory reductions from 90 days to 30 days of stock while they maintain service levels above 95%. Track your inventory turnover ratio monthly because this financial ratio shows how many times a company turns over its inventory in a given period, typically a fiscal year (calculate this ratio with cost of goods sold divided by average inventory value). Restaurant supply companies and retail operations see immediate cash flow improvements when they eliminate products with turnover ratios below industry benchmarks.

Consignment arrangements with key suppliers eliminate upfront inventory costs and improve cash flow timing for seasonal businesses. Sporting goods retailers use consignment for winter equipment because they avoid purchasing $50,000 in ski inventory during summer months when cash flow runs tight. Furniture stores and appliance dealers negotiate consignment terms for high-ticket items that sit for months before selling. Electronics retailers report improvements in working capital when they move slow-moving accessories and cables to consignment terms rather than traditional wholesale purchases. These inventory strategies work together with revenue diversification to create multiple income streams that protect your business from market fluctuations.

Single-client dependence destroys small businesses when major customers vanish without warning. Professional service firms that generate significant revenue from one client face immediate challenges when that relationship ends, while businesses with multiple clients lose only a portion of income during client departures. Software companies like Adobe transformed their business model from one-time purchases to monthly subscriptions and increased their stock price from $30 to over $400 per share between 2012 and 2021. Subscription models provide predictable monthly income that improves cash flow forecasts and reduces collection headaches compared to project-based contracts. Service businesses can convert existing customers to monthly retainer agreements that guarantee steady income while they reduce administrative costs associated with individual project negotiations.

Seasonal revenue opportunities fill cash flow gaps during slow periods and maximize annual income potential. Landscaping companies add snow removal services that generate $50,000 to $100,000 during winter months when grass revenue disappears completely. Tax preparation firms offer year-round services because clients need monthly financial management beyond annual tax preparation. Pool maintenance companies expand into Christmas light installation services that produce additional revenue from October through January while they use existing customer relationships and similar service delivery methods. Wedding photographers add corporate headshot services that provide steady income between seasonal wedding peaks while they use identical equipment and skills.

Technology automation streamlines these financial processes and eliminates the manual work that consumes valuable time and creates costly errors.

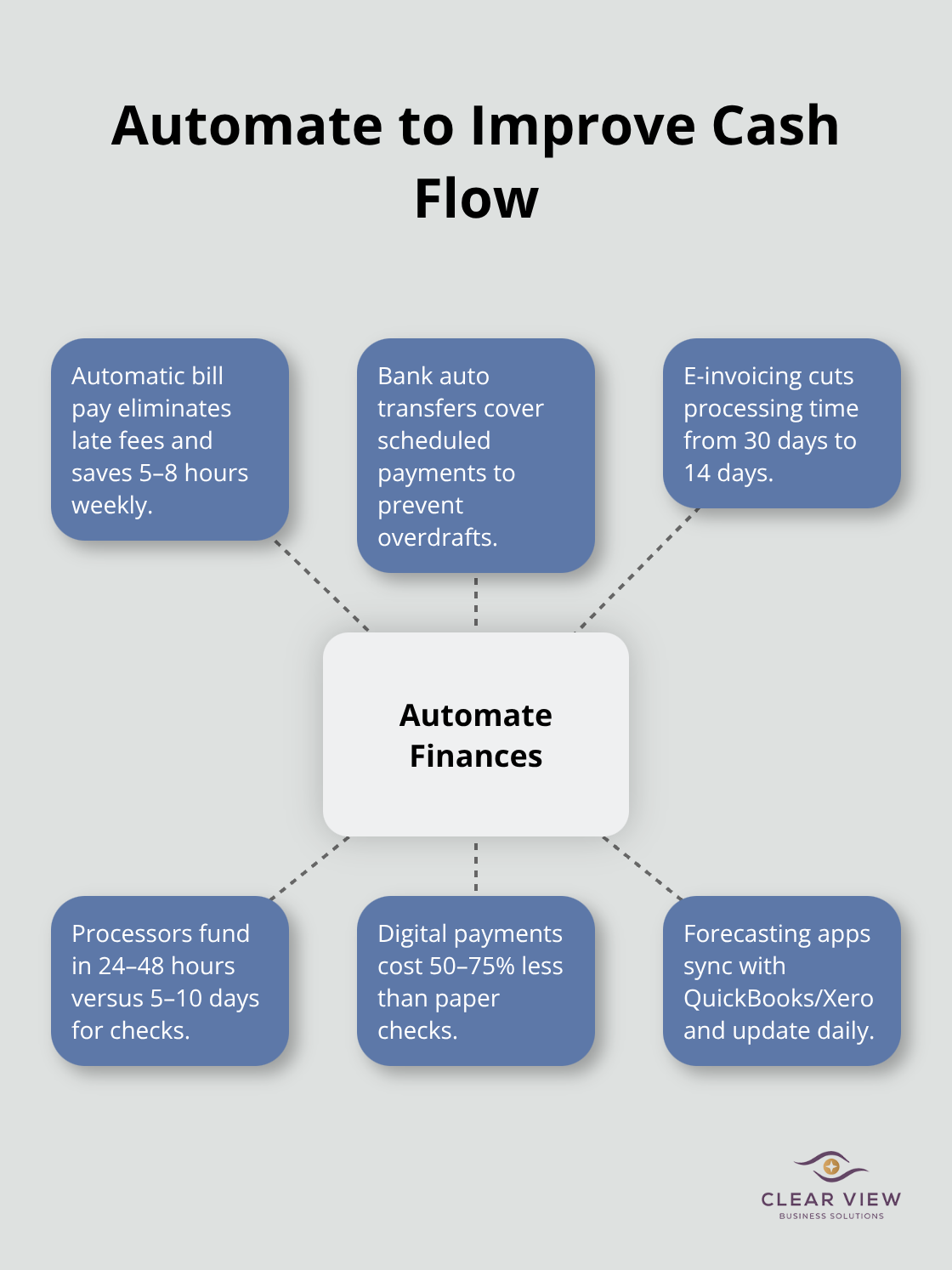

Automatic bill pay eliminates late fees while manual payment processing wastes 5-8 hours weekly for typical small business owners. Bank of America Business Advantage and Chase Business Complete Banking offer automatic payment schedules that handle rent, utilities, insurance, and loan payments without human intervention. Wells Fargo Business Choice Checking provides automatic transfer services that move money between accounts to cover scheduled payments and prevent overdrafts that destroy cash flow. Set up automatic payments for fixed monthly expenses because these obligations never change and manual processing creates unnecessary risk. Electronic payment systems through Zelle Business, ACH transfers, and wire services cost 50-75% less than paper checks while they process 3-5 days faster than traditional mail methods.

Cash flow management apps like Pulse and Cashflow Frog integrate directly with QuickBooks and Xero to generate automated forecasts that update daily without manual data entry. Electronic invoices through Square Invoices and Stripe reduce payment processing time from 30 days to 14 days compared to paper-based systems. PayPal Business and Stripe process credit card payments within 24-48 hours compared to traditional checks that take 5-10 business days to clear, and these platforms charge 2.9% transaction fees that most businesses recover through faster cash access and reduced collection costs.

Professional service firms report improvements in accounts receivable turnover when they switch from paper invoices to electronic payment systems that accept credit cards, ACH transfers, and mobile payments through integrated platforms. These automated systems create the foundation for exploring alternative financing options that provide additional cash flow flexibility during growth periods.

Business lines of credit deliver immediate cash access during seasonal slowdowns and unexpected expenses without lengthy approval processes that traditional loans demand. Wells Fargo Business Elite Line of Credit offers credit limits up to $100,000 with interest rates that start at prime plus 2.75%, while Bank of America Business Advantage Line of Credit provides similar terms for established businesses with strong credit scores above 680. Manufacturing companies and retail operations use these credit lines to bridge 30-60 day gaps between customer payments and supplier obligations, and they pay interest only on funds actually used rather than the full credit limit. Equipment finance options preserve working capital for daily operations while businesses acquire machinery, vehicles, and technology assets through structured payment plans. Balboa Capital and Crest Capital offer equipment finance solutions with approval rates above 90% for businesses that operate more than two years (charging 8-25% interest rates depending on equipment type and borrower creditworthiness).

Merchant cash advances provide rapid funds within 24-48 hours but cost significantly more than traditional finance options. Companies like Kabbage and OnDeck charge factor rates between 1.2 and 1.5, which translates to effective annual percentage rates that reach 200-350% for short repayment periods. Revenue-based finance through companies like Capchase offers financing solutions for software and subscription businesses, helping them close deals faster and increase earnings. Technology companies and professional service firms prefer revenue-based options because repayment fluctuates with business performance rather than fixed monthly payments that strain cash flow during slow periods. These alternative finance strategies support the comprehensive cash flow management approach that transforms small business structure financial stability.

Small business cash flow management transforms struggling companies into profitable enterprises that survive economic downturns and capitalize on growth opportunities. The ten strategies outlined above work together to create financial stability that protects your business from the cash flow disasters that destroy 82% of failed companies. Consistent monitoring through automated tools prevents surprises that bankrupt unprepared business owners.

Weekly forecasts identify problems months before they become critical, while optimized payment terms and collection procedures accelerate cash inflows. Strategic supplier relationships and emergency reserves provide the flexibility needed during challenging periods. Professional accounting services amplify these benefits when they implement systems that work automatically rather than require constant attention.

We at Clear View Business Solutions help Tucson businesses establish QuickBooks systems, develop cash flow forecasts, and maintain the financial controls that support sustainable growth. Our comprehensive bookkeeping and tax planning services free business owners to focus on operations while we handle the financial management that keeps cash flowing smoothly. The difference between businesses that thrive and those that fail often comes down to cash flow discipline (companies that implement these proven strategies build the financial foundation necessary for long-term success and growth).

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.